When the Nuclear Money Option Fails

Stock-Markets / Stock Markets 2015 Apr 25, 2015 - 05:33 PM GMTBy: Doug_Wakefield

"To combat the economic fallout caused by the credit crisis (07-08), countries have allowed their fiscal deficits to increase dramatically. In order to pay the bills, governments had to sell enormous amounts of bonds. As more and more investors stopped buying these government bonds, central banks needed to step up to the plate. By turning on the (digital) printing presses, they have been buying up bad debts and government bonds to a total of $10 trillion worldwide, between 2008 and 2013. Economists describe this process as the monetization of debt by central banks. Economic textbooks refer to this process as 'the nuclear option' - only to be used when no other method of financing can be applied effectively. This is a process that is easy to start, but almost impossible to stop."

"To combat the economic fallout caused by the credit crisis (07-08), countries have allowed their fiscal deficits to increase dramatically. In order to pay the bills, governments had to sell enormous amounts of bonds. As more and more investors stopped buying these government bonds, central banks needed to step up to the plate. By turning on the (digital) printing presses, they have been buying up bad debts and government bonds to a total of $10 trillion worldwide, between 2008 and 2013. Economists describe this process as the monetization of debt by central banks. Economic textbooks refer to this process as 'the nuclear option' - only to be used when no other method of financing can be applied effectively. This is a process that is easy to start, but almost impossible to stop."

[The Big Reset: Gold Wars and the Financial Endgame (2014), Willem Middlekoop, pg 11 of 250, Kindle Edition]

[Source - 10 Years of 'Why Sell Now?", Dec 11 '14]

We get up in the morning, take a shower, grab something to eat, and head to work. In the evening, we may run by the store to restock the fridge, before watching a digital movie, or chatting on FB. The weekend comes, and the bills need to be paid. We check off the household projects and chores.

Life is lived out in hundreds of millions of lives as though only "surprises" alter our day-to-day life. What we experience is real, and what we hear on the news that is scary has become nothing but noise. Turn if off, and it does not exist.

The common theme across the financial world has become that WE are the center of our goals and dreams, not current events or history. With the "assistance" of the "nuclear option", we need not be informed or consider risk, especially at the system level. Someone is "always" making certain stocks don't decline much anymore.

For those watching this drama since it was first rolled out in 2009 as "the rescue plan", Middlekoop's comments are very well understood. There is no question that the "nuclear" option has been used worldwide. Debt levels are staggering.

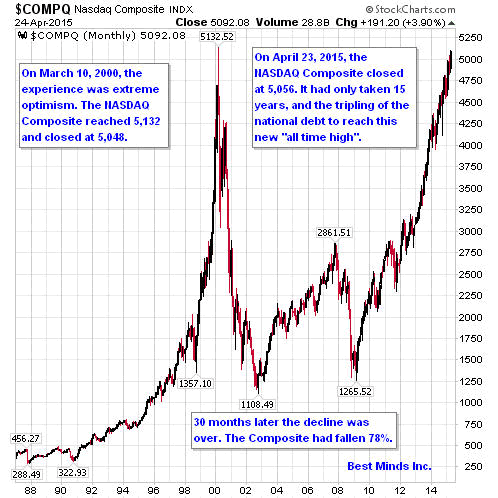

However, every idea that starts to haunt us with the reality that those staggering debt levels might someday have serious consequences on this new "road to riches" scheme, has been quickly quashed with a new "all time high" headline. Yesterday, on April 23, 2015, it was the NASDAQ Composite, which closed at 5,056. What could be more convincing than the REAL experience from being with "the crowd" and watching markets leap to make new records!

Those scary headlines; just noise.

"Greece Facing 'Lehman' Moment, As Debt Cost Soar, CNBC, April 21, '15

US Growth Forecast Dropped To Zero, 24/7 Wall Street, April 3 '15

China Debt Spikes By More Than A Third, CNBC, April, April 24, '15

Wall Street Declines As Worries About Earnings Deepens, Reuters, Apr 13 '15

Those complicated charts from professional traders have no purpose when "the bottom line" is all one needs to know.

