Distorted Financial System Expect Deflation, Inflation And Hyperinflation

Stock-Markets / Global Financial System Apr 23, 2015 - 03:02 PM GMTBy: GoldSilverWorlds

Which ‘flation will it be? Deflation or inflation or both? Looking at the BIG PICTURE …

Which ‘flation will it be? Deflation or inflation or both? Looking at the BIG PICTURE …

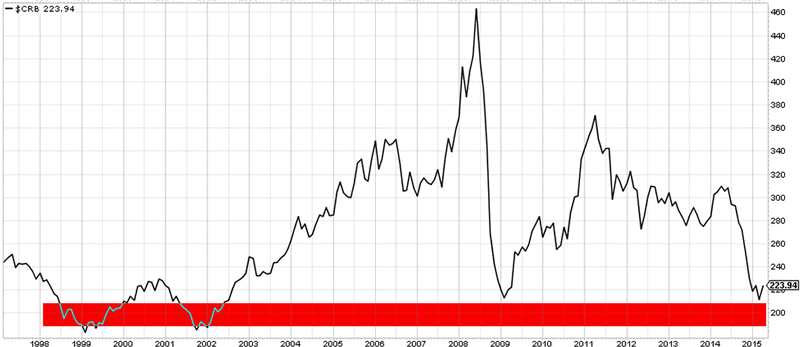

CRB: Deflationary pressures are clearly seen in commodities prices, which are currently at 2009 levels, at the depth of the collapse, as evidenced by the CRB (a proxy for commodities).

Other indicators are confirming this deflationary trend.

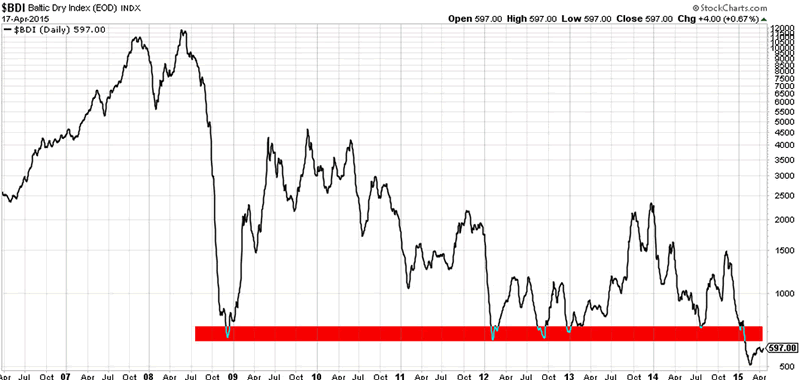

The Baltic Dry Index, which measures the cost of global maritime transport, is below crisis levels (2008/9, 2012 crisis), and falling.

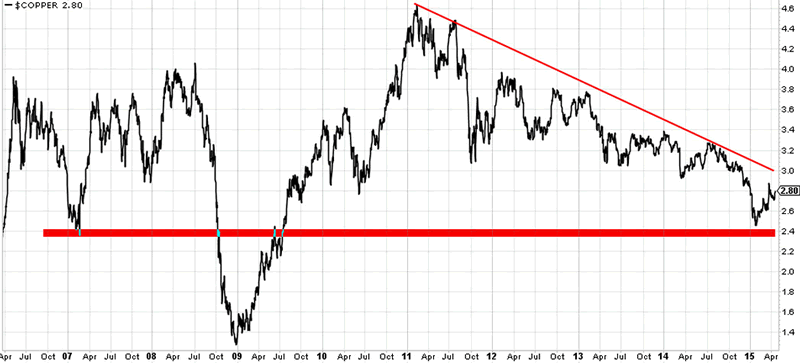

Dr. Copper, the indicator of global economic activity and health, is flashing a similarly unhealthy signal; prices have created a huge descending triangle.

