Is the Fed about to Ignite the Stock Market Sell in May and Go Away Trade?

Stock-Markets / Stock Markets 2015 Apr 30, 2015 - 06:29 AM GMTBy: Rajveer_Rawlin

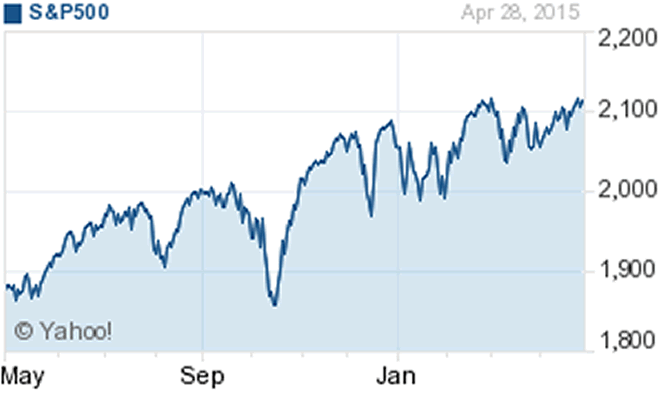

First and foremost most fed meetings are positive for the stock market. The fed usually gives the market what it wants and the markets keep going up and away. The last fed meeting stocks rallied after the fed successfully jaw boned the dollar into submission. Since then stocks have rallied and are encountering major resistance at the top end of their trading ranges.

First and foremost most fed meetings are positive for the stock market. The fed usually gives the market what it wants and the markets keep going up and away. The last fed meeting stocks rallied after the fed successfully jaw boned the dollar into submission. Since then stocks have rallied and are encountering major resistance at the top end of their trading ranges.

The dollar has sold off close to 5% but has already contributed to very weak quarterly earnings reports from several global powerhouses. With Greece lurking in the shadows any Euro strength may be short lived going forward and a resumption of broader dollar strength is likely.

This could spell trouble for commodities like gold and oil and other risk assets.

Eventually carry trade liquidation could spread to stock indices, with some recent bastions of strength like the German and Indian markets already showing some cracks.

Eventually markets will come around to the realization that QE forever polices globally have artificially propped up assset prices and their implosion is just around the corner in a painful and protracted process, with the "Sell in May and Go Away" trade just round the corner.

By Rajveer Rawlin

rajveersmarketviews.blogspot.in

http://www.linkedin.com/pub/rajveer-rawlin/3/534/12a

Rajveer Rawlin received his MBA in finance from the University of Wales, Cardiff, UK. He is a Associate Professor in Finance in the Department of Management Studies Acharya Bangalore Business School. His research interests includes areas of Capital Markets, Banking, Investment Analysis and Portfolio Management and has over 15 years of experience in the above areas covering the US and Indian Markets. He has 9 publications in the above areas. The views expressed here are his own and should not be construed as advice to buy or sell securities.

© 2015 Copyright Rajveer Rawlin - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.