More Evidence Gold Stocks Have Bottomed Relative to Gold Price

Commodities / Gold and Silver Stocks 2015 May 02, 2015 - 12:39 PM GMTBy: Jordan_Roy_Byrne

As we penn this article Gold is trading below $1180/oz and set to close at its lowest level in six weeks. Gold is less than 2% from its weekly low of $1158. It is fairly close to another technical breakdown. However, the gold mining stocks appear to be bucking the trend and showing increasing relative strength. It appears likely that the stocks have bottomed relative to the metal and maybe so in nominal terms.

As we penn this article Gold is trading below $1180/oz and set to close at its lowest level in six weeks. Gold is less than 2% from its weekly low of $1158. It is fairly close to another technical breakdown. However, the gold mining stocks appear to be bucking the trend and showing increasing relative strength. It appears likely that the stocks have bottomed relative to the metal and maybe so in nominal terms.

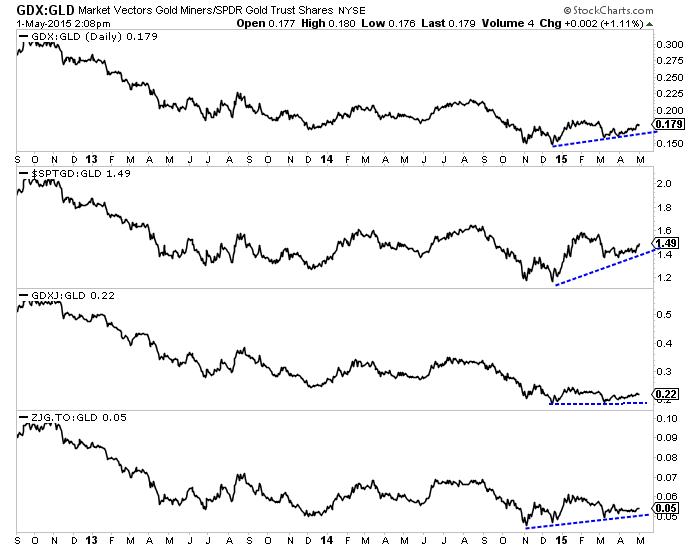

Below we plot various gold miner indices against Gold. We essentially plot the juniors and large caps from both the US and Canada against GLD. Not only have these ratios increased in recent months but they have increased in the past few weeks as Gold has declined from $1220 down below $1180. That is a very important signal of relative strength.

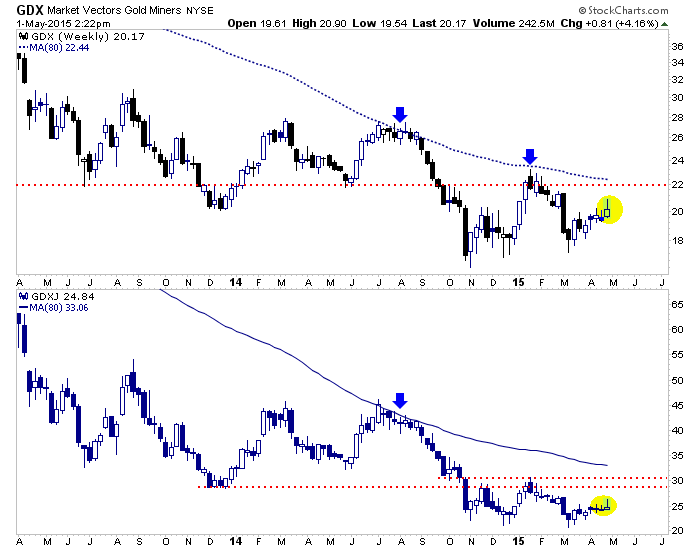

The price action in nominal terms would have been far more encouraging if the miners had closed near their weekly highs. The weekly candle charts for GDX and GDXJ are below. The miners are up for the week but failed to hold the majority of the gains. GDX touched $20.90, which is 7% from its 80-week moving average. If it could reach that resistance it would mark the third test in the past ten months (after previously no tests in two years). That would be a strong signal of a transition from a bear market to a bull market.

The reasons for the gold miners' relative strength are unlikely to be temporary. Sure Oil has rebounded but its price remains well below the $100/barrel it averaged throughout 2011 to 2014. That is helping miners. In addition, local currency weakness has been a boon. Even though the US$ index has stalled out, the Gold price against foreign currencies is 20% above its December 2013 low. That helps miners operating outside of the US with some costs denominated in local currencies. Other factors to consider include the strength in the two largest gold miners Newmont and Barrick and the fact that gold stocks recently were potentially the cheapest in history.

The gold miners can continue to show relative strength but they may not rip to the upside until Gold cooperates. A weekly close below $1150/oz could accelerate Gold's final breakdown. On the other hand, a weekly close above $1220 would be bullish. I would actually prefer the former as it would give us real clarity to the end of the bear market and it would give us a final chance to buy miners before they explode to the upside.

Consider learning more about our premium service including our current favorite junior miners which we expect to outperform in the second half of 2015.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.