What Obama's First-Ever Energy Review Missed

Commodities / Energy Resources Apr 26, 2015 - 12:49 PM GMTBy: Money_Morning

Dr. Kent Moors writes: The Obama administration just released its inaugural Quadrennial Energy Review (QER).

Dr. Kent Moors writes: The Obama administration just released its inaugural Quadrennial Energy Review (QER).

The aim of the 348-page report, which was ordered by a Presidential Memorandum in January 2014, is to help the U.S. government create a "comprehensive and integrated energy strategy" by identifying the roadblocks to providing affordable and secure energy and energy services for the country.

The QER's concerns mirror those I have considered in Oil Energy Investor and even addressed before the queen's Windsor Energy Consultation last month at Windsor Castle outside London.

And as the severity of the problems outlined in the QER become apparent, there are going to be some very nice opportunities for investors to profit.

However, the report neglected to address a number of key issues that are crucial to understanding the challenges in the energy sector.

Here's my take on what really needs to be fixed…

There Are Three Looming Crisis Points

The QER, which will see a regular release, will have its own multi-departmental and agency task force charged with making policy recommendations. The government's intention here is to meet a need I have demanded we fill for some time: the development of a genuine national energy plan.

Highlighted in the government's treatment are detailed indications of a crisis fast approaching in three areas:

- A huge replacement need for broad areas of energy delivery systems inside the U.S.

- A rising situation threatening the nation's ability to transmit, store, and distribute energy (TSD).

- Some pretty serious security considerations weighing on the integrity of the overall TSD system.

But there are many very important factors the report does not consider. Of this rather long list, there are four I would emphasize here at what I hope is the first stage of a long and serious process.

The Report Doesn't Look at the Global Situation

First, nothing outside the U.S. is considered. Such is to be expected; this is, after all, a domestic policy report. But given the integrated nature of the global energy system, what is occurring elsewhere will have a decisive impact on what is done within America's borders.

The global crisis is far worse and dovetails into some of our most pressing security and terrorism concerns. At current projections, a widening percentage of the world's population will be cut off from any access to energy, literally living in the dark…

…And easy prey for whatever radical movement comes by.

As I discussed in my Windsor briefing, there will be a huge global price tag to avoid international infrastructure collapse.

My estimate of essential requirements to avoid a "World Collapse Scenario" is $2-$5 trillion by 2035 in targeted areas. Currently, there is a 40% shortfall; investment is down despite long-term funding supply expanding.

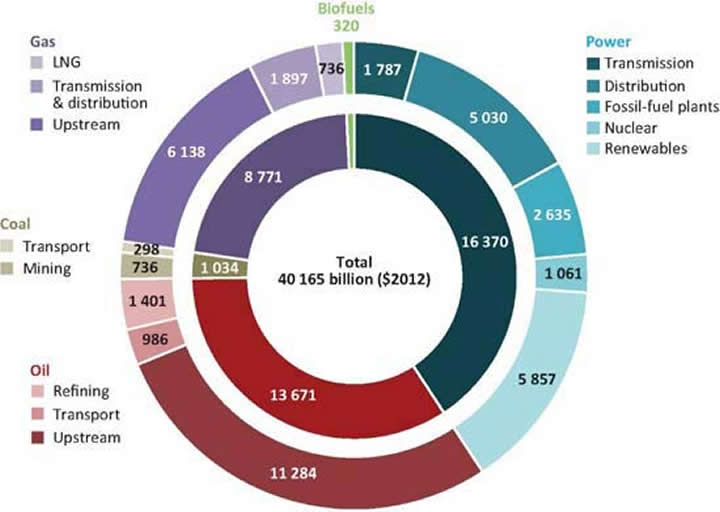

The International Energy Agency (IEA) Projected Need stands at $48 trillion (in the agency's New Policies Scenario – $40 trillion for energy supply, $8 trillion for improved efficiency). The need increases to $53 trillion with the so-called "450 Scenario," which seeks to limit the global increase in temperature to 2 degrees Celsius.

Energy Supply Will Require a Huge Commitment

At current projections, we are moving toward merely buying a Band-Aid to patch over the troubles in the existing global energy network with approaches tied to national and corporate debt limitations. Put simply, most of the world will be unable to cope without massive population and lifestyle disruptions.

This is the slide I used at Windsor to break down what the IEA regards as required through 2035:

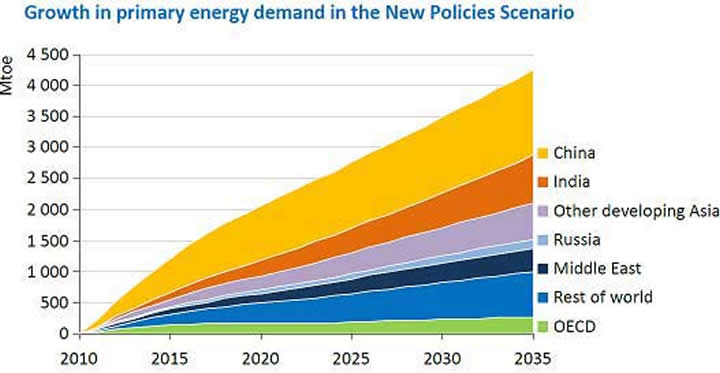

Rising energy demand is progressively moving away from the developed industrial nations to the developing world, as another of my presentation slides graphically indicated (once again using the IEA's New Policies Scenario):

However, the most significant conclusion is this: Less than 50% of the infrastructure needs are to meet increasing demand. Most are to offset declining energy production. As we move forward, it is energy supply that will require the greatest commitment. For example, I estimate that as much as 80% of future capital needs in oil and gas will be upstream – that is, at the production or generation point – not in the TSD addressed by the QER.

How to Avoid Going over the Cliff

That leads to the second factor. Infrastructure needs can be neither estimated nor met without primary consideration given to the energy production side. Infrastructure connects upstream, midstream (this is really what the report's TSD centers on), and downstream (processing and wholesale/retail).

The cost of rescuing the national energy infrastructure resides in this interconnection.

Third, security concerns deal with both the physical assets and the logistical support – that is, how the system coordinates the movement of energy from one place to another. We need to identify primary points of vulnerability. Most of these will actually be targets of cyberattacks.

Finally, a cohesive energy plan must ask a fundamental question. This involves what infrastructure we will pursue. Is it to be a cut-and-paste job, basically keeping the same system, repairing where necessary? Or do we use this as an opportunity to develop new approaches that are more efficient and easier to maintain?

This factor will be the most contentious, both politically and financially. It will have to address the energy balance we choose, the combination of traditional energy sources and alternative, renewable options. Some regions of the U.S. will fare better in this competition than others. And that guarantees some knock-down, drawn-out political donnybrooks.

Nonetheless, one thing is clear: Repeating the same processes will produce the same problems. Only this time, they will be more acute and more expensive.

This week's QER release may be a major first move in finally meeting the real energy challenges facing the country.

But it is just a small first step in a very long process.

Join the conversation. Click here to jump to comments…

Source :http://moneymorning.com/2015/04/25/heres-what-obamas-first-ever-energy-review-missed/

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.