The Rise of the Paper Machines

Stock-Markets / Fiat Currency Apr 20, 2015 - 03:14 PM GMTBy: DeviantInvestor

Since 2011 the financial markets have been dominated by rises in paper markets and declines in commodity markets.

Group One Paper Examples: T-Bonds, US Dollar Index, S&P 500 Index

Group One Paper Examples: T-Bonds, US Dollar Index, S&P 500 Index

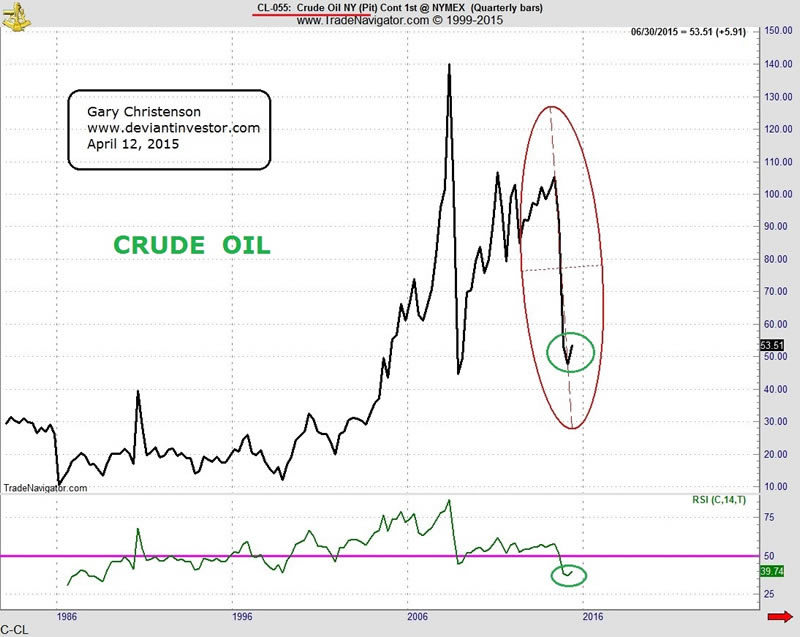

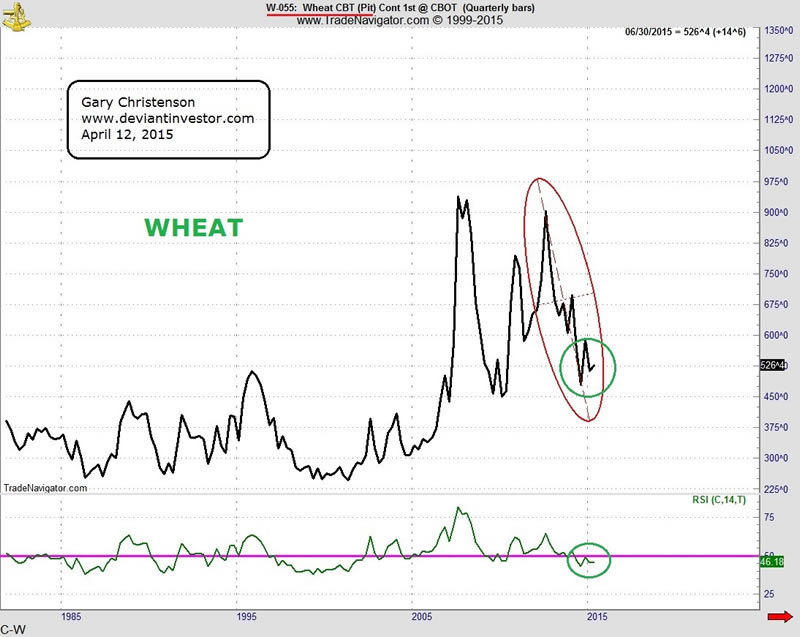

Group Two Commodity Examples: Crude Oil, Sugar, Wheat, Gold, Silver

Group One markets are “paper” markets in fiat debt, fiat currency, and paper equities. They are heavily influenced by “money printing,” Quantitative Easing, High-Frequency-Trading, futures, central banks, and political agendas.

Group Two markets are supposedly more real commodity markets, but they are also influenced by futures trading, HFT, and other agendas.

Examine Group One charts – quarterly charts for 30 years showing only the quarterly close lines.

Examine Group Two charts – quarterly charts for 30 years showing only the quarterly close lines.

Clearly the paper markets in Group One have done well, while Group Two markets have been hurt.

Group One markets have what in common? They are supported by central banks, governments and politicians who fear deflationary forces. Deflation is difficult to control, destroys debt instruments (the lifeblood of banking), reduces tax revenue (lifeblood of governments), and makes it more difficult to “buy votes” (lifeblood of politicians). Deflationary forces are fought with “stimulus,” more spending, more debt, Quantitative Easing, bond monetization, Zero Interest Rate Policy (ZIRP), dodgy government statistics, and propaganda.

In my opinion, the financial and political elite have done a good job force feeding created currencies into the paper markets of Group One, thereby levitating them for the benefit of bankers, politicians, and the financial and political elite.

Similarly, the gold and silver markets are often viewed as an early warning of inflationary forces, excessive “money printing” and political and financial mismanagement. Hence gold and silver prices must be suppressed, particularly after the scare that gold and silver gave the powers-that-be in 2011 when gold surged to a new all-time high. Since 2011 the created liquidity has been injected into the paper markets at the expense of commodity markets such as crude oil, sugar, wheat, gold, and silver.

The powers-that-be have done a great job levitating Group One markets and suppressing Group Two markets. They have considerable resources, massive quantities of fiat currency, considerable influence over the media and government statistics, and the power of the banking cartel and “printing press” behind them. They possess the motive, means and opportunity, so there should be no surprise at their success levitating Group One markets.

But really, how long can fiat paper markets be levitated? There are signs of strain everywhere:

- Swiss sovereign debt out to 10 years “pays” negative interest.

- German sovereign debt out to 8 years “pays” negative interest.

- US T-Bonds had a 3+ sigma move, based on monthly closes, from February 28 to March 31.

- The US dollar index has risen to a 12 year high.

- The S&P reached an all-time high in March 2015 and is within a percent of that high as of April 10.

These beg the following questions:

- If sovereign debt is increased every year and is never liquidated because it is continually “rolled over,” how much is that debt truly worth and how long will perpetually increasing debt persist before a violent reset occurs?

- If currencies (euros, yen, pounds, and dollars) are created by the trillions each year, thereby diluting the existing stock of currency in circulation, how rapidly will purchasing power diminish?

- Unbacked fiat currencies have eventually been inflated into worthlessness, so when should we expect the demise of euros, yen, pounds, and dollars? Is a “currency crisis” in our future?

- If sovereign debt has a negative yield, what rational person would “lend” money to an irresponsible government when the government guarantees the return of only a fraction of the loan in currency units that will be devalued and worth considerably less when/if the loan is repaid?

- If governments and central banks are intensely working to levitate bonds, fiat currencies, and stock markets, and are working equally intensely to suppress commodity prices, what do they have to hide?

- Are gold and silver purchases more sensible than investing in overpriced paper debts that guarantee a negative yield in a devaluing currency issued by a dodgy government or central bank?

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2015 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.