The European Stock Markets Trend Is Up. We're In. Are You?

Stock-Markets / Stock Markets 2015 Apr 29, 2015 - 10:04 PM GMTBy: DailyWealth

Brian Hunt and Ben Morris write: If you're on the sidelines, don't wait any longer...

Brian Hunt and Ben Morris write: If you're on the sidelines, don't wait any longer...

One of the strongest uptrends in the world is gaining ground... And it's making some investors lots of money. If you're following DailyWealth, you should be one of them.

We're talking about the uptrend in European stocks...

Before January 22 of this year, most European stocks were either trending lower or moving sideways. But those trends were broken on January 22...

That's the date the head of the European Central Bank (ECB) – Mario Draghi – announced a massive, €1 trillion bond-buying program. The ECB will buy €60 billion in bonds every month until September 2016... and maybe longer. The move is meant to support the European economy, which is struggling with high unemployment and slow growth.

This is the big idea behind what Steve calls the "Draghi Asset Bubble."

To show you what we mean, let's take a look at the charts of a few funds that track stocks in European countries...

Germany is the largest economy in the European Union (EU). Here's the chart of the Germany iShares fund. You can see the downtrend was broken right around the time of Draghi's announcement.

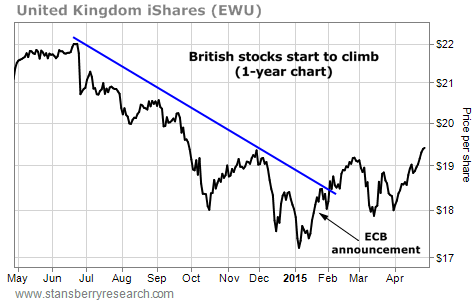

The same goes for British stocks. The United Kingdom is the EU's second-largest economy.

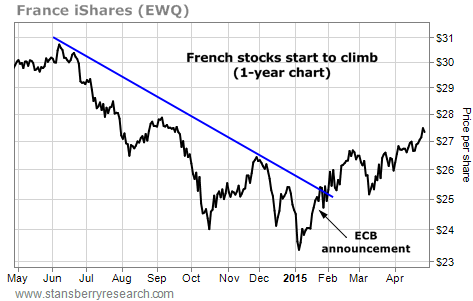

Here's the chart of French stocks. France is the EU's third-largest economy.

And Italy... the European Union's fourth-largest economy.

You get the idea. Mario Draghi's announcement – which was followed by massive amounts of money flowing into European economies – has boosted share prices. If the ECB's actions have similar effects on European stocks as the Federal Reserve's had on U.S. stocks, we're in for more gains to come.

And it's not just the charts that look good. European stocks pay big dividend yields... The Dow Jones Euro STOXX 50 Index – the "Dow Jones Industrial Average of Europe" – yields 3.2% today. The index is made up of 50 blue-chip stocks across 12 European countries. They include multinationals like British consumer-goods firm Unilever, French health and beauty product company L'Oréal, and Belgian beer-maker Anheuser-Busch InBev.

The 30 stocks in the U.S. Dow Jones Industrial Average – for comparison – have an average dividend yield of 2.3%.

Plus, lots of bonds and bank accounts in Europe pay near-zero interest rates. Others have negative rates... meaning you have to pay to store your money. The comparatively high yields in stocks will attract fund managers and individual investors searching for income. And this supports share prices...

One of our favorite ways to take advantage of this idea is with the SPDR Euro Stoxx 50 Fund (FEZ), which tracks the Euro Stoxx 50 Index we mentioned above. As you can see in the chart below, FEZ also broke its downtrend... and on Monday, the fund hit a six-month high.

European stocks have bigger yields than U.S. stocks... And they have the support of the European Central Bank... at least through late next year. If you're not making money on this big trend, start today.

Regards,

Brian Hunt and Ben Morris

Editor's note: If you'd like more insight and actionable advice from Brian Hunt, consider a free subscription to DailyWealth. Sign up for DailyWealth here and receive a report on the most important books on investing. This report will show you several of the DailyWealth team's "must read" books, which will help you become a much better investor right away. Click here to learn more.

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.