Monetary And Economic Insights From Incrementum’s Advisory Board

Commodities / Gold and Silver 2015 May 01, 2015 - 12:18 PM GMTBy: GoldSilverWorlds

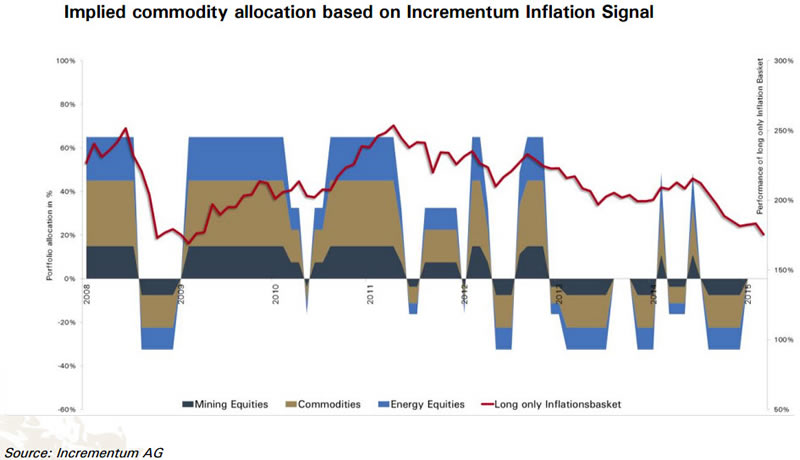

Gold Silver Worlds has received the minutes of the latest Advisory Board meeting by Incrementum Liechtenstein and is pleased to summarize the key insights that were discussed by a panel of experts. Incrementum had launched the “Austrian Economics Golden Opportunities Fund,” a fund that takes investment positions based on the level of inflation based on their proprietary “Incrementum Inflation Signal.” Ronald Stoeferle, author of In Gold We Trust, is the managing partner along with Mark Valek.

Gold Silver Worlds has received the minutes of the latest Advisory Board meeting by Incrementum Liechtenstein and is pleased to summarize the key insights that were discussed by a panel of experts. Incrementum had launched the “Austrian Economics Golden Opportunities Fund,” a fund that takes investment positions based on the level of inflation based on their proprietary “Incrementum Inflation Signal.” Ronald Stoeferle, author of In Gold We Trust, is the managing partner along with Mark Valek.

The Advisory Board gathers once per quarter to discuss the economic and financial outlook. Respected people like Jim Rickards and Heinz Blasnik are part of the panel.

The detailed transcript of the Advisory Board is embedded below. We encourage serious market students to thoroughly read the document as it contains wealth of insights. We picked out 25 insights related to the state of the monetary system, economy and markets.

Before looking into the details, it should be noted that the Incrementum Inflation Signal is “neutral” at this point. This is pretty unusual, based on the calibration of the model, but it quite accurately represents the tug-of-war between inflation and deflation.

What does this suggest for precious metals investors? Mark Valek comments on that question: “Given this ongoing neutral signal we recently adopted a “Barbell strategy” for both scenarios: rising inflation and also rising deflation. On the deflation side, it was plain vanilla going long treasuries. On the inflation side, we were long gold miners and complimented this with some straddles on the SLV Silver ETF. The volatility on silver had been quite low before volatility spiked after the Fed Meeting – that was quite a successful position. We started to accumulate some of the miners – midMarch, before the Fed Meeting. Right now, we are tending towards rising inflation, but we are still positioned with this Barbell strategy. This has started to pay off since the end of March.”

The monetary system

I believe that all the economies in the world are on very shaky ground. The central bank experiment, which has been going on since 2008, is a very, very big mistake. In the end, this is going to lead to the implementation of another monetary architecture – only I fear it will be another type of fiat money system, probably an even more centralized one than is now in place. (by Heinz Blasnik)

No monetary authority can do anything to get us out of this mess. We need structural changes, not monetary stimulus. (by Jim Rickards)

Asian Infrastructure Investment Bank: what it really means is that China wants to be part of the old boys club, which is the IMF. (by Jim R.)

