Stock Market Poised for a Flash Crash

Stock-Markets / Financial Crash Apr 15, 2015 - 07:56 PM GMTMy earlier thesis of an unfinished retracement in SPX hit the nail on the head. Note that it didn’t go above the March 23 high, verifying the weakening uptrend. I recalibrated the Megaphone formation and verified it as an Orthodox Broadening top rather than a Broadening wedge. The formation may be triggered at 2103.00, so this is where I expect a Flash Crash to begin.

The lack of liquidity has me very concerned, since the last time this was tested was on October 15, when the market declined 3% in three hours. The last two levels at which you should be short are the rising trendline at 2090.00 and the 50-day Moving Average at 2082.08.

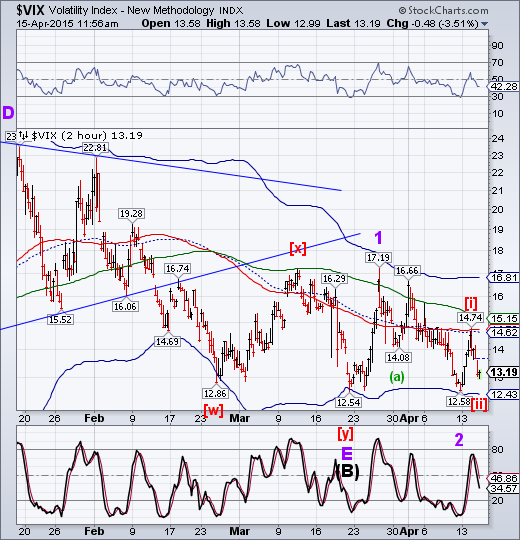

As I had surmised, the VIX is being suppressed into the close of trading in the VIX options at noon today. I suspect that it will liven up after 3:00 when the options settle. The two confirming levels for a VIX sell signal are 14.62 and 15.15. Presumably they will be attained as the SPX crosses its 50-day Moving Average.

WTIC has broken out above its Wave [a] high at 54.24 and at 55.86 it appears to be gaining strength for a much higher push. Mid-Cycle resistance at 69.51 is the apparent target, but whether it attains it or goes higher is still anyone’s guess.

I’ll be out with a Mid-week Report after the close.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.