Boom Zero Interest Rates

Interest-Rates / US Interest Rates Apr 15, 2015 - 04:03 PM GMTBy: Gary_Tanashian

There is so much data flying around out there. From the Credit data we reviewed yesterday to weakening manufacturing and exports to employment up nicely one month and down big the next, to frisky consumers (the economy’s ‘back end’, putting it nicely) out there confidently living it up.

There is so much data flying around out there. From the Credit data we reviewed yesterday to weakening manufacturing and exports to employment up nicely one month and down big the next, to frisky consumers (the economy’s ‘back end’, putting it nicely) out there confidently living it up.

Big pictures help us let it all simmer and take out the noise. Here is a big picture for you… and it is an unchanged story; America has eaten its financial seed corn (replacing it with the soft meal known as credit) and financial market analysis is now in the hands of data freaks parsing and quantifying every little twitch on short time frames to draw conclusions and extrapolations based on little more than a black hole (that would be debt).

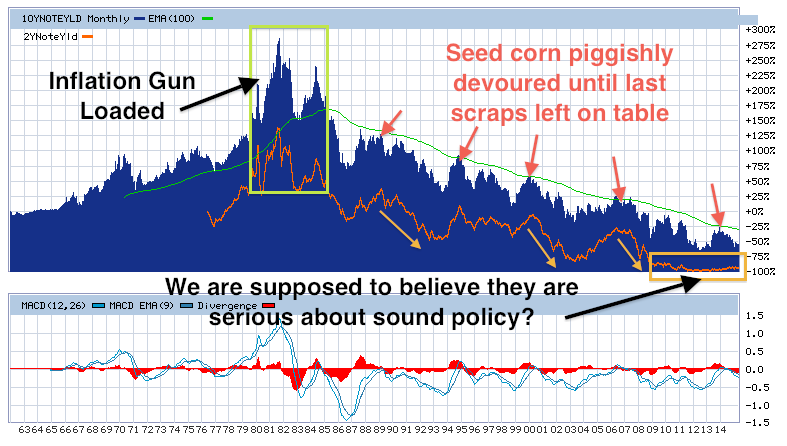

Here is the 10 year yield (blue shaded area) pinned down for decades by our ‘Continuum’ indicator, the monthly EMA 100 along with the 2 year yield (orange).

10yr & 2yr yields from WSJ

Don’t get me wrong, playing to the short-term data and not fighting what is vs. what we think we know has worked well in the current phase. But that is interim stuff. The chart above says so. 2 year yields have been rising! Oh my, they must be serious about normalizing monetary policy!!

Ha ha ha… we have been eating the national seed corn over the decades, all the way down to 0% today; and now they are normalizing policy?

“Why, sometimes I’ve believed as many as six impossible things before breakfast.” –Alice in Wonderland

I live in America, so naturally I am more America-centric in my criticism. But our friends in Europe, Japan, China, Canada, Australia… they have all hopped aboard to one degree or another and by one method or another.

Constant doom-saying by the doom sayers does no good, because we are talking big pictures here. These things creep along literally for decades. Indeed, doom-saying to stimulate peoples’ fear instincts has caused a lot of pain over the last few years for the people who acted on the advice of the Sons of Martin Weiss.

But it does not change the fact that the US is near zero yields and relies on the engineering of debt to manufacture its boom cycles.

Here at Boom ZERO (™, ©) one might wonder where the future path leads. Secular Stagnation, as seems to be the new faddish reason to be bullish? I could see that as long as people continue to suspend disbelief (which again, can take decades). Hyperinflation? I don’t think so. At least not in any form that commodity bulls will be able to pitch. Deflationary resolution? Well, deflation is and has been trying to address systemic excesses for decades.

I’ll take C, Alex… deflation. This is fought every step of the way by (inflationary) policy makers now stuck at ZERO and trying desperately to put some ammo back in the Inflation Gun. It is too late.

Taking out all the brainy egg heads (Keynesian and Austrian alike), short-term data crunchers and trading captains who think they can predict what is upcoming for other people to follow, what if just maybe, there is no predictable answer because we are pinned to the mat (ZERO rates) in a system that has never been at this juncture with this particular combination of inputs?

Tell me again why it’s called Notes From the Rabbit Hole? Why is the other site called ‘but it is what it is’ (biiwii)? Another good one from Alice in Wonderland:

“How puzzling all these changes are! I’m never sure what I’m going to be, from one minute to another.”

What is so wrong with that concept? In this kind of a system, you stand too strong for any one thing (i.e. putting your capital where your idealistic self is) you can get blown up in a heartbeat. Changes always come, but you have to be patient (measured in years), play the game and yet realize at all times what the big picture says.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2015 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.