Stocks and Bond Markets Reach an Epiphany...

Stock-Markets / Stock Markets 2015 May 12, 2015 - 03:24 PM GMT Good Morning!

Good Morning!

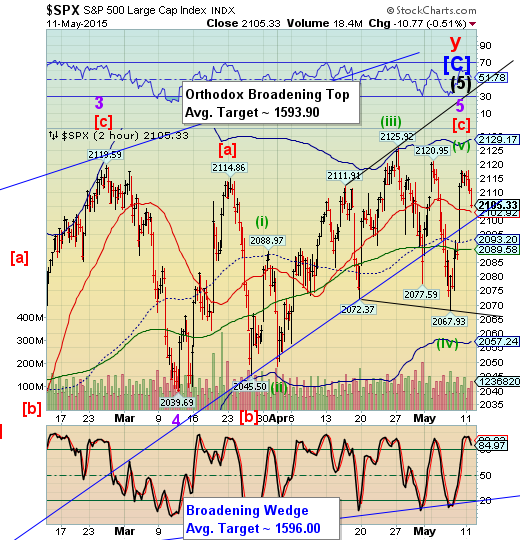

The SPX Premarket has bounced from the 50-day Moving Average at 2089.58 this morning. It appears that the algos have been turned on while the volume is light to ramp it back, but so far SPX remains negative prior to the open.

USD/JPY had a sharp sell-off while SPX was in decline. It is attempting a retracement, but appears to be stalled at 120.14. Meanwhile, SPX appears to have given up all the gains from the positive employment report form Friday.

TNX has clearly “broken out” above its prior highs. Remember, the 10-year Treasury Note is the basis for all bank leverage. This alone could force banks to raise their margin requirements to force the sale of equities.

ZeroHedge comments, “When risk-free assets, with de minimus regulatory capital requirements move like penny stocks, firms are forced to do something about economic risk capital - either derisk (sell assets), or increase capital (delever carry). The ongoing carnage in the world's bond market is creating just such a self-fulfilling problem for risk-assets everywhere (despite simpleton hopes that bond-selling means stock-buying - it doesn't as the marginal buyer is all repo/carry funded and not 'real' cash being rotated). Everywhere one looks, financial markets are turmoiling...”

The epiphany has finally arrived…”Six years ago we first warned that unbridled central planning around the globe in the form of runaway debt monetization (which adds to stock market "liquidity" while soaking up trillions in high quality collateral i.e., government bonds) together with the uncontrolled proliferation of HFT which in turn soaks up all liquidity, can only mean one thing: crash across all assets classes. Years later, everyone is starting to finally get it.”

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.