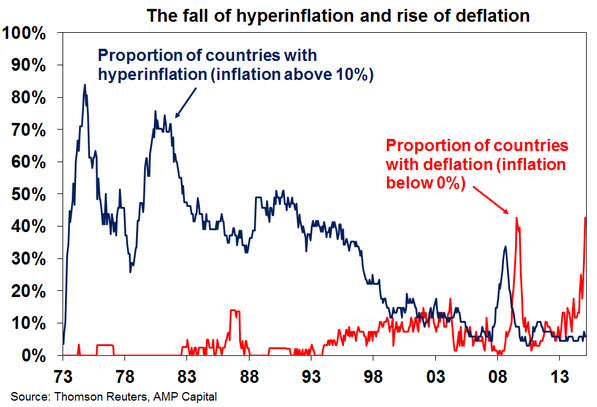

Countries experiencing deflation and inflation: Further confirmation of deflation can be seen in the chart below which shows an increasing number of countries experiencing deflation.

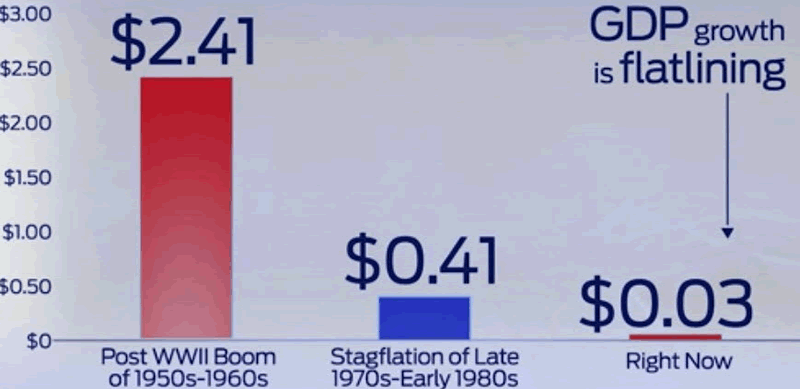

Governments and central banks are so indebted that excessive debt has destroyed their economy’s ability to generate wealth. The marginal utility of paper money is truly sinking, as shown by the fact that in 1950-60 every US$ of debt created 2.41 US$ of growth while today only 0.03 US$ is created with an additional dollar of debt.

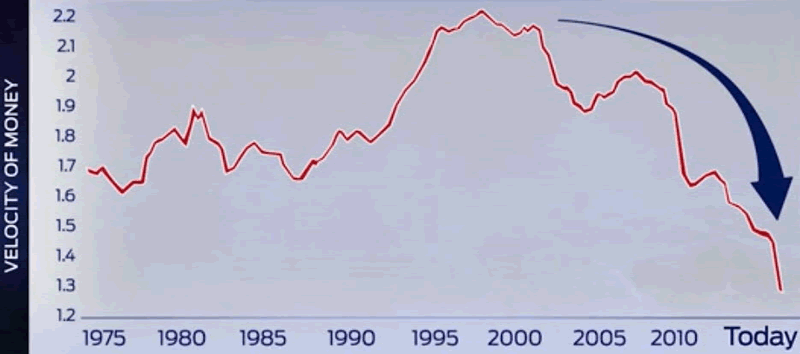

The velocity of money is collapsing and shows no sign of reversing.

The above charts show that the last six years of monetary expansion have produced no significant positive impact on the real economy.

