Will Ever More Boomers Selling Retirement Assets Change Investment Prices For Decades?

Stock-Markets / Demographics Apr 16, 2015 - 05:01 PM GMTBy: Dan_Amerman

When investors pour cash into a market, all else being equal – prices rise. And when investors pull cash from a market – prices fall.

When investors pour cash into a market, all else being equal – prices rise. And when investors pull cash from a market – prices fall.

If we accept that simple relationship, and agree that the basic laws of supply and demand apply to investments just like they do to the rest of economics, this could mean that we are in the early stages of a tidal reversal in the investment markets – which just may change everything when it comes to our future income and standards of living.

As explored herein, what we believe to be true about investment prices and yields – what decades of market numbers show us, and what decades of personal experience have taught us – are all based on a unique set of circumstances, that has existed from roughly the early 1980s until today. This unique set of circumstances combined to become the largest and most reliable source of incoming cash for financial markets in history – and the markets responded.

From here forward, however, with each passing year – that unique set of circumstances is not only coming to an end, but will be reversing. That is, the unique convergence of factors that reliably poured cash into the markets will eventually come to a stop, and then begin to reliably pull cash out of the markets.

The Largest Supply Of Investment Cash

The Baby Boomers, those of us born between 1946 and 1964 – have never done anything on a small scale. We were the largest generation, and therefore much of what we did was the biggest in American history up until that time. First, we overloaded the school system, then we transformed the labor force and the economy, and then we transformed the housing market.

We also became the biggest generation of investment buyers in history – and still are. Which necessarily means that the Boomers will gradually also become the biggest generation of investment sellers in history.

Now, becoming the biggest generation of investors involved much more than just the total number of people, for what mattered even more was the percentage of the population who were buying investments.

New tax-advantaged savings plans came out: IRAs, 401(k)s, and many others, which were intended to encourage middle class investors to participate in the investment markets. Besides widely broadening the base of investors, the new plans were designed to alter investor behavior, through the use of the tax code to encourage tens of millions of people to put as much cash as possible into the markets each month of every year.

Of at least equal importance was that the tax code created another revolutionary change in investor behavior – which is that you could put your money in but you couldn't take it out, at least not without substantial penalties. Instead, once the money was put in the financial markets, for younger investors it couldn't be taken out for decades, a restriction that was supposedly for the greater good.

There was a third and even more important twist to the new regulations that spurred another crucial change in investor behavior as a matter of law, but which is not generally understood by the general public (even if very well understood by the investment industry). In prior years, many wealthy people had purchased investments so that they could support a comfortable lifestyle based on the income generated. So cash was paid out by the markets in the form of dividends and interest income – and it often left the markets.

With the new regulations, the capital gains, dividends and interest on investments earned by these many millions of new middle class investors also could not be taken out before retirement age. So no cash could come out (without a significant penalty), but rather all of it had to go straight back into the markets and to buying still more investments, supporting market prices and driving them higher.

Thus with an investment made thirty years before retirement, it wasn't just that the original contribution itself couldn't be cashed out, but every single cash payment received over those thirty years also had to stay in the markets.

Now, for the general public, this mandatory reinvestment of all cash flows over the decades may not sound like such a big deal, at least not as important as the original savings. In truth, however, this required 100% reinvestment of cash flows received would become the single largest and most reliable source of market support by retirement account investors.

Indeed, it is the reinvestment of income that is the core of conventional financial planning. As explored here, after someone had been saving for a number of years, the goal was for these reinvestment purchases to grow to be larger than the annual contributions from their working income, and then twice as large, and eventually three times as large, and so forth.

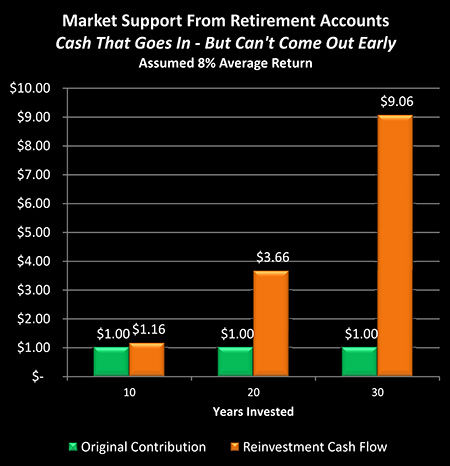

As shown in the graph, within a long-term retirement account the original contribution becomes dwarfed by reinvestment earnings over time – or at least, that is how it was supposed to work. What matters most for the market when it comes to driving pricing upwards is not the original $1.00 retirement account contribution that can't come out, but rather the $9.06 in investment earnings over 30 years that also can't come out.

The idea is sometimes referred to as "our money working for us, instead of us working for our money". And eventually, that is how it is supposed to work out, once we are retired. But in the meantime, this twist in retirement account legislation absolutely transformed the markets, because all that income from all those millions of people for all those years went straight back into the markets – seeking a home, increasing the supply of money seeking investments each and every month, and fundamentally altering the laws of supply and demand when it came to investment prices.

