Bitcoin Price Short-term Outlook Soon to be Clarified

Currencies / Bitcoin May 13, 2015 - 10:52 AM GMTBy: Mike_McAra

In short: no speculative positions.

In short: no speculative positions.

The technology underlying Bitcoin might prove to be what is needed to change the face of payments, record keeping and the way stock market is functioning, we read on Wired:

James Angel compares bitcoin to MySpace, the social network that paved the way for far more influential services like Facebook and Twitter.

Today's bitcoin digital currency, says Angel, a professor of finance at Georgetown University, is too flawed to replace existing currencies. But the basic ideas underpinning the technology, he believes, can significantly change how the financial world operates. This is already starting to happen.

(...)

Nasdaq already has built a prototype using what's called the Open Assets Protocol. Essentially, this is a way of "coloring" bitcoin transactions so they represent an asset other than a bitcoin (such as a stock trade). The prototype runs atop bitcoin's existing network of machines, and [Brad] Peterson [Executive Vice President at Nasdaq] says Nasdaq will start experimenting with outside private companies "right away."

Angel warns, however, that there are many challenges to overcome before this kind of thing can succeed, particularly on the public stock market. Nasdaq and other exchanges must hone the ideas that underpin the blockchain before it can thrive in the face of what Angel calls the "incredible conservatism" that characterizes Wall Street. Most notably, he warns that the technology must balance the open nature of the blockchain with the need for privacy. A chief benefit of the blockchain is it tracks all transactions on a ledger anyone can view at any time. But as Angel notes, many investors prefer to keep transactions private. A bitcoin-based stock system will need a way of keeping transactions public while hiding the identity of individual investors.

This comes right on the heels of the very announcement that Nasdaq is in fact playing around with Bitcoin-based solutions, which we reported yesterday. Now some more details have emerged. At the same time, we would like to stress that it seems that it's not Bitcoin itself but rather its basic ledger system that will become the core of the new system.

Our take here is that even if Bitcoin becomes the same Myspace became for social networks, it is still pretty good news that things are moving ahead for the stock market as far as the application of ledger systems is concerned. Even if the systems are only based on Bitcoin solutions and do not incorporate the currency itself, we might still see a lot of improvement in record keeping and transaction processing.

For now, let's take a look at the charts.

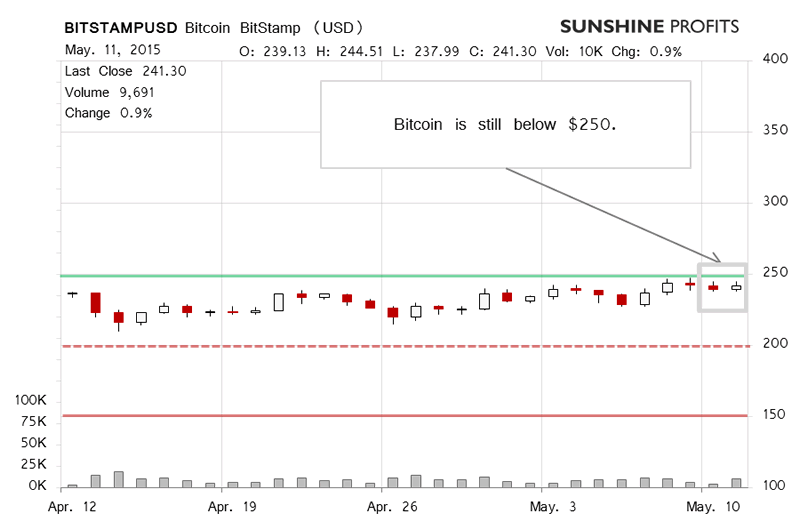

On BitStamp, we didn't see a move to $250 (green line). In fact, we didn't see much action at all. The volume was up but Bitcoin didn't budge significantly, it actually stayed in a pretty tight range. The action of yesterday does seem like more of the same - an extension of a sideway move below $250. Yesterday, we commented on the action in the following way:

(...) If anything, Bitcoin hasn't moved further up and the volume has been relatively weak. Today, we saw some increase in trading but not anything that should make traders nervous at this time. Bitcoin has stayed below $250 and it might be the case that the corrective upswing is over. However, Bitcoin is not oversold at this moment, so an additional confirmation of a move down would be in order.

This is very much still the case. Our take is that the next couple of days could be pretty defining for the weeks to come. We might see a move above $250 followed by a relatively quick drop back below it. In such a case, Bitcoin could be in for more declines back in line with the downward trend.

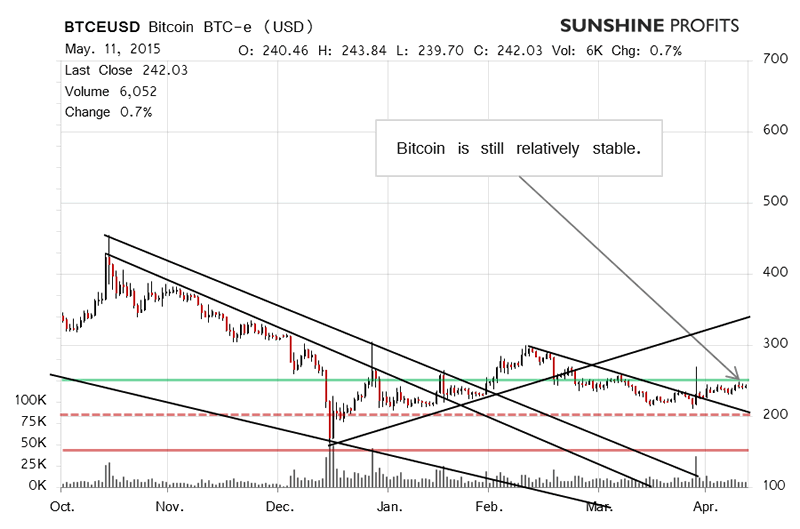

On the long-term BTC-e chart, Bitcoin is close to $250 (green line), but not yet quite at this level. Our comments from yesterday are still up to date:

(...) Will $250 stop the move up? It might, and we would actually be inclined to think that if Bitcoin is to move up any more, it wouldn't be far above $250. Of course, there are no sure bets but we now think that a turnaround might be relatively close.

The currency still seems to have some room for appreciation but our bet is that it would begin moving lower after any such move. Because of the possibility of a move up, we don't think going short is the way to proceed. The possible move up also doesn't seem to be too promising as it could end just above $250. At present, we are of the opinion that waiting for the next entry point for a short position might be the way to go.

At this point, we still think we might see a move above $250 but that any such move could be followed by more declines. We would like to wait for additional confirmation in the form a move down back in line with the trend down.

Summing up, we don't support any speculative positions at the moment.

Trading position (short-term, our opinion): no positions.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.