Stock Market Boom and Crash: Cause and Effect

Stock-Markets / Stock Market Crash Apr 16, 2015 - 02:16 PM GMTBy: Wim_Grommen

This article explains, based on transition properties, why a stock market boom occurs during the acceleration phase of a transition, inevitably followed by a stock market crash in the stabilization phase of a transition.

This article explains, based on transition properties, why a stock market boom occurs during the acceleration phase of a transition, inevitably followed by a stock market crash in the stabilization phase of a transition.

Transitions

Every production phase, civilization or other human invention goes through a so called transformation process. Transitions are social transformation processes that cover at least one generation. In this article I will use one such transition to demonstrate the position of our present civilization and its possible effect on stock exchange rates.

A transition has the following properties:

- it involves a structural change of civilization or a complex subsystem of our civilization

- it shows technological, economical, ecological, socio cultural and institutional changes at different levels that influence and enhance each other

- it is the result of slow changes (changes in supplies) and fast dynamics (flows)

A transition process is not fixed from the start because during the transition processes will adapt to the new situation. A transition is not formulaic.

Four transition phases

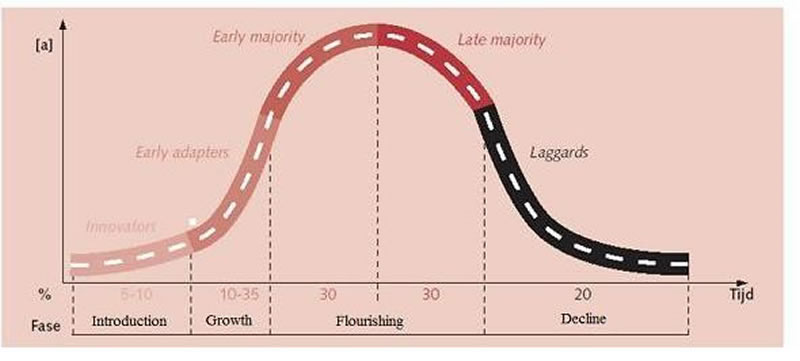

In general transitions can be seen to go through the S curve and we can distinguish four phases:

- a pre development phase of a dynamic balance in which the present status does not visibly change

- a take-off phase in which the process of change starts because the system starts to shift

- an acceleration phase in which visible structural changes take place through an accumulation of socio cultural, economical, ecological and institutional changes influencing each other; in this phase we see collective learning processes, diffusion and processes of embedding

- a stabilization phase in which the sociological change slows down and a new dynamic balance is gradually achieved

A product life cycle also goes through an S curve. In that case there is a fifth phase: the degeneration phase in which cost rises due to over capacity and in which the producer will finally withdraw from the market.

When we look back into the past we see three transitions, also called industrial revolutions, taking place with far-reaching effect:

1. The first industrial revolution (1780 until circa 1850); the steam engine

2. The second industrial revolution (1870 until circa 1930); electricity, oil and the car

3. The third industrial revolution (1950 until ....); computer and microprocessor

The emergence of a stock market boom

In the development and take-off phases of the industrial revolution many new companies emerged. All these companies went through more or less the same cycle simulataneously. During the second industrial revolution these new companies emerged in the steel, oil, automotive and electrical industries, and during the third industrial revolution the new companies emerged in the hardware, software, consulting and communications industries. During the acceleration phase of a new industrial revolution many of these businesses tend to be in the acceleration phase of their life cycle, more or less in parallel (Figure 1).

Figure 1. Typical course of market development: Introduction, Growth, Flourishing and Decline

There is an enormous increase in expected value of the shares of companies in the acceleration phase of their existence. This is the reason why shares become very expensive in the acceleration phase of a revolution.

There was also an enourmous increase in price-earnings ratio of shares between 1920 – 1930, the acceleration phase of the second revolution, and between 1990 – 2000, the acceleration phase of the third revolution.

The increase in the price-earnings ratio is amplified because many companies decide to split their shares during the acceleration phase of their existence. A stock split is required if the market value of a share has grown too large, rendering the marketability insufficient. A split increases the value of the shares because there are more potential investors when they are cheaper. Between 1920 - 1930 and 1990 – 2000 there have been huge amount of stock splits that impacted the price-earnings ratio positively.

In the acceleration phase of a revolution there will always be a stock market boom.

Figure 2. Two industrial revolutions: Shiller PE Ratio (price / income)

The consequence of a stock market boom is a market crash

The third industrial revolution is clearly in its saturation and degeneration phase. This phase is characterized by the saturation of the market and the increasing competition. Only the strongest companies can compete, or take on the competition (like for example the take-overs by Oracle and Microsoft in the past few years). This puts many of the newly created companies in the stabilization phase or decline phase of their life cycle, decreasing their growth potential and the expected value of their shares. This means that the price-earnings ratio of shares will go down. This trend started in 1930 during the first industrial revolution and has started repeating itself from 2000 on.

Depending on the behavior of the central banks, the future will tell whether and at what rate the price-earnings ratio of shares will continue to drop. Aristotle's law of cause and effect also applies to a stock market boom and a stock market crash.

Wim Grommen

Mr. Grommen was a teacher in mathematics and physics for eight years at secondary schools. The last twenty years he trained programmers in Oracle-software. The last 16 years he studied transitions, social transformation processes, the S-curve and transitions in relation to market indices. Articles about these topics have been published in various magazines / sites in The Netherlands and Belgium.

Copyright 2015 © Wim Grommen - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.