Stock Splitting Caused the Stock Market Crash

Stock-Markets / Financial Crash Apr 25, 2015 - 12:13 PM GMTBy: Wim_Grommen

This article explains why the introduction of stock splitting on December 31st, 1927 eventually caused the crash of 1929. The frequent splitting of shares into very large proportions gave a massive boost to the stock market boom, making the stock market crash of 1929 equally violent.

This article explains why the introduction of stock splitting on December 31st, 1927 eventually caused the crash of 1929. The frequent splitting of shares into very large proportions gave a massive boost to the stock market boom, making the stock market crash of 1929 equally violent.

The emergence of a stock market boom

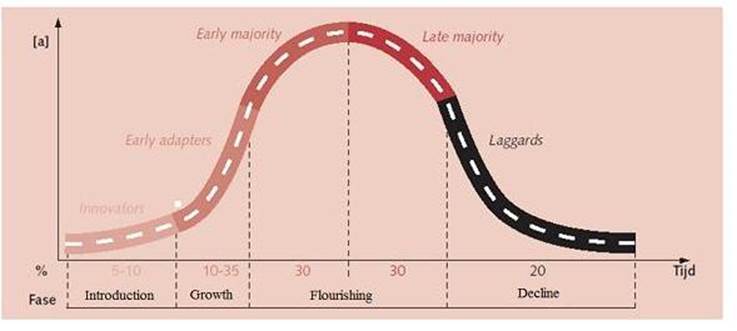

In the development and take-off phases of an industrial revolution many new companies emerge. All these companies go through more or less the same cycle simultaneously. During the second industrial revolution these new companies emerged in the steel, oil, automotive and electrical industries. During the acceleration phase of an industrial revolution many of these businesses tend to be in the acceleration phase of their life cycle, also more or less simultaneously (Figure 1).

Figure 1 - Typical course of market development: Introduction, Growth, Flourishing and Decline

There is an enormous increase in expected value for companies in the acceleration phase of their existence. This is the reason shares become so expensive in the acceleration phase of a revolution. There was an enormous increase in price-earnings ratio of shares between 1920 – 1930, the acceleration phase of the second industrial revolution.

Splitting shares fuels price-earnings ratio

Stock splitting refers to the reduction of the nominal value of a share by a certain factor and an increase in the total number of shares by the same factor. Essentially, if the nominal value is reduced by a factor of two the number of shares increase that same factor. This means that the total value of the shares remains the same. A stock split is desirable if the market value of a share has grown too large, rendering it insufficiently marketable. Because there are more potential investors at the lower exchange rate the split causes a positive effect on the value of the share.

The increase in the price-earnings ratio is amplified as well, because many companies decide to split their shares during the acceleration phase of their existence.

Stocks were split for the first time on 31 December 1927, two years before the stock market crash in October 1929. Between 1927 and 1929, the shares of many companies were split into very large proportions (see Table 1). These splits further increased the price-earnings ratio of stocks.

Figure 2 - Two industrial revolutions: Shiller PE Ratio (price/income)

Splitting shares also made the Dow Jones Index explode

The Dow Jones Index was first published on May 26, 1896. The index was calculated by dividing the sum of all the shares of 12 companies by 12:

Dow12_May_26_1896 = (S1 + S2 + .......... + S12) / 12

On October 4, 1916, the Dow was expanded to 20 companies; 4 companies were removed and 12 were added.

Dow20_Oct_4_1916 = (S1 + S2 + .......... + S20) / 20

On December 31, 1927, for the first time a number of companies split their shares. With each change in the composition of the Dow Jones and with each share split, the formula to calculate the Dow Jones is adjusted. This happens because the index, the outcome of the two formulas of the two baskets, must stay the same at the moment of change, because there can not be a gap in the graph. At first a weighted average was calculated for the shares that were split on December 31, 1927.

