The Existential Danger To The Euro Is Elections

Politics / Euro-Zone Apr 23, 2015 - 05:05 PM GMTBy: Dan_Amerman

There is a respectable chance that the euro will collapse sometime in the next several years, with implications for employment, economic growth and investment markets on a global basis. And the biggest threat is not directly money, debt, a potentially rapidly approaching Greek default, or a failure of central banking policies – but is instead something much simpler.

There is a respectable chance that the euro will collapse sometime in the next several years, with implications for employment, economic growth and investment markets on a global basis. And the biggest threat is not directly money, debt, a potentially rapidly approaching Greek default, or a failure of central banking policies – but is instead something much simpler.

The risk is elections. That is, the near term existential threat to the euro – and indeed the global financial system – is when voters don't do what the status quo politicians, the media and bankers want them to do.

After all – that is exactly what we are seeing with the current iteration of the Greek crisis.

The Greek government has now seized the financial reserves from all local governments in a last ditch effort to find cash, and according to the New York Times the European Central Bank may be triggering a liquidity crisis by raising the collateral requirements for Greece when it comes to receiving emergency liquidity assistance.

However, it was not Greece's massive debts or economic damage from austerity programs that actually provoked this crisis. Those problems had been there for years after all, and the situation had been more or less stable.

What triggered the crisis was voters in Greece choosing to elect a party of the far left because they'd had enough of austerity policies and they simply weren't going to take it anymore.

The primary dangers are thus political, they are brewing in many nations in Europe, and we may just be getting started.

The Gaping Hole In The Financial Defenses Of The Status Quo

What is too often forgotten about the euro is that it isn't a "normal" currency – but rather an experiment on a grand scale that is both economic and political in nature. An economic union that is not a true political union is inherently unstable, which has been understood since the euro was first created, but the assumption was always that there would be an ongoing, irreversible and inevitable process of political union, which would then help foster a tighter economic union – and a "normal" euro that would compete with the US dollar for the status of global reserve currency.

Now, as explored in this analysis, any Greek default or exit from the euro is far from preordained. We need to take into account that changing banking, accounting and money-related regulations or laws to help avert collapse is considerably easier than dealing with the effects of a collapse that has already happened. And it's very important to remember that through the monetary creation ability of the collective central banks, there is an effectively infinite supply of money to work with.

Because of these capabilities, the current mainstream market narrative is that if it is just "little" Greece that defaults, then these defenses should be more than adequate, which is why various market participants are not seriously pricing in a major financial crisis.

Now whether these defenses could handle Spain embracing Pablo Iglesias of the Podemos party, which is their version of Greece's Tsipras, is a quite different question, with the upcoming Spanish general elections.

But if we look around the world right now, we see gaping holes in these defenses. And this goes to the very heart of the assumptions that led to the creation of the euro.

There is an assumption that the world will follow a political path that fits with the narrative described by the current dominant media/political/financial power structure.

Which is that in Europe, essentially the center will always hold – because the alternatives can't be even contemplated.

However, as we've been seeing in real time, events seem to be moving in the other direction. As covered here, there has been a polarization in European politics and a rapid rise in the power of both the far left and the far right – at the expense of the center.

The current crisis in Greece is an example of but one side of the issue. All it took was one political election of a far-left party in one smallish nation – and it was straight to a crisis for the eurozone. Which could lead to something that was supposed to be impossible – which was a Greek exit from the euro, or Grexit.

Now, picture what happens if the National Front in France wins an election, or joins a coalition government, or if another of the "far-right" parties does that in another country. And we have a far-left party in Greece (or Spain) demanding effective debt forgiveness, lest the euro be destroyed. And across the table, needing to be part of any consensus decision is the leader of a newly installed far-right government, who was elected on the basis of both leaving the euro and stopping the flood of immigrants.

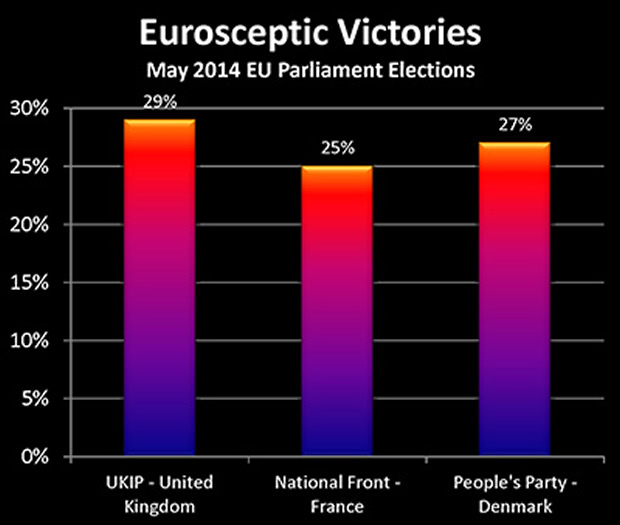

How does that scenario play out for the grand experiment that is the euro? The far right and far left won about 40% of the vote between them in the May 2014 EU parliament elections, and that was before the elections in Greece, or the rise of ISIS and sharp increase in terrorist attacks, or the recent surge in North African immigrant boats crossing the Mediterranean. All it takes is a further movement of 11% – and the center is lost, along with those widespread assumptions about the future.

All It Takes Is One Election

The single most important take away from the current Greek crisis is not the immediate effects of this crisis, nor is it the effectiveness of the financial defense mechanisms that may in fact be able to contain any damage in the near future.

What really matters is that the "powers that be" have been powerless to stop it.

Obama, Kerry, Merkel, Hollande and Cameron had no ability to change the results of the election in Greece.

Just as Yellen and Draghi also lacked that power.

Just as the New York Times and Washington Post lacked that power.

Just as Goldman Sachs, JP Morgan and Morgan Stanley also all lacked that power, as did the International Monetary Fund, and the World Bank.

We have this enormously powerful collection of financial institutions, governments, media and international organizations, all of whom were powerless to stop what triggered the current crisis. Which was simply a nation holding elections, and appropriately enough in this case, whatever else you may agree or disagree with, this did occur in the cradle of democracy.

And what that tells us is two things:

1) the defense of the financial stability of the eurozone is and always has been based on political consensus; and

2) Greece proves that this political consensus is an assumption that can't actually be controlled.

It is a proven wildcard that can bring the whole house of cards down.

Part II

The 2nd part of this article discusses the ongoing risk to the euro over the coming months and years, as well as what force overrides the powers of central banks.

Daniel R. Amerman, CFA

Website: http://danielamerman.com/

E-mail: mail@the-great-retirement-experiment.com

Daniel R. Amerman, Chartered Financial Analyst with MBA and BSBA degrees in finance, is a former investment banker who developed sophisticated new financial products for institutional investors (in the 1980s), and was the author of McGraw-Hill's lead reference book on mortgage derivatives in the mid-1990s. An outspoken critic of the conventional wisdom about long-term investing and retirement planning, Mr. Amerman has spent more than a decade creating a radically different set of individual investor solutions designed to prosper in an environment of economic turmoil, broken government promises, repressive government taxation and collapsing conventional retirement portfolios

© 2015 Copyright Dan Amerman - All Rights Reserved

Disclaimer: This article contains the ideas and opinions of the author. It is a conceptual exploration of financial and general economic principles. As with any financial discussion of the future, there cannot be any absolute certainty. What this article does not contain is specific investment, legal, tax or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the results of the application of principles contained in the article, website, readings, videos, DVDs, books and related materials, either directly or indirectly, are expressly disclaimed by the author.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.