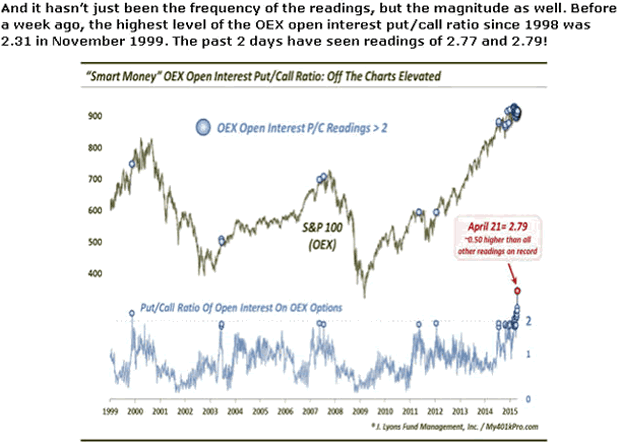

The "Smart Money" Has Never Been More Bearish, Zero Hedge, April 22 '15

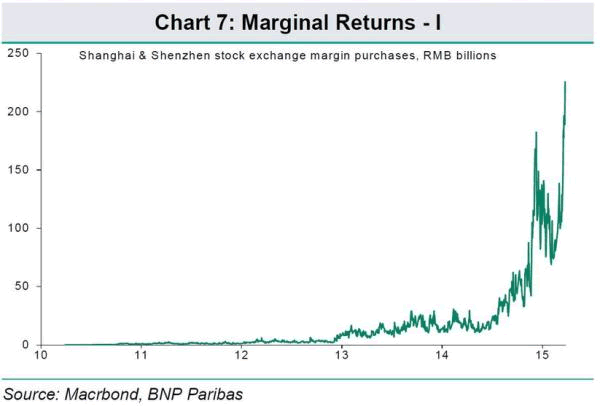

"Too Many Zeros": China Stock Bubble Proves Too Much for Computers, Apr 20

However, if we step away from the most intervened markets in history, we start to see some simple things that should alter our perspective as we look at the NASDAQ Composite's record on April 23, 2015.

On March 10, 2000, the NASDAQ Composite closed at an all time high of 5,048. On October 9, 2002 it closed at 1,114. The decline of 78% drop in a major US equity market had not taken place since the Great Depression. 2000-2002 changed the experience of the crowd.

Easy To Create a Bubble, Impossible To Stop Its Consequences

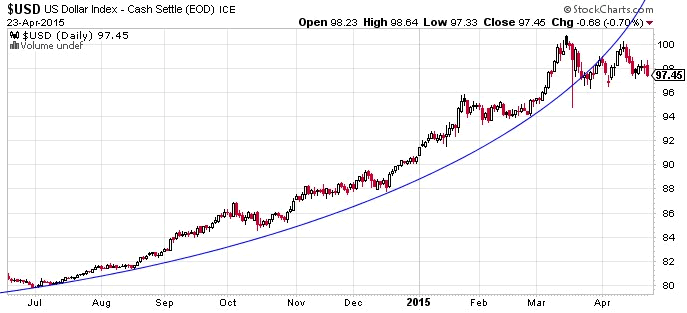

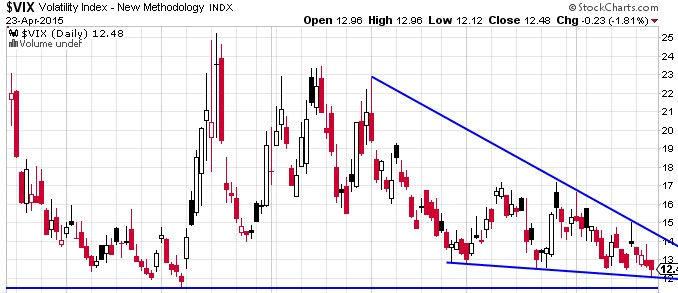

Yesterday, a colleague of mine sent me the following charts.