Date |

Company |

Split |

December 31, 1927 |

American Can |

6 for 1 |

December 31, 1927 |

General Electric |

4 for 1 |

December 31, 1927 |

Sears, Roebuck & Company |

4 for 1 |

December 31, 1927 |

American Car & Foundry |

2 for 1 |

December 31, 1927 |

American Tobacco |

2 for 1 |

November 5, 1928 |

Atlantic Refining |

4 for 1 |

December 13, 1928 |

General Motors |

2 1/2 for 1 |

December 13, 1928 |

International Harvester |

4 for 1 |

January 8, 1929 |

American Smelting |

3 for 1 |

January 8, 1929 |

Radio Corporation of America |

5 for 1 |

May 1, 1929 |

Wright-Aeronautical |

2 for 1 |

May 20, 1929 |

Union Carbide split |

3 for 1 |

June 25, 1929 |

Woolworth split |

2 1/2 for 1 |

Table 1 - Stock splits before the stock market crash of 1929

The formula looks like this: (American Can, split 6 to 1 is multiplied by 6, General Electric, split 4 to 1 is multiplied by 4, etc.)

Dow20_dec_31_1927 = (6.AC + 4.GE+ ..........+S20) / 20

On October 1st, 1928, the Dow Jones grows to 30 companies.

Calculating the index had to be simplified at this point because all the calculations were still done by hand. The weighted average for the split shares is removed and the Dow Divisor is introduced. The index is now calculated by dividing the sum of the share values by the Dow Divisor. Because the index for October 1st, 1928, cannot suddenly change, the Dow Divisor is initially set to 16.67. After all, the index graph for the two time periods (before and after the Divisor was introduced) should still look like a single continuous line.

The calculation is now as follows:

Dow30_oct_1_1928 = (S1 + S2+ ..........+S30) / 16.67

In the fall of 1928 and the spring of 1929 (see Table 1) 8 more stock splits occur, causing the Dow Divisor to drop to 10.77.

Dow30_jun_25_1929 = (S1 + S2+ ..........+S30) / 10.77

From October 1st, 1928 onward an increase in value of the 30 shares means the index value almost doubles. From June 25th, 1929 onward it almost triples compared to a similar increase before stock splitting was introduced. Using the old formula the sum of the 30 shares would simply be divided by 30.

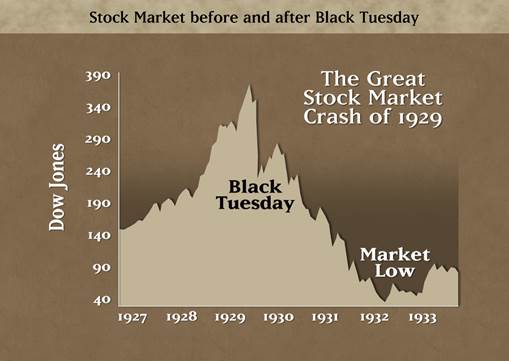

Figure 3 - Dow Jones Index before and after Black Tuesday

From Stock market crash 1929 to stock market correction 1929

The stock market boom in the period 1920 - 1929 was obviously primarily caused by a huge expected increase in the value of shares belonging to companies in the acceleration phases of their existence. The introduction of share splitting on December 31st 1927 caused an even bigger boom, and the changes in the Dow Jones formula on October 1st 1928 was the icing on the cake.

The stock market crash in October of 1929 would probably have been much less severe if share splitting had not happened (which would leave the Dow Jones formula unchanged). In that case we would not be talking about the stock market crash of 1929 but the stock market correction of 1929.

Wim GrommenMr. Grommen was a teacher in mathematics and physics for eight years at secondary schools. The last twenty years he trained programmers in Oracle-software. The last 16 years he studied transitions, social transformation processes, the S-curve and transitions in relation to market indices. Articles about these topics have been published in various magazines / sites in The Netherlands and Belgium.

Copyright 2015 © Wim Grommen - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.