If Other Gold Miners Can Do What Newmont Just Did, Look Out

Commodities / Gold and Silver Stocks 2015 Apr 26, 2015 - 01:02 PM GMTBy: John_Rubino

The past few years have been brutal for the gold miners, most of which brought it on themselves by starting new, high-cost mines just in time for the metal's price to crater. The resulting write-downs and operating losses have made this without question the most unloved sector in the whole market.

The consensus among analysts has been that most miners' costs are so structurally sticky that only slight reductions will be possible, making the industry a financial basket case until gold starts rising again.

Then Newmont, the second biggest gold miner, reported its first quarter earnings. Among other startling numbers, its all-in sustaining costs to produce one ounce of gold fell nearly 18 percent to $849 and its earnings rose by either 50% or 89% year-over-year, depending on the definition of profit being used (analysts were predicting a slight earnings decline). Free cash flow, meanwhile, soared to $344 million from the year-earlier $52 million.

Over the next week or two these results will get a thorough exam from analysts, and if they hold up they'll change the game for miners. Specifically, if it's possible to take this much out of costs without resorting to scams like high-grading (where the miner uses up the best ore to goose near-term results at the cost of future earnings) or fiddling with the timing of revenues and expenses, then other miners may be able to generate some pleasant surprises in coming quarters as well. And suddenly this is a happy, outperforming industry.

One indicator that this may be the case is insider buying: From Acting Man's Pater Tenebrarum:

Insider Buying by Gold Mining Executives Increases Further

In spite of the gold price weakening once again this week and coming dangerously close to breaking an important support zone, gold investors have actually reason to take heart. Readers may recall what we wrote in our most recent update on gold about gold mining margins:

"The market has not yet really given any credit to the fact that mining margins are improving due to strength in the real price of gold. Management boards of gold companies may be coming around to a different view though - after all, they are acutely aware that the real gold price is the only thing that counts with respect to their margins."

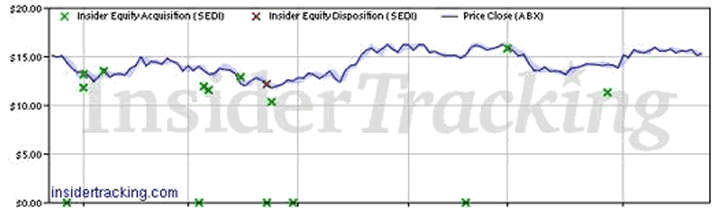

As data from our friends at INK Research in Canada (a highly recommended service) show, gold mining managers are indeed "acutely aware" of their improving profit margins. Insiders of several major and mid tier gold mining companies have embarked on a buying spree. Here is Barrick Gold as an example:

Recent insider activity at Barrick Gold: the green crosses denote purchases.To put a few concrete numbers to this: On March 27, ABX chairman John L. Thornton bought 360,000 shares in the open market. In early March, four different board members acquired 23,200, 10,200, 3,200 and 30,750 shares respectively (amounts are rounded), also in the open market. It is nothing special when insiders are selling - it does however mean something when they are buying, especially when they are buying in size and seemingly without concern for short term price gyrations. Note here that the gold sector is really standing out in this respect. In most other market sectors, insiders are bailing out as fast as they can.

By John Rubino

Copyright 2015 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.