One Stock Market Where You Haven't Missed the Bull Market Boom Yet

Stock-Markets / Stock Markets 2015 Apr 26, 2015 - 01:09 PM GMTBy: DailyWealth

Dr. Steve Sjuggerud writes: U.S. stocks are up an incredible 75% over the last four years.

Dr. Steve Sjuggerud writes: U.S. stocks are up an incredible 75% over the last four years.

It's not just U.S. stocks that are up, though. Stock markets around the globe are soaring higher...

• China's stock market is up more than 100% over the last 12 months.

• Germany's DAX index just hit an all-time high two weeks ago.

• Japan's Nikkei 225 stock index just hit 20,000 a few days ago for the first time since 2000.

But one area of the market has been left out...

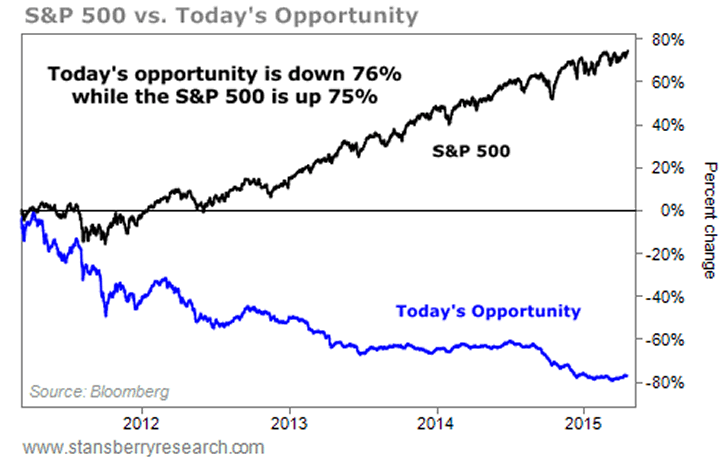

The following chart tells the story. U.S. stocks are up big over the last four years... but this index of stocks is down nearly 80%.

Think about that... We've experienced an incredible bull market in stocks over the last four years. What group of stocks could possibly be down this far?

I'll spare you any more suspense... I'm talking about the Toronto Venture Exchange (TSX-V) – an index made up of hundreds of small-cap Canadian natural resource stocks.

It's not hard to understand why these companies have fallen so much since 2011. After all, the price of gold has fallen from a high of about $1,900 in 2011 to less than $1,200 today. The price of oil has fallen nearly 50%... from more than $105 a barrel last fall to around $56 today.

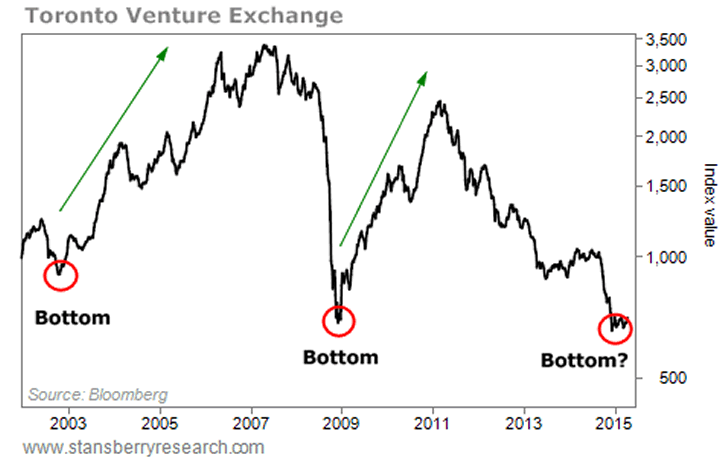

But right now, legendary Canadian resource investor Rick Rule believes it's time to consider buying these stocks. He thinks we're near a bottom. And if history is any indication, we could see huge gains in the near future.

You see, the last two times the Toronto Venture Exchange bottomed (in 2002 and 2009), it soared by 350% and 150%, respectively. Take a look...

Like I said, while markets around the world march to new highs, the Toronto Venture Exchange is down 76% in the last four years. That's a monumental crash. And the two times these stocks crashed in the last 15 years, they soared hundreds of percent over the next few years.

So... can they do it again? Absolutely.

Of course, we can't know for certain that today is the perfect moment to buy. In fact, without an uptrend in place, I'm not ready to buy these stocks right now. But this group of stocks is near the top of my list of investment opportunities... and it's one I'll gladly jump into once the trend starts to turn in our favor.

That's part of the reason why I'm speaking at the Sprott-Stansberry Natural Resource Symposium in Vancouver this July.

I've attended and spoken at this event many times in the past. It's truly a "who's who" of the natural resource sector.

Speakers include Rick Rule, Sprott Asset Management founder Eric Sprott, and billionaire mining-industry financier Robert Friedland. I'm especially excited to hear from these folks myself... and get a feel for the opportunity these guys are seeing in the natural resource sector today.

If you're interested in hearing these experts speak – and learning about the huge upside this sector offers – I recommend making it to the conference.

Regardless, you need to keep an eye on small-cap resource stocks right now. They're down nearly 80% in four years... And once they turn around, the upside opportunity is incredible.

Good investing,

Steve

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.