Just How Unreliable Is the U.S. Electricity Grid?

Companies / Electricity Apr 12, 2015 - 09:12 PM GMTBy: Investment_U

Sean Brodrick writes: Editor’s Note: If you’ve read some of Sean Brodrick’s recent articles, you know how much of a threat cyberattacks currently pose the U.S. This week’s chart comes from Sean’s most recent report, “Smart Grid Security: Cash In on These Four Companies as They Prepare to Secure Our Nation.” To read the full report and learn more about the companies poised to profit from this situation, click here. - Rachel Gearhart, Managing Editor

Not only does the U.S. suffer more blackouts than any other developed nation... The number of U.S. power outages lasting more than an hour has increased steadily for the past decade. That’s according to federal databases at the Department of Energy (DOE) and the North American Electric Reliability Corp. (NERC).

Those outages cost about $500 for every man, woman and child in America. That adds up to an estimated $150 billion per year, according to the DOE.

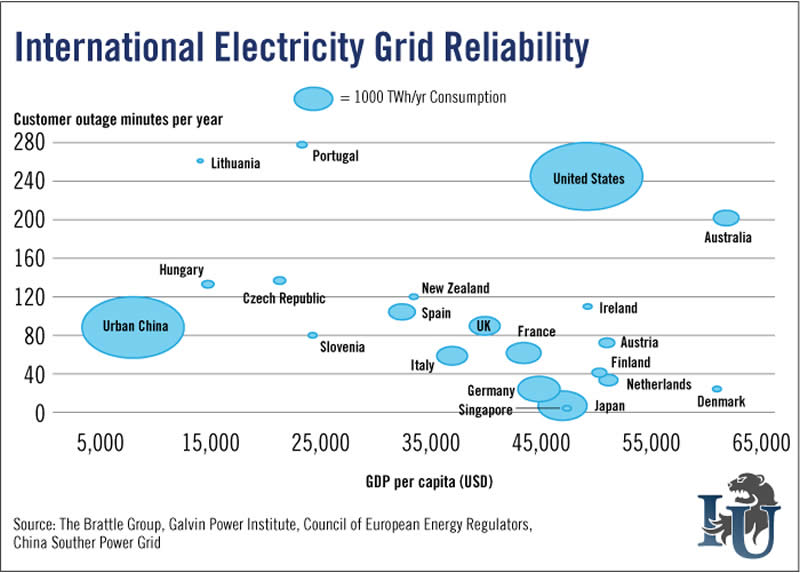

In fact, the U.S. power grid is surprisingly unreliable at the best of times, especially when compared to those of other developed countries.

As you can see in the chart above, the U.S. power grid has by far the most customer outage minutes per year for its economic size.

While people in Japan lose power for an average of four minutes per year, residents of the upper American Midwest lose power for an average of 92 minutes per year. The worst is in the upper Northwest. There, people lose power for an average of 214 minutes per year.

Is it getting worse? Yes! Here are the hard numbers: According to federal data, the U.S. electric grid loses power 285% more often now than in 1984. That’s when data on blackouts was first collected.

The good news is America’s utility industry is moving toward updating its infrastructure into a “smart grid.” This would allow utilities to monitor customers’ electricity use remotely, from a central location, rather than requiring on-site monitoring from gauges or meters at homes and businesses.

A smart grid lets operators calibrate energy supply and use it with precision. A smart grid could reduce costs of power outages by about $49 billion per year.

The bad news? This makeover won’t be cheap. It’ll cost between $338 billion and $476 billion, according to the Electric Power Research Institute.

On the bright side - for investors, at least - much of that money will go to a handful of publicly traded tech companies.

Copyright © 1999 - 2015 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.