Bitcoin Price Counterintuitive Signs

Currencies / Bitcoin Apr 28, 2015 - 05:19 PM GMTBy: Mike_McAra

In short: speculative short positions, stop-loss at $239, take-profit at $153.

In short: speculative short positions, stop-loss at $239, take-profit at $153.

Overstock, a U.S. online retailer already accepting Bitcoin, is now making a move to issue stock based on a ledger system, we read on the Wired website:

On Friday, the Salt Lake City-based online retailer filed a prospectus with the Securities and Exchange Commission that indicates it may issue up to $500 million in stock or other securities using technology akin to the online software system that underpins bitcoin. "We may decide to offer securities as digital securities...the ownership and transfer of which are recorded on a cryptographically-secured distributed ledger system using technology similar to (or the same as) the distributed ledger technology used for trading digital currencies," the filing reads.

This past summer, Overstock's free-thinking CEO, Patrick Byrne, said that the company was hoping to issue a "cryptosecurity" using bitcoin-like technology, and he hired both the developers and the lawyers needed to do so. Now, he and his company have taken the idea to government regulators. As Byrne puts it, he's calling on the SEC to "sprinkle holy water" on his push towards digital securities. "This is a decision point for the establishment," he says.

It will be very interesting to see how the SEC will respond to the filing. The initiative of Overstock seems to be ahead of most of what is going on in the Bitcoin space. If the company is actually in a position to design and execute the issuance of digital stock, we might see other firms following with similar efforts. The SEC's response is crucial here.

This might be important as we're now actually seeing the ledger system being applied to other kinds of solutions. If stocks might be controlled by a Bitcoin-like protocol, then other kinds of assets could also be managed within such a framework. At the moment, we don't think that digital securities will replace the traditional marketplaces any time soon, but if the SEC approves such systems, we might see a gradual transition of at least some market activities to Bitcoin-based systems.

For now, let's focus on the charts.

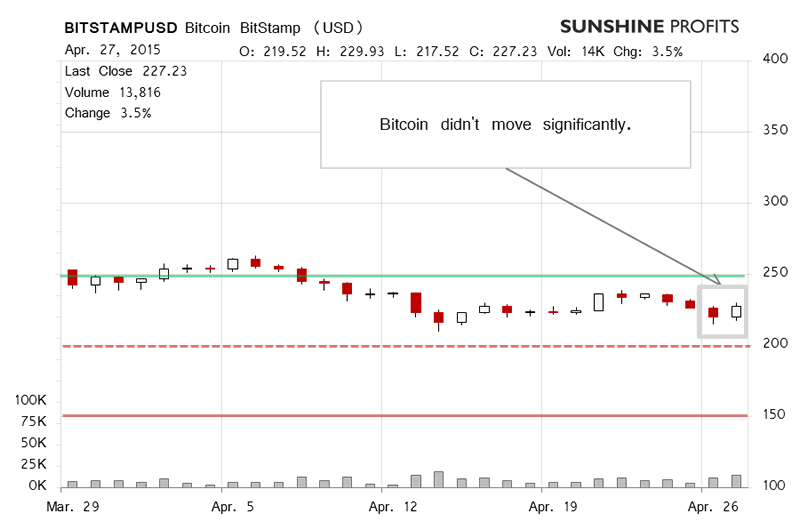

On BitStamp, we saw depreciation over the weekend and Bitcoin went as low as to $215. This was consistent with the short-term bearish outlook and the volume was up on the last day of this depreciation pattern (Sunday). Yesterday, the action was completely different. Bitcoin went up on relatively strong volume. In light of such developments, did anything change based on yesterday's action.

In short words, we don't think it did. Today, we have seen slight depreciation and the volume has been weaker than yesterday (this is written before 9:00 a.m. ET). What we saw yesterday and today hasn't actually brought Bitcoin above the recent trend to the downside. Without a strong move, we do not have much to support a change in short-term outlook. Consequently, even though we saw a move up yesterday, it seems that the bearish outlook is still in place.

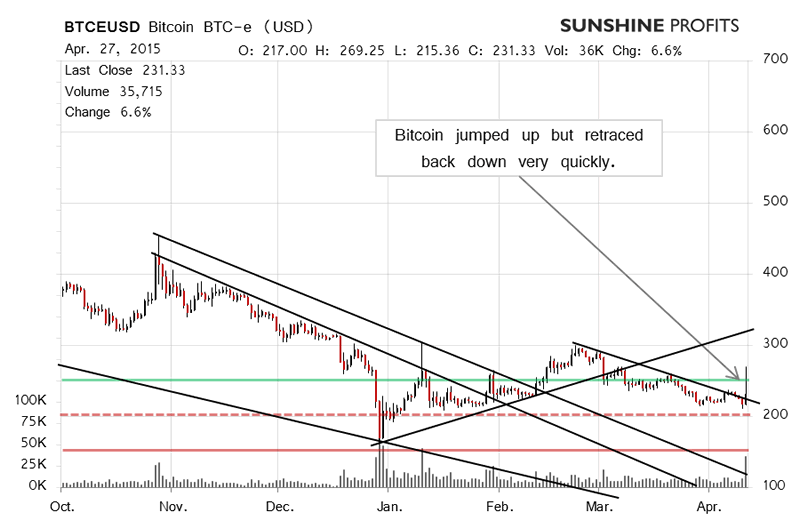

On the long-term BTC-e chart, at first sight the situation looks very different than on the previous chart. What seemed to be the significant development? The fact that Bitcoin went up above $250 (green line in the chart) yesterday, almost hitting $270 at one point in the day. Our stop-loss level was hit, closing our hypothetical short position at a profit (we first suggested a hypothetical short position on Mar. 20, 2015 when Bitcoin was still above $250 and the daily low stood at $254). But does this mean that the outlook is now bullish?

We think not. First of all, the intense action yesterday was reversed within the day and finally Bitcoin closed below $250, actually close to $230, below our previous stop-loss level. Secondly, the action today hasn't really supported a further move up. Thirdly, we now see Bitcoin at, but not decisively above, a possible declining trend line. All of this suggests that the action of yesterday, only seen on BTC-e and not on other major Bitcoin exchanges, might have not been anything more than a temporary blip. As such, we think that the short-term outlook is still in place. Based on that, we reopen the hypothetical short position. If anything, the fact that yesterday's action was reversed makes the situation more, not less, bearish.

Summing up, in our opinion speculative short positions might be the way to go now.

Trading position (short-term, our opinion): short, stop-loss at $239, take-profit at $153.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.