A paper wealth cyclone of sorts was created, that effectively generated its own weather pattern. The money could go in – but not come out, not for a very long time. The money, the paper wealth, would steadily throw off more wealth – but that also couldn't be spent. Instead, it had to go straight back into the financial markets. Driving prices still higher, creating still more paper wealth, which couldn't leave, but had to say in for another round of driving prices higher. Year, after year, after year.

Inside a retirement account and in the decades leading up to retirement, it is actually somewhat debatable whether our money is really working entirely for us, or whether it is at least equally working for the markets (and the financial firms), thanks to the way the retirement account legislation was written.

Even those employees who never contributed a dime to these self-directed plans still became investors on a massive scale by way of pensions given to them by their private and governmental employers – who invested in the markets on their behalf. The flow of cash into pension-plan investments was also a one-way street, with the original cash going in but not coming out for decades – as a matter of law – even as every penny of the interim cash earnings over the decades also had to go back into the markets – also as matter of law.

Further feeding the paper wealth cyclone with the retirement savings of all of those with pension plans.

When Everyone Sells

When we put all of these factors together and look back at these past few decades, the results were pretty fantastic indeed (or at least they were during the 1980s and 1990s).

But the issue is we've now entered a pivotal phase in which with each passing day, that massive group of Baby Boomers is reaching retirement age in ever-greater numbers. So when we look to the future then, this begs a simple but essential question: what happens when everyone sells? And not only sells, but takes their money out of the markets as it is received instead of reinvesting?

What happens to prices and returns when tens of millions of Baby Boomers and their pension funds are simultaneously selling their investments? That is after all the whole idea of investing for retirement – eventually selling our investments, cashing out, and enjoying the proceeds in our golden years.

What happens when the tax laws reverse what they encourage now, and force sales instead of buying? When Boomers in their 70s and 80s have to be spending down their portfolios instead of adding to them?

What happens to prices when instead of cash, cash and more cash pouring into the markets – it is cash, cash and more cash being pulled out of the markets?

Words like “Boomer Bust”, “tidal wave”, “crash”, “battle” and “storm” have been used to describe what will happen to the markets, within the small section of the investment community that has been anticipating the consequences of the Baby Boom collectively selling its investments. As if some monstrous one time force will rise up out of nowhere and come crashing through the markets, leaving devastation behind it before dissipating.

There is an element of truth to that "high drama" perspective, but rather than a tsunami of some sort I'd argue that a better analogy would be a gradual shift in the tide. For the Baby Boom's impact on the markets isn’t some hypothetical force to be reckoned with at some future point down the road – it is what has dominated the markets already for the last 35 years.

A rising tide of cash has lifted all the boats over the years, and shaped the way an entire generation looks at the markets, along with our expectations for returns. Whenever we look to returns, or prices, and consider what is reasonable to expect when it comes to future results, we tend to view it from within the framework of our personal experience over our lifetimes – which is that of cash steadily pouring into the markets for decades.

Now the tide is not yet actually receding, but we are nearing high tide, and the rate at which the tide of cash is coming into the markets is starting to slow. The Baby Boom is aging, those born in the 1940s are already retiring in large numbers, even as more and more of those born in the 1950s take early retirement. But the substantial majority of Baby Boomers are still in their peak earning years. Indeed, some are just now reaching those years – so the Baby Boom cash influx isn't over with yet.

The Five Factors

When that time does come that most of the Baby Boom have retired and are starting to liquidate their retirement portfolios or draw down their pensions – or both – we are going to see five distinct but interrelated impacts on cash flow:

The 2nd part of this article discusses the impact of steadily-building Boomer investment sales and five factors affecting future markets.

Daniel R. Amerman, CFA

Website: http://danielamerman.com/

E-mail: mail@the-great-retirement-experiment.com

Daniel R. Amerman, Chartered Financial Analyst with MBA and BSBA degrees in finance, is a former investment banker who developed sophisticated new financial products for institutional investors (in the 1980s), and was the author of McGraw-Hill's lead reference book on mortgage derivatives in the mid-1990s. An outspoken critic of the conventional wisdom about long-term investing and retirement planning, Mr. Amerman has spent more than a decade creating a radically different set of individual investor solutions designed to prosper in an environment of economic turmoil, broken government promises, repressive government taxation and collapsing conventional retirement portfolios

© 2015 Copyright Dan Amerman - All Rights Reserved

Disclaimer: This article contains the ideas and opinions of the author. It is a conceptual exploration of financial and general economic principles. As with any financial discussion of the future, there cannot be any absolute certainty. What this article does not contain is specific investment, legal, tax or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the results of the application of principles contained in the article, website, readings, videos, DVDs, books and related materials, either directly or indirectly, are expressly disclaimed by the author.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.