Bitcoin Recent Low Price Volatility Might Be Deceptive

Currencies / Bitcoin Apr 21, 2015 - 04:00 PM GMTBy: Mike_McAra

In short: speculative short positions, stop-loss at $239, take-profit at $153.

In short: speculative short positions, stop-loss at $239, take-profit at $153.

We frequently comment on new initiatives in the startup scene, and today we also read and interesting press release on the Market Watch website:

BitGo, the leader in bitcoin security, today announced a partnership with online cryptocurrency data provider TradeBlock. The combination of TradeBlock’s execution and analysis tools and BitGo’s trustless multi-signature security products create a complete security and transaction solution for private and institutional Bitcoin traders.

“Today’s trading environment demands flexible, responsive and highly connected infrastructure while also remaining completely secure,” said TradeBlock CEO Greg Schvey. “We believe the combination of TradeBlock’s execution and analysis tools with BitGo’s class leading multi-signature security creates the most powerful of feature set available to traders today.”

As part of the newly formed partnership, BitGo and TradeBlock will work to create seamless interoperability between the companies’ product suites, resulting in one easy to integrate system for private and institutional customers. Now, institutional and individual traders can manage their over-the-counter trading activity and portfolio in a single system.

One has to bear in mind that this is promotional material, so we take the claims made in it with a pinch of salt, but the idea of combining analytics tools with multi-signature security does seem appealing. We have frequently mentioned that in order to get more users, Bitcoin will have to evolve to become more secure and, at the same time, easier to use. This usually applies to the idea of Bitcoin being used as a means of payment by individuals and companies. Here, the situation is slightly different since the BitGo and TradeBlock’s product is likely to be used by private and institutional traders rather than for payments. This potentially makes security even more important since the security of trades should be paramount to any financial institution.

How the final product will actually look like remains to be seen, but we count this as one of many similar positive developments suggesting that the ledger mechanism is here to stay. And since Bitcoin is the most popular cryptocurrency, it seems that most of the solutions proposed will be for the Bitcoin system.

For now, let’s focus on the charts.

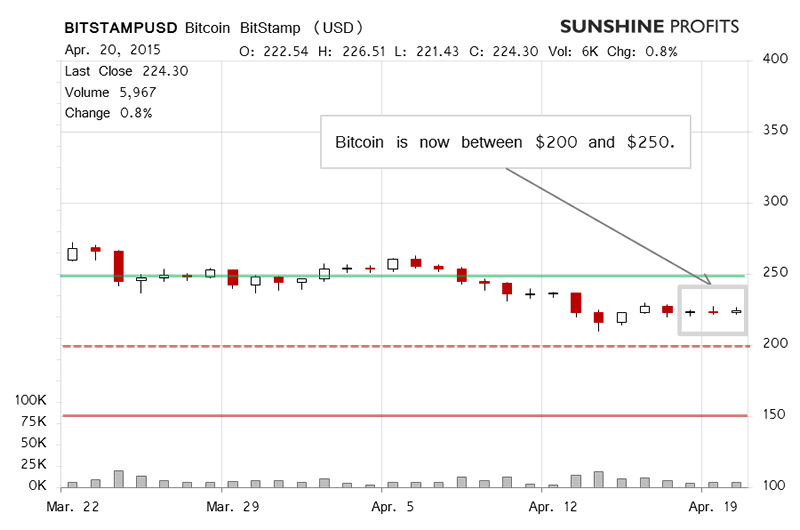

On BitStamp, yesterday was a perfect continuation of the no-action period we saw over the weekend. Bitcoin barely moved and the volume was almost identical to what we had seen on the day before. Yesterday, we wrote:

(…) we’ve seen more of the same (…), that is not much action in terms of price with relatively weak volume levels. Bitcoin is still below $250, the rebound we saw before the weekend might already be over, and it seems that the currency still has some room to decline. The one question now is whether the decline would come in a matter of days or weeks. The action suggests that what we’re seeing now might be more of a pause but the possibility of a decline remains very much in sight.

Today, the action has been even less visible (this is written before 10:00 a.m. ET). It seems to us that Bitcoin is now in consolidation mode, drifting sideways after a short-lived rebound. Since there has been no continuation of the rebound and the current action is rather weak, it doesn’t seem that we’re seeing a move higher just now. In our opinion, the lack of action after the small rebound suggests that we might be in for more depreciation.

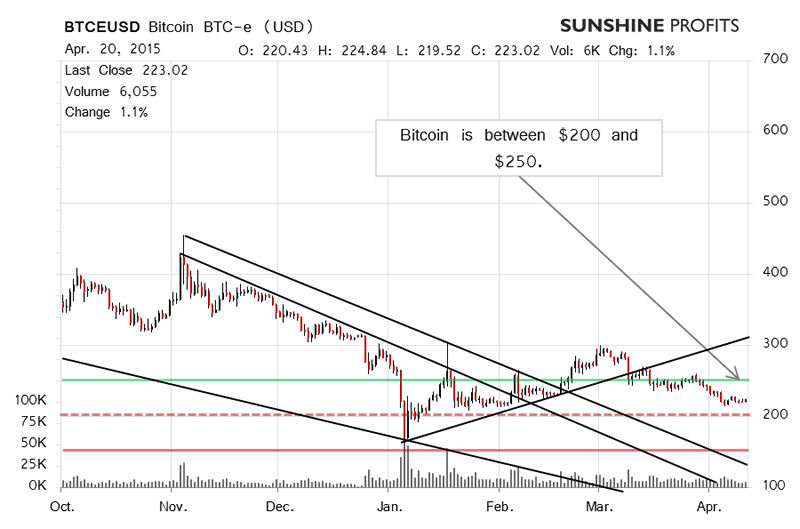

On the long-term BTC-e chart, we’re seeing that the movement has been relatively flat recently, following a tiny rebound from a move down. Yesterday, we wrote:

It seems now that we might be in for a consolidation. The thing here is that even though we might have to wait for the move to materialize, the possible slide below $200 (dashed red line in the chart) might be worth the wait in terms of how deep the currency might go down. The recent downtrend has been in place since the first week of April but the move has not been really strong. We also might have just seen a miniature correction (Wed.-Thu.) and Bitcoin might still have some room to decline. All of this suggests that even though we might still have to wait out some fluctuations, the following move might be rewarding.

Today has been even more supportive of the above comments. The consolidation has continued, there has been no significant move up and Bitcoin is fluctuating close to $225. What is more, the currency still seems to have room for decline. Right now, we think that some up and down movement might still be ahead of Bitcoin traders but the current environment suggests that more declines can follow.

Summing up, in our opinion speculative short positions might be the way to go now.

Trading position (short-term, our opinion): short, stop-loss at $239, take-profit at $153.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.