Stock Market Deflationary Outcome. It's Coming

Stock-Markets / Stock Markets 2015 May 08, 2015 - 10:39 AM GMTBy: Tim_Wood

The reality is that ever since the 2000 top, both the economy and the stock market have been trying to deflate. It has been these deflationary forces that the Money Masters have been fighting. In the process, they created the housing bubble, the 2007 stock market bubble, the 2008 commodity bubble, the banking crisis and consequently the worst financial disaster since The Great Depression. Those deflationary forces have yet to be fully expressed, but they will. Ever since the rally out of the March 2009 low began, I have said that it has been an advance within the context of a much longer-term secular bear market. As the 2009 low was being made, I also said that the longer the rally out of that low lasts, the more dangerous it would become.

The reality is that ever since the 2000 top, both the economy and the stock market have been trying to deflate. It has been these deflationary forces that the Money Masters have been fighting. In the process, they created the housing bubble, the 2007 stock market bubble, the 2008 commodity bubble, the banking crisis and consequently the worst financial disaster since The Great Depression. Those deflationary forces have yet to be fully expressed, but they will. Ever since the rally out of the March 2009 low began, I have said that it has been an advance within the context of a much longer-term secular bear market. As the 2009 low was being made, I also said that the longer the rally out of that low lasts, the more dangerous it would become.

When I made that statement, I had no idea just how profound that statement would prove to be. As a result of the massive global liquidity campaign, the rally out of the 2009 low has been stretched into the longest 4-year cycle advance since the inception of the Dow Jones Industrial Average in 1896. All the while, the underlying economic woes have not been fixed nor has the underlying secular bear market been negated. Contrary to popular opinion, secular bull markets are not solely a function of price, but of a sound underlying economy and technical foundation. We have neither. Fact is, the secular bull market and the underlying economy peaked in 2000. Pushing this market to new highs once again and extending this cycle has been an attempt to jump start the underlying economy and in the process it has masked the secular bear market from the general public. It's a mirage, an illusion, a trick and one hell of a financial experiment that is not going to end well.

Neither the duration nor the extent of this advance has changed the fact that it has been a bear market rally or that there is a deflationary collapse into the bear market bottom to follow. In fact, all they have done is once again made matters worse. The manipulative efforts associated with the advance into the 2007 top and the fallout that followed is evidence of that. I have also maintained all along that the post-2008 rally seen in oil, gasoline, other commodities, housing and most other asset classes were counter-trend rallies as well. This has been proven correct in oil and commodities. I'm telling you that as a result of the duration and extent of this advance, along with the underlying environment in which this rally has occurred and the general public's inability to see it, that this has become the most dangerous stock market environment since the inception of the DJIA in 1896. Don't make the mistake of thinking that all is well. The post-2008 rally in commodities turned down in late 2013 and became obvious to all in 2014. Stocks, housing and other asset classes will follow in association with the deflationary unwinding of this overextended advance.

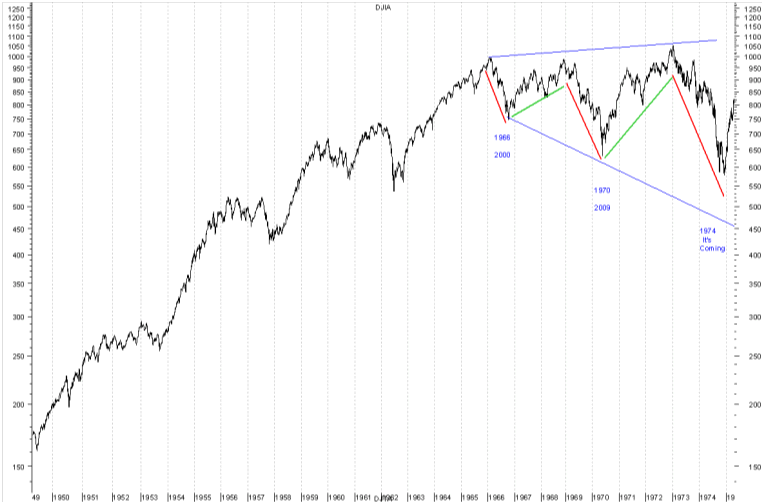

Everyone is familiar with the 1966 to 1974 bear market. I have maintained that the rally out of the 2002 low is synonymous with the rally out of the 1966 Phase I secular bear market low and that the rally out of the 2009 low is synonymous with the rally out of the 1970 Phase II low. I have included a chart of the 1966 to 1974 secular bear market below. While everyone is familiar with the 1966 to 1974 secular bear market, most are not aware of the fact that the advance out of the 1970 Phase II low carried price to a new high before the collapse into the final 1974 Phase III bear market bottom. Let me point out here again, secular bull markets are not solely a function of price, but of a sound technical and economic foundation. The proof to this effect is the rally into the 2007 high that was followed by lower bear market lows as well as the 1972-74 example. In the current case, the rally out of the 2009 Phase II low has been fueled to new highs and extended solely as a result of the global liquidity campaign. The Phase III deflationary decline of the ongoing secular bear market lies ahead. It is coming! There is no avoiding it. Fact is, the efforts to manipulate the natural ebb and flow of the cycle has once again only made matters worse.

