What Gold's Bull Market (That's Right, Bull Market) Means For Miners

Commodities / Gold and Silver Stocks 2015 Apr 12, 2015 - 03:27 PM GMTBy: John_Rubino

One of the oddities of floating exchange rates is that they cause people to view the world in terms of their own national currency. For Americans that means looking out through a window that is distorted by the dollar's recent surge. A C$100-a-night Vancouver BC hotel room, for instance, cost about US$100 in 2013 and now costs about $80. Most other Canadian products are commensurately cheaper, making a week north of the border suddenly a lot easier to fit into the family budget. Though fundamentally not much has changed.

