They Said Go to College - Learning to become Debt Slaves

Politics / Student Finances Apr 22, 2015 - 10:24 AM GMTBy: James_Quinn

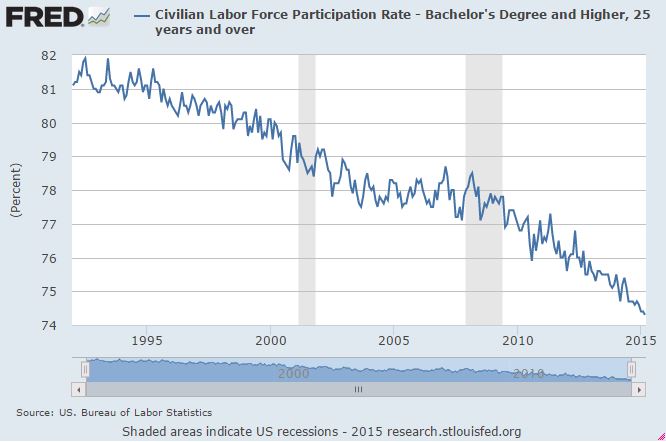

When I graduated from college in 1986 it was easy to get a job. The economy was booming and 82% of college graduates had a job. The other 18% were probably raising kids because their college educated spouse made enough to raise a family. The mantra for my entire life has been – go to college and you’ll get a good paying job. It seems something went wrong on the road to riches. The percentage of college graduates with jobs has been falling for the last 30 years and has been plummeting since 2008. It is now at an all-time low of 74.3%. Shouldn’t these people have obtained jobs since the government tells us the unemployment rate has dramatically dropped from 10% to 5.5% since 2009?

When I graduated from college in 1986 it was easy to get a job. The economy was booming and 82% of college graduates had a job. The other 18% were probably raising kids because their college educated spouse made enough to raise a family. The mantra for my entire life has been – go to college and you’ll get a good paying job. It seems something went wrong on the road to riches. The percentage of college graduates with jobs has been falling for the last 30 years and has been plummeting since 2008. It is now at an all-time low of 74.3%. Shouldn’t these people have obtained jobs since the government tells us the unemployment rate has dramatically dropped from 10% to 5.5% since 2009?

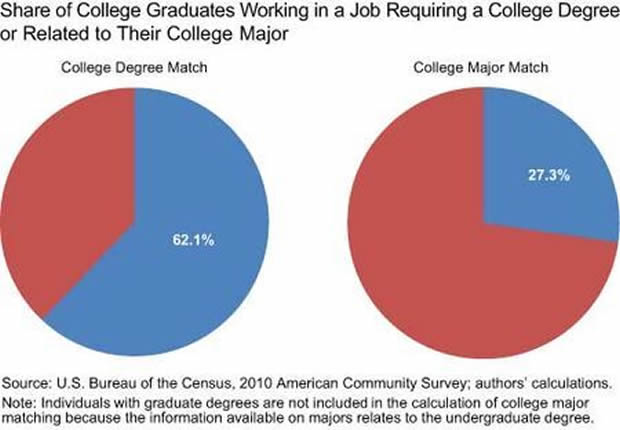

Not only is college graduate labor participation at record lows, but those getting jobs didn’t need a college degree in the first place to get that job, in the majority of cases. A new Careerbuilder survey indicates that though the majority of Class of 2014 college graduates are currently working, 51% of that group are in jobs that don’t require a degree. This is up dramatically from the 38% found in the 2010 US Census survey. The Careerbuilder survey also found that only 36% of 2014 college graduates had obtained full-time permanent jobs. The findings are as follows:

- 65 percent of recent college grads are employed (of these, 36 percent are in full-time, permanent positions; 17 percent are in part-time, permanent positions; and 12 percent are in temporary/contract positions). Fifty-one percent are in jobs related to their college major.

- 4 percent are in internships.

- 31 percent are not working at all (although many in this group haven’t started their job search or are already back in school to pursue a higher degree). Of this group, not even half (43 percent) say they’re currently looking for a job.

- Only 44 percent expect to make more than $30,000 their first year out of college.

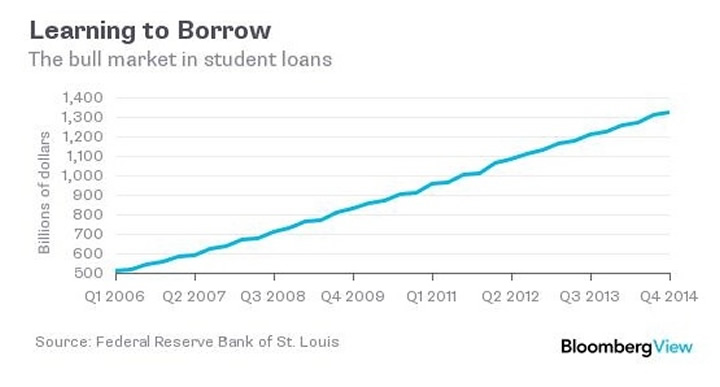

So we have less and less college graduates being employed, a majority of college graduates ending up with jobs that don’t require a college degree, many getting part-time temp jobs, and even if they get a job their wages are low. What did Obama and his minions do in 2009? They take over the entire student loan program for the country and proceed to dole out $600 billion of new student loans to anyone who could fog a mirror, let alone add or subtract. Millions have been lured into irreversible chains of debt over the last six years in order for Obama to artificially lower the reported unemployment rate, while pumping billions into consumer spending through a devious backdoor method. Now the brilliant summa ***** laude graduates of the University of Phoenix are pouring into the marketplace with $30,000 of student loan debt and interviews at Ruby Tuesday, Texas Roadhouse, and TGI Fridays.

Student loan debt has surpassed $1.3 trillion and the American taxpayer is now on the hook. At least 30% of the outstanding debt is already in default or deferral. The students are left with a debt burden that can’t be written off by declaring bankruptcy, very few jobs in their fields of study, wages that can barely cover the debt payments, and no chance of ever owning a home. They were told by their parents, politicians, and the mainstream media that college was the path to prosperity. They were lied to.

The Federal Reserve and the politicians in Washington D.C. have destroyed our economy with their debt based solutions and vast array of laws, regulations, and taxes, which have drained the life out of our financial system. The number of good paying new jobs for college graduates will continue to decline, but the amount of government backed student loans continues to go up by $5 billion per month. Those who have been unwittingly convinced college was a great idea, will pay for the rest of their lives. Or at least until the $500 billion taxpayer bailout when future president Clinton or Bush decides to relieve the burden of potential voters in a future election. Our hole is deep, but we just keep digging deeper. And the vested interests get richer as students and taxpayers go deeper into debt. They like the system just as it is.

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2015 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.