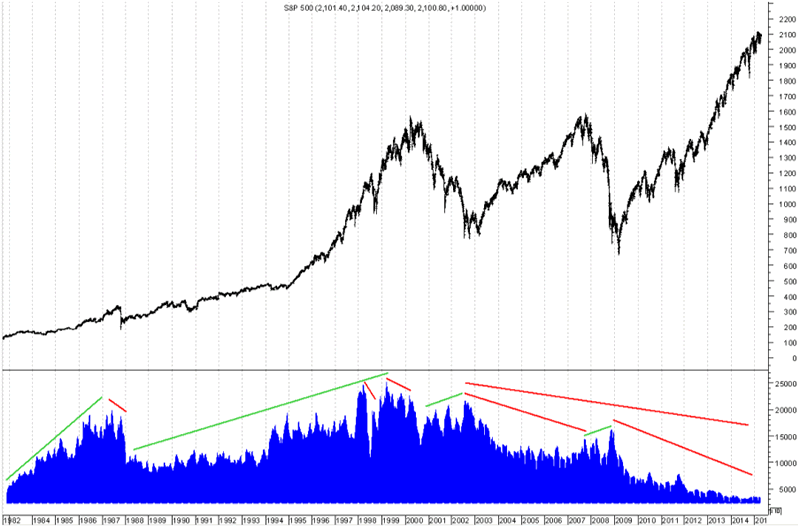

Want evidence that we are operating within a secular bear market? Without going into all of the details, I will show you one very basic and undeniable technical fact that proves the secular bull market peaked in 2000 and that we have been operating within a secular bear market since. Below is a chart of the S&P 500 with volume in the lower window. Regardless of the fact that price moved to new highs in association with the advance into the 2007 4-year cycle top and now again in association with the advance out of the 2009 low, with the latest new highs being seen on March 2, 2015, the volume behavior continues to clearly show that we are operating within the context of a secular bear market that began at the 2000 top.

From the book, Technical Analysis of Stock Trends, Edwards and Magee write, "Volume goes with the trend- Those words, which you may often hear spoken with ritual solemnity but little understanding, are the colloquial expression for the general truth that trading activity tends to expand as price moves in the direction of the prevailing Primary Trend. Thus, in a Bull Market, volume increases when prices rise and dwindles as prices decline; in Bear Markets, turnover increases when prices drop and dries up as they recover."

The bullish behavior with expanding volume as price rose and contracting volume on the declines is illustrated and clearly visible from 1982 into the 2000 secular bull market top. Note that there was a volume non-confirmation with the price advance into the 1987 top, which lead to the 1987 decline. However, as price moved out of that low, volume returned and continued to expand with price. As price moved into the 1998 4-year cycle top there was another volume non-confirmation that was followed by the decline into the 1998 4-year cycle low. But, volume peaked in early 1999 and that non-confirmation lead to the 2000 4-year cycle top and the decline into the 2002 4-year cycle low.

Now, this is where the volume characteristics changed and consequently the secular bear market began. Note that as price declined into the 2002 4-year cycle low, volume expanded. Then, as price moved up out of the 2002 4-year cycle low, volume contracted. Per Edwards and Magee, the shift from bull to bear market clearly took place in 2000. Moving on, look how volume again expanded in conjunction with the decline out of the 2007 top and into the 2009 low. Since the 2009 low, look at the indisputable collapse in volume as price has advance4 out of the 2009 4-year cycle and Phase II bear market bottom. This is not complicated. Common sense should tell anyone that this is not a positive trait for a rising market. Rather, this is a clear indication that the advance out of the 2009 low has been a bear market rally, which once again has been extended and fueled to these levels solely as a result of the global liquidity infusion efforts, which I believe are now beginning to lose their effectiveness. I'm not denying that price is at a new high and I'm not denying that this rally has extended further than anticipated. The point I want to make clear is that in spite of the new price high and the extended 4-year cycle we are nonetheless clearly operating within a secular bear market. Once all the pieces are in place with the setup to cap this extended advance, the deflationary collapse into the Phase III secular bear market low will exert itself.

I've heard all the reasons that this time is different, that volume doesn't matter, that the lack of volume is due to ETFs, that we have already seen the 4-year cycle low, that the Fed won't let the market go down, etc. etc. These are all excuses that people use in an effort to try to justify what otherwise makes no sense to them. It is simply an attempt to explain away an extreme abnormality and to create a sense or normal out of the abnormal. I operate with data, statistics and facts. I'm telling you, this time is not different in that volume does in fact matter. We have not seen the 4-year cycle low. This is the longest 4-year cycle extension ever and yes, the Money Masters have done a masterful job at manipulating the market. But, they have not changed the underlying characteristics of the market. They are losing their effectiveness. The deflationary forces will have their way. The 4-year cycle cannot be denied forever and once a setup is confirmed structurally, the statistics tell us that the inevitable unwinding is going to be worse than that associated with the manipulated and extended 4-year cycle advance into the bear market rally top in 2007.

As a result of the liquidity infusion following the bear market decline into the 2002 Phase I low, everything went up together into the 2007 top, with the commodity tops occurring in 2008. Everything then moved down together into the late 2008/2009 bottoms. From those lows, everything again moved up together. I told my subscribers in December 2013 that commodities had peaked and that has obviously been proven correct as commodities have lead the way this time. Equities and housing will be the next shoe to drop and once the setup is solidified, there will be nothing the Money Masters can do. More detailed research and specifics in regard to the current developments are available at cyclesman.com

By Tim Wood

Cyclesman.com

© 2015 Cycles News & Views; All Rights Reserved

Tim Wood specialises in Dow Theory and Cycles Analysis - Should you be interested in analysis that provides intermediate-term turn points utilizing the Cycle Turn Indicator as well as coverage on the Dow theory, other price quantification methods and all the statistical data surrounding the 4-year cycle, then please visit www.cyclesman.com for more details. A subscription includes access to the monthly issues of Cycles News & Views covering the stock market, the dollar, bonds and gold. I also cover other areas of interest at important turn points such as gasoline, oil, silver, the XAU and recently I have even covered corn. I also provide updates 3 times a week plus additional weekend updates on the Cycle Turn Indicator on most all areas of concern. I also give specific expectations for turn points of the short, intermediate and longer-term cycles based on historical quantification.

Tim Wood Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.