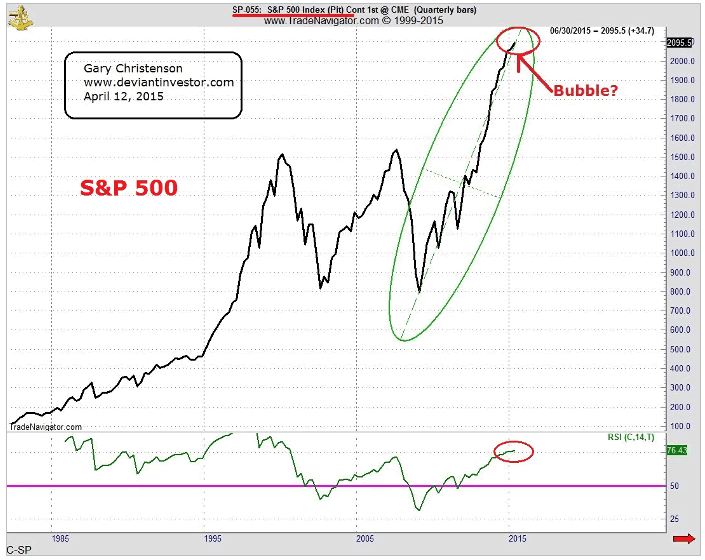

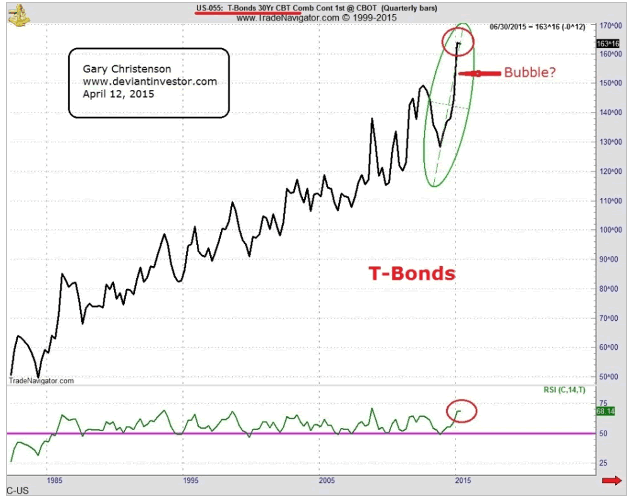

While commodity prices and economic activity have been falling, equities and bonds have been rising due to that monetary expansion.

All these signals are firmly laying out the direction: we are heading to the endgame. Note that the timing of the collapse is impossible to foresee, but the direction is clear.

Conclusions

- Quantitative Easing, artificially low interest rates, “printing money” and other such monetary policies have seriously distorted our financial systems.

- Asset bubbles, mal-investment, economic and financial distortions and other craziness such as negative interest rates on sovereign debt have resulted from those monetary policies.

- Deflationary forces in commodity prices have been dominant for several years. See charts above.

- However, inflationary forces in bonds and equities have been dominant for over six years. See charts above.

- Based on the massive increase in global debt of over $50 Trillion since the 2008 crisis, the often stated intention of central banks to create inflation (they fear deflation in bonds and equities), and the need for government to inflate away their debts, we can be assured of more monetary and price inflation in our future.

- But we can also be assured of more price deflation in our future – the consequence of asset bubbles, mal-investment, and the inevitable corrections.

- So we should expect more inflation (thanks to “printing money” and massive debt increases) and more deflation as the bubbles collapse. The correct answer to the inflation/deflation question, in our opinion, is both.

- Since US (and other) equities have been levitated into bubble territory during the past six years and bonds have climbed to generational highs, we should expect considerable deflation in those “paper” assets. Central banks, on behalf of the financial elite, will fight those deflationary forces with more “money printing” that will eventually fuel inflationary increases in commodity prices, which have been depressed for several years.

The End Game

Expect deflationary forces to eventually overwhelm the stock and bond markets, probably soon, and expect the deeply over-sold commodity markets to move higher.

Depending on the magnitude of additional “money printing” that the world’s central banks will unleash upon the global financial community, we could see hyperinflation in several countries within a few years.

Why?

Central banks will try everything to avoid or reverse a deflationary collapse in paper asset markets because a deflationary collapse is “game over” for their credibility, governments, and politicians. They will print and print more and continue to fuel the inflationary boom, and … the bigger the boom, the larger the distortions, and the deeper the collapse.

Expect more distortions, a correction in the equities and sovereign debt markets, and significant increases in the gold and silver markets as people search for safety in a dangerous sea of devaluing currencies and erratic stock and bond markets.

Courtesy of Global Gold Switzerland. Subscribe for future updates on http://www.globalgold.ch. To read more about wealth protection by holding physical gold outside the banking system, please visit http://welcome.globalgold.ch/physicalgold and request an investor kit for free.

© 2015 Copyright goldsilverworlds - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.