[Source - Matt McCracken, CTA, McCracken and Co., April 23 '15]

For those with no background in technical analysis, these charts may look like nothing more than colorful lines. For those who understand technical analysis, operational levels in the futures markets, and crowds, you understand that these two trends, combined with the largest global stock and bond bubble on record, are evidence that a change of direction will NOT be a surprise. This is not just for the NASDAQ Composite, but for currencies, metals, bonds, and volatility. The long trends of "all gains, no pains" or "no gains, all pain" these last few years, is pushing hard toward a major shift.

With the largest exposure in dollar and euro futures on record in March by the commercial hedgers, and as of April 23rd, the VIX closing below its 13 level for 8 of the last 10 days (extreme complacency and feeding stock mania levels) and in a descending wedge, one's experience seems extremely likely to change dramatically in the very near future.

The "Nuclear Debt Option" Is Good For Our Wealth, Right?

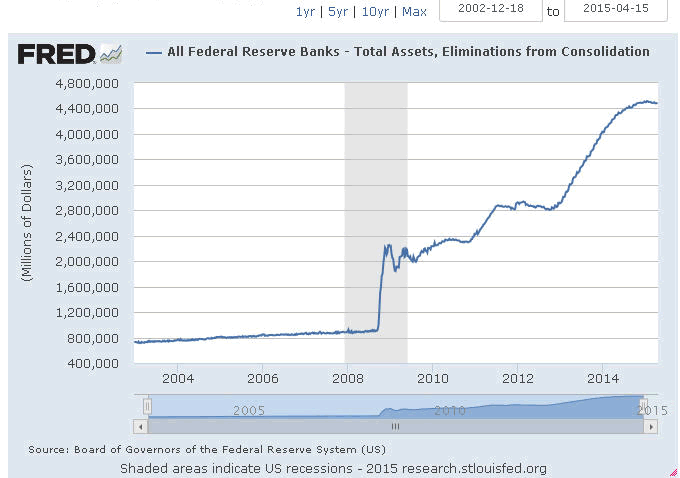

Between the first year of operation for the Federal Reserve in 1914 until July 19, 2007, the Federal Reserve's balance sheet grew from zero to $853 billion.

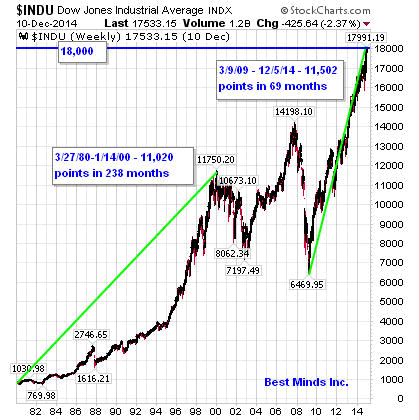

On Friday, July 19, 2007, the Dow Jones Industrial Average, the most watched stock indicator in the world, closed for the first time in its history above 14,000.

If history could have stopped on that day in July 2007, the largest financial collapse in history would never have taken place. There would have been no Bear Stearns collapse, no Lehman's bankruptcy, no nationalization of AIG, Fannie, or Freddie. There would have never been a $60 trillion loss in global wealth, or initial $700 billion bailout for the global financial institutions, leading to the first ever, zero interest rate policy by the Federal Reserve, which began on December 16, 2008 and remains in place today, over six and a half years later.

If there is even the slightest doubt in your mind that these numbers, dates, or events took place, please click the links in this article. All of this is our history.

Now we leap to more recent data as of April 23, 2015.