The big guys – United States, Europe and China – do not really think of gold in terms of the dollar and price. They think about gold in terms of quantity. What matters is the weight, how much gold you actually have, how much gold is available when they restructure the national monetary system. (by Jim R.)

None of these [the growth phenomena of recent years] are normal cyclical recoveries! All these are the temporary effect of a cheap currency, but no one has come up with a solution to the global problem. The only solution is structural reform, which we are not seeing; the other solution is to merge all the currencies into a single global currency and then print a lot of that. (by Jim R.)

In November 2011, the year-on-year rate of growth of money supply was 14.8%, and then by October 2013 it had fallen to 5.8%. This is the reason for the sharp fall in the growth momentum that we are witnessing. (by Frank Shostak)

Printing money by itself, it does not matter what kind of Quantitative Easing, is not going to fix the issue if we are in a depression; it will make things much worse. (by Frank S.)

I think crude oil and gold look like quite good bets at the moment, especially the former. (by Zac Bharucha)

The economy

The ECB has begun with its Quantitative Easing program; money supply is growing in Europe already above 11% annualized. Hence, there is a big push in money supply growth in Europe and we already see that economic data in Europe is beginning to improve. (by Heinz B.)

We have seen economic data weakening across the board in recent months. This is some indication that the economy – especially the US economy – is weakening, which I attribute to a lagged effect of a slow-down in money supply growth that happened a while ago. (by Heinz B.)

What I would watch in terms of data are certain components of the ISM, for instance the new orders component. If the reading falls below the 50-mark, then you know the danger of a recession is elevated. (by Heinz B.)

The Fed has the worst record when it comes to forecasts. All the way through the last 6 years, they have been wrong each year with their growth forecasts by a huge magnitude. So they are relying on forecasts that are always wrong. But they still trust those numbers. (by Jim R.)

The defining characteristic of a depression is growth that is significantly below potential. So if potential is 3 or 3.5% in the long run and 5% in the short run and your actual growth is 2%, this is a depression from my point of view. (by Jim R.)

We are now at the point where the United States is bearing the entire cost of global adjustment through the strong Dollar. The Dollar cannot get much stronger, technically it can, but it probably cannot without putting the US into a recession. The Euro is probably at its lowest. (by Jim R.)

The biggest bubble in the world right now is the Shanghai Stock Exchange; when that bursts, it is going to be one of the biggest collapses in the world. (by Jim R.)

The momentum of price inflation will weaken further, such that we could end up with a severe price deflation by December this year. (by Frank S.)

Next year, we will probably have a sudden bounce in economic growth again, based on the current structure of the money supply. (by Frank S.)

I am surprised that the S&P is still holding – it would not surprise me to see it plunge. (by Frank S.)

Japan and Germany have enjoyed better progress due to their courses of trashing their currencies. (by Zac B.)

The negative effects of the declining oil price will be visible in the data before the positive effect on oil consumers. (by Heinz B.)

Interest rates

Right now the Fed Funds Future Market is pricing a rate increase for December. It would not take much to push this out to 2016. If they should actually raise rates in September – which is not my assumption – this could be a disaster, as they would be hiking into weakness. (by Jim R.)

Nobody thinks rates are going to rocket up here. I think we all appreciate that something structurally has changed since this last crash 2007/2008. (by Zac B.)

Asian state of affairs

Entrepreneurs in South East Asia are pretty confident that the future is theirs, but they do at the same time feel that they are falling short in identifying entrepreneurial opportunities. They lack creativity and culture in a certain sense. (by Rahim T.)

I am a bit doubtful about China’s economic expansion strategy – labor productivity is generally very low in Laos and Cambodia and those countries that are not already even part of the Chinese-driven bubble economy. (by Rahim T.)

In contrast to South East Asia: We have seen a lot of diversity in the area of the Alps, and this diversity has led to quite a large cultural capital, which still has survived in crafts and quite a lot of cultural knowledge is embedded. (by Rahim T.)

Transcript of the Advisory Board

Transcript of Incrementum’s Advisory Board April 2015

Source - http://goldsilverworlds.com/economy/25-monetary-economic-insights-incrementum-advisory-board/© 2015 Copyright goldsilverworlds - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.