Is a Global Economic Recession Coming?

Economics / Recession 2015 May 08, 2015 - 04:19 PM GMTBy: Arkadiusz_Sieron

Last month a lot of negative data on the global economy was brought to light. China's trade plunged in March and the World Trade Organization cut the 2015 global trade growth outlook to 3.3 percent from the previous 4 percent. We have already suggested in the Gold News Monitor that weak worldwide trade indicates a coming global slowdown. It is time we shared more details and in this article we analyze whether the global economy is coming into recession and what it would mean for the gold market.

As we have already noted in the Gold News Monitor, trade expansion will no longer outstrip overall economic growth as it once did for decades. Part of the explanation lies in the slowing pace of international vertical specialization (and other structural factors, such as increased trade protection or U.S. progress towards energy self-sufficiency), but the cyclical shortfall in investment in advanced economies and weak demand should not be ignored. According to the World Bank, high-income economies account for some 65 percent of global imports, thus their soft demand translates into lower import volumes. A large negative turn-around in emerging economies' import volume growth which happened in January 2015 supports our opinion that the strengthening greenback would be negative for the developing countries. The WTO confirms that "strong exchange rate fluctuations, including a 14% appreciation of the US dollar against other currencies between July and March" contributed to the sluggishness of world trade and output in 2014 and the beginning of 2015 (in February world trade fell by 0.9 percent month-over-month, following a 1.6 percent decrease in January).

What is the outlook for global trade and the economy? The WTO projects a 3.3 percent growth of global trade in 2015; however its estimations are typically overstated. The unexpected drop in U.S. output in the first quarter of 2015 (and any further shortfall in China's performance, which is very probable) will negatively affect trade growth. This does not spark optimism about global economic growth, since global trade is perhaps the key barometer of the contemporary, interconnected and worldwide economy. Although the Baltic Dry Index has stabilized somewhat after its huge plunge, the actual value of trade calculated in USD (not the volume of goods) is sliding.

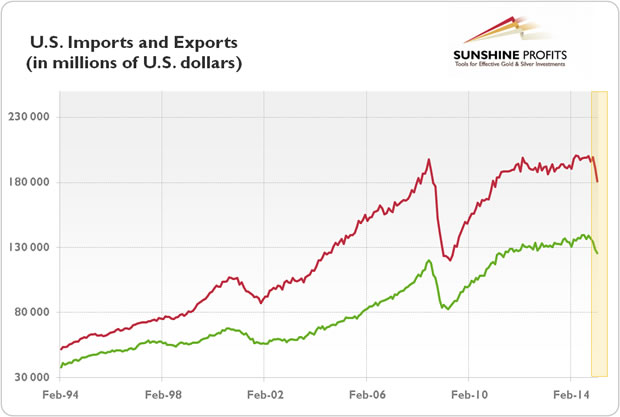

Should low commodity prices, low interest rates and many weak currencies not boost the value of trade and global economy? They should, but the U.S. economy is slowing down, which was partially reflected by falling exports: by around 2.9 percent in January (the biggest drop since 2009), and in February by 1.6 percent, to a two-and-a-half year low (see Figure 1).

Figure 1: U.S. imports (red line) and exports (green line) from February 1994 to February 2015 (in millions of U.S. dollars)

The drop in exports may be attributable to a rising U.S. dollar, however U.S. imports were also declining in January and February (see Figure 1), despite the strong greenback, which should, after all, boost imports. Forget the idea of U.S. decoupling from the rest of the global economy. The boom is apparently so powerful that U.S. consumers have lost their appetite for the Chinese goods they used to purchase in bulk, even with the weaker greenback. It should be clear now that the slowdown in China (and other economies), which may ripple out across the globe, is directly related to the slowing levels of U.S. aggregate demand (in March, shipments to U.S. dropped by 8 percent). According to the CPB World Trade Monitor, world import volume declined in February on account of a contraction in advanced economies, mostly the U.S.

What are the implications of the global slowdown for the gold market? We will elaborate on the correlation between the yellow metal and the GDP growth in the next part; however, here we will repeat that slowing growth should be a friendly environment for gold prices. The concerns about the global economy should increase the safe-haven demand for the yellow metal, while the gloomy outlook for the U.S. not-decoupling economy may soften the Fed's monetary policy.

Thank you for reading the above free issue of the Gold News Monitor. If you'd like to receive these issues on a daily basis, please subscribe. In addition to these short daily fundamental reports, we focus on the global economy and the fundamental side of the gold market in our monthly gold Market Overview reports. We also provide Gold & Silver Trading Alerts for traders interested more in the short-term prospects. If you're not ready to subscribe yet, or are unsure which product suits you, we encourage you to sign up for our mailing list and receive other free alerts from us. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.