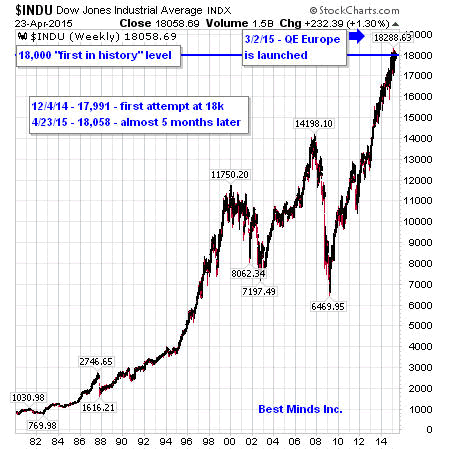

As pointed out already in the December 10th chart of the Dow above, by December 5, 2014, the Dow had already climbed more in 69 months from its March 2009 low than it did during the 238 months between its low in 1980 to its high in 2000. Like breaking the 14,000 level in July 2007, it came within inches of breaking its 18,000 level on December 5, 2014. By the end of December, it had achieved that objective.

Now look back at the opening of this article. The chart by the Federal Reserve reveals the total assets owned by all Federal Reserve Banks as of tax day, April 15, 2015. It is clear, that something very dramatic changed in the role of the Federal Reserve in 2008. 2008 had not merely been a bear market, but a year that changed the very nature of the Federal Reserve, and would go on to change the role of central banks worldwide. This was clearly a new frontier, not a return to "normal".

From the use of the "nuclear option" - going into hyper over drive printing up debt to buy assets off the balance sheets of the banks and from the markets - the Federal Reserve's three quantitative easing programs managed to explode the amount of assets the Federal Reserve now held on their own balance sheet... something never seen in its 101 years of existence other than the period since 2008. By artificially inflating asset values through flooding the system with the cheapest money ever in American history, the balance sheet of the Federal Reserve rose to $4,446 billion by December 4, 2014.

As of April 23, 2015, just shy of 5 months since the Dow came within 9 points of reaching 18,000 for the very first time, the Dow closed at 18,058 as shown in the second chart of the Dow at the opening of this article, and the April 23, 2015 balance sheet of the Federal Reserve stood at $4,447.

So what does the math tell us about the actions of the Dow, and its correlation with the Fed's balance sheet since QE III ended last October?

On December 5, 2014 the Dow closed at 17,991. On April 22, 2015, the Dow closed at 18,058. This is a gain of 67 points (.37%) over almost 5 months.

On December 4, 2014 the balance sheet of the Federal Reserve stood at $4,446 billion. On April 23, 2015, it stood at $4,447 billion. This is a gain of $1 billion (.02%) over the same timeframe.

So what conclusion can be drawn?

The Federal Reserve, the highest authority in the financial/political establishment in the U.S., is running out of time to convince the public that with QEIII shut down that the U.S. is on the mend, and by June, they will start raising interest rates, since 6 years of zero interest money is no longer needed.

While the headlines may appear as though raising interest rates on the largest debt bubble on record is merely a heated topic for debate for academic types, the reality of the global debt markets make it absolutely clear this is not the case.

The Economy Has Given the Fed and 'Epic, Historic Window' to Raise Rates, Business Insider, April 12, 2015

Why The Fed May Almost Never Raise Interest Rates, Washington Times,

April 21, 2015

Half of All Sovereign Bonds Now Carry Negative Yields, Bonner and Partners, April 22, 2015

Central bankers took the nuclear option because it was the easier of two options in 2009. We kicked the problems created by cheap money, poor collateral, and wild speculation down the road....by fostering more cheap money, poor collateral and wild speculation.

Anyone listening to some of the biggest names in the world of finance very recently, knows that THEY are very aware that another crisis is inevitable and yes, trends do come to an end Virginia.

Four Men At the Top See Major Systemwide Risks Ahead

I know this is past the 5 minute reading limit, but with so much at stake, take another couple of minutes and read the comments made by the four men below, whose experience has placed them at the highest national, and frankly international, levels of finance. See if you see a pattern.

