Gold Weakens on Another Dollar Dead Cat Bounce

Commodities / Gold & Silver Jun 10, 2008 - 08:15 AM GMTBy: Mark_OByrne

Gold closed at $894.80 in New York and was down 70 cents and silver closed at $17.15 down 22 cents. Both have sold off in Asia overnight and in early European trading this morning.

Gold closed at $894.80 in New York and was down 70 cents and silver closed at $17.15 down 22 cents. Both have sold off in Asia overnight and in early European trading this morning.

Gold's sell off is somewhat counter intuitive given the host of positive fundamentals. However, oil selling off and the dollar strengthening again (despite increasing credit, financial and systemic risk) is contributing to gold's weakness. Complacency and risk appetite remain very prevalent as seen in the bizarre welcoming of the staggering Lehman Brother's quarterly loss of $2.8 billion. Supposedly, market s “took heart” from news of Lehman's plans to raise $5bn of capital which it is hoped would help to stabilise the US financial system. Hope springs eternal.

It is again important to remember that the dollar's most recent bounce (another dead cat bounce) is only against the euro and sterling and the dollar is again down against the Swiss franc and Canadian dollar today.

Today's Data and Influences

Today sees U.S. trade data which is important and a bad number and widening deficit could put the dollar under pressure and be supportive of gold. The U.S. trade deficit probably widened in April as the surging cost of oil boosted imports, economists said ahead of a government report today.

In the eurozone, French and Italian industrial production numbers the main feature. There are though also several US and ECB officials scheduled to speak which may provide currency markets with some direction.

Interest Rates to Rise Internationally to Combat Inflation

The FT and the Daily Telegraph both report how investors are betting on higher interest rates in the UK in the coming months.

Investors have bet that the Bank of England will have to raise interest rates at least once and possibly as much as three times before the end of the year.

The Telegraph reports that “Swap rates - the key money market measure reflecting traders' expectations for borrowing costs - rose at the fastest rate since Black Wednesday 16 years ago after a "shocking" rise in factory gate inflation. In scenes described by one observer as "carnage", traders embarked on a massive sell-off of UK government bonds, pricing in the likelihood that the Bank's Monetary Policy Committee will lift the official base rate to 5.75pc by the end of the year.”

The sell-off in sterling interest rate markets was the biggest daily move in more than a decade according to Michael Saunders, economist at Citigroup.

As inflation surges, rising interest rates are likely to be seen in the U.S. and internationally. Otherwise, inflation may get out of control and threaten the modern fiat based, non Gold Standard monetary system.

Contrary to some misguided commentary - rising interest rates are positive for gold as was seen in the 1970's under the prudent monetary stewardship of Paul Volcker, the ex Federal Reserve Chairman. As interest rates went up so did the gold price and it was only at the end of the interest rate tightening cycle with rates nearly at 20% that inflation was contained and investors began to sell gold and return to the safety of very high yielding U.S. government bonds.

U.S. – World's Largest Debtor Nation Ever

Also, it is worth remembering that the U.S. was the world's largest creditor nation in 1980. Today the U.S. is the world's largest debtor nation with a national debt of some $9.4 Trillion (

http://www.treasurydirect.gov /NP/BPDLogin?application=np ). Up massively (65% in 8 years) since President Bush took power in 2000 when the national debt was only some $5.7 trillion. Meanwhile, since 2001, long-term unfunded liabilities to Medicare, Social Security Trust Fund and other long term commitments have ballooned from about $20 trillion to an unaffordable more than $50 trillion.

The fiscal problems facing the U.S. today are gargantuan compared to those in the 1970's and this is why gold will at least surpass its adjusted for inflation high in 1980 of $2,200 per ounce in the coming years.

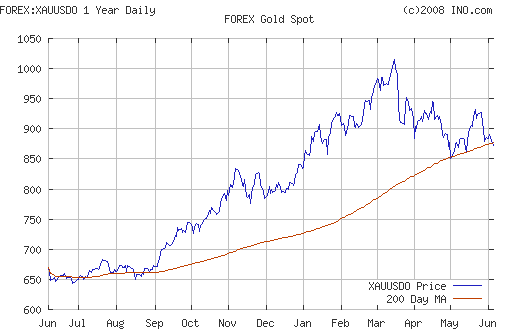

http://quotes.ino.com/chart/?s =FOREX_XAUUSDO&v=d12&w=1&t=l&a =200

Silver

Silver is trading at $17.00/17.10 per ounce (1200 GMT).

PGMs

Platinum is trading at $2018/2028 per ounce (1200GMT).

Palladium is trading at $422/427 per ounce (1200 GMT).

By Mark O'Byrne, Executive Director

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@www.goldassets.co.uk Web www.goldassets.co.uk |

Gold and Silver Investments Ltd. have been awarded the MoneyMate and Investor Magazine Financial Analyst of 2006.

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Mark O'Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.