US Dollar Lifted by Talk of Intervention

Currencies / US Dollar Jun 11, 2008 - 05:56 AM GMTBy: Mark_OByrne

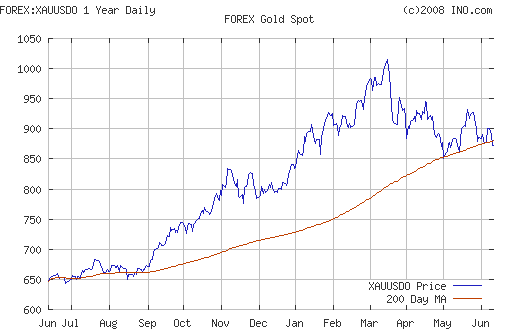

Gold closed at $867.80 in New York and was down $27 and silver closed at $16.57 down 58 cents. Gold has risen in Asia overnight and in early European trading this morning is up some 0.5%. Further consolidation between $850 and $950 is needed and the 200 day moving average at $855 is likely to provide good support (especially with oil up 2% today).

Gold closed at $867.80 in New York and was down $27 and silver closed at $16.57 down 58 cents. Gold has risen in Asia overnight and in early European trading this morning is up some 0.5%. Further consolidation between $850 and $950 is needed and the 200 day moving average at $855 is likely to provide good support (especially with oil up 2% today).

Talk of Intervention in Markets Lifts Dollar

Further talk of intervention by Treasury Secretary Henry Paulson led to a sharp rally in the U.S. dollar yesterday and a selloff in the gold market. And this despite very bad data yesterday including another near record trade deficit in April and U.S. consumer confidence sinking to a record low in June as a surge in gasoline prices to more than $4 a gallon and a jump in the unemployment rate helped depress the modest rebound in Americans' outlook seen the previous month.

Paulson said he stood by comments made earlier in the week in which he said he would never rule out currency intervention as a potential policy tool. He did not spell out what this currency intervention would entail but it is likely that any such currency intervention would involve the Working Group on Financial Markets buying the dollar through proxies on Wall Street in order to support the dollar.

It is quite possible that this would also involve selling gold in order to support the dollar (as was done by the London Gold Pool in the 1960's). Interestingly, almost 75% of the day's very heavy volume in the gold market was estimated to have traded by 1000 EST which could be indicative of official intervention. Given the severity of the problems facing the U.S. financial system and economy and the clearly stated intentions of senior US officials in this regard, it would be naïve to absolutely rule out official intervention in the gold markets today and in the coming months.

While this could lead to short term weakness in the gold price, it would be very bullish for gold in the medium to long term as it would clearly show that the fundamentals of the dollar are very weak and conversely that the fundamentals of gold are very strong. Investors and institutions internationally would take positions accordingly in anticipation of free market forces resulting in markets reaching their corresponding fair value.

Bernanke's Credibility In Question?

The US economy may have avoided a major decline, US Federal Reserve Chairman Ben Bernanke has said. Mr Bernanke said the risk of a substantial downturn had "diminished over the past month or so".

It is worth remembering that Bernanke was absolutely wrong when he claimed that subprime credit problems were largely contained and would not spill over into the broader economy. These incorrect assertions were echoed by Treasury Secretary, Hank Paulson and by President Bush

One should be concerned when the stewards of an economy can be so wrong.

The ‘dogs in the street” were aware of and warning of the risks posed by the array of different opaque asset backed securities and exotic derivative vehicles. Officials in the EU and UK and their corresponding central banks also warned and yet the most important U.S. government officials remained in absolute denial.

Were they simply complacent and thus blind to the obvious risks these vehicles would pose to the financial system and wider economy? Or have they simply become cheerleaders who think all can be simply and magically corrected by attempting to boost consumer and investor confidence through hollow sound bites and a constant attempt to manipulate public perception rather than deal in financial and economic reality.

http://quotes.ino.com/chart/?s =FOREX_XAUUSDO&v=d12&w=1&t=l&a =200

In the fullness of time, it seems likely that they will be seen as the latter and may well be reviled for their incompetent stewardship of the economy during this period. Although it should be remembered that many of the monumental problems that the present Federal Reserve Chairman is confronted with were actually created by his predecessor Alan Greenspan and his easy money policies which created a series of huge imbalances and bubbles, the aftermath of which Ben Bernanke has been left to attempt to ameliorate.

No amount of “putting lipstick on a pig” by Bernanke, Paulson or Bush will stop the U.S. economy from entering a serious and prolonged recession. A recession likely as bad as the stagflation of the 1970's if not worse.

Today's Data and Influences

There is little in the way of data today but this evening's Fed Beige Book could provide some direction.

Economic data to watch for the rest of the week will be the inflation numbers in the US tomorrow and on Friday afternoon. High readings will further heighten real fears regarding deepening stagflation and fuel expectations for interest rate hikes from the Federal Reserve going forward.

Silver

Silver is trading at $16.60/16.70 per ounce (1130 GMT).

PGMs

Platinum is trading at $2018/2028 per ounce (1130GMT).

Palladium is trading at $423/428 per ounce (1130 GMT).

By Mark O'Byrne, Executive Director

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@www.goldassets.co.uk Web www.goldassets.co.uk |

Gold and Silver Investments Ltd. have been awarded the MoneyMate and Investor Magazine Financial Analyst of 2006.

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Mark O'Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.