-

"There is far less liquidity in the general marketplace....Recent activity in the Treasury markets and the currency markets is a warning shot across the bow....on one day, October 15, 2014, Treasury securities moved 40 basis points, statistically 7 to 8 standard deviations - an unprecedented move - an event that is suppose to happen only once in every 3 billion years or so....Some currencies recently have had similar large moves. Importantly, Treasuries and major currencies are considered the most standardized and liquid financial instruments in the world...Some things never change. There will be another crisis, and its impact will be felt by the financial markets." [JP Morgan Shareholder letter from Jamie Dimon, April 8, 2015, pg 31 and 32]

-

"Former Treasury Secretary Hank Paulson said Wednesday that stocks and other assets need to start to trade again on "real economics." It seems people are addicted to these near zero percent interest rates that the Federal Reserve has had in place to jump start the economy after the 2008 financial crisis, he said in an interview on CNBC's 'Squawk Box'." [Hank Paulson: Investors Seem to Be Addicted to Low Rates, Yahoo Finance, April 15 '15]

-

William White, former Economic Advisor to the Bank of International Settlement and current Chairman of the Economic and Review Committee of the OECD (Organization of Economic Cooperation and Development, a 34 nation economic organization) made the following comments to Sean Corrigan, Chief Strategist for UK based Hinde Capital, who asked White in an interview, "How are we ever going to get them [central bankers] back to doing the job that they should have been doing, which is just providing a back stop to a functioning financial system? White's response was as follows:

The answer is I don't know. I think, increasingly, they are discomforted. More than anything else I think it's not just the ex central bankers but increasingly the people that are still holding the levers. They are starting to ask whether they have somehow been backed into a place where they don't really want to be. Now, I agree with you, Sean, that there's an element in everybody, although some more than others, where they're glad to be looked upon as the saviours of the day. But I rather sense that an increasingly large number of central banks are actually looking at what is going on and saying "We are being asked to do something that is effectively impossible." In a nutshell, most central bankers know that our economies do not face a liquidity problem but a solvency problem linked to excessive debt accumulation. If it's a solvency problem, central banks can't fix it. The only way they can fix it is by inflation which, with the debt levels being the way they are, could very quickly get out of hand. [The Road to Nowhere, An Interview with William White, Part I, Hindesight Letters, March 2015, pg 5]

Finally, lest anyone take comfort that drowning the nation with a fourth QE is coming from the Federal Reserve, I would have them look at the size of the Federal Reserve's balance sheet (as of April 23, 2015, standing at $4,447 billion), and consider these words from James Rickards, who has served as an advisor on global economics and systemic financial threats with the Department of Defense and the U.S. intelligence community:

"In continuing to print money to subdue deflation, the Fed may reach the political limits of printing, perhaps when its balance sheet passes $5 trillion, or when it is rendered insolvent on a mark-to-market basis." [The Death of Money: The Coming Collapse of the International Monetary System (2014) James Rickards, pg 10 of 356, Kindle Edition]

Being a Contrarian, Remembering 2000

The big shift from longs to shorts and shorts to longs continues to rumble, a warning that continues to grow louder with each passing week now.

Click here to start the next six months reading the newsletters and trading reports as we come through this incredible year.

With the NASDAQ Composite finally breaking its March 10, 2000 high on Thursday, April 23, 2015, I really cannot think of a better time to benefit from independent, contrarian research.

On a Personal Note

I have recently started a blog called, Living2024. It is a personal blog, not business. I wanted to have a place to write some deeper stories about where this entire drama seems to be taking us all. Check out my latest post, A Centrally Planned Sex and Financial Life.

Doug WakefieldPresident

Best Minds Inc., a Registered Investment Advisor

2548 Lillian Miller Parkway

Suite 110

Denton, Texas 76210

www.bestmindsinc.com

doug@bestmindsinc.com

Phone - (940) 591 - 3000

Alt - (800) 488 - 2084

Fax - (940) 591 –3006

Copyright © 2005-2011 Best Minds Inc.

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology.

Disclaimer: Nothing in this communiqué should be construed as advice to buy, sell, hold, or sell short. The safest action is to constantly increase one's knowledge of the money game. To accept the conventional wisdom about the world of money, without a thorough examination of how that "wisdom" has stood over time, is to take unnecessary risk. Best Minds, Inc. seeks advice from a wide variety of individuals, and at any time may or may not agree with those individual's advice. Challenging one's thinking is the only way to come to firm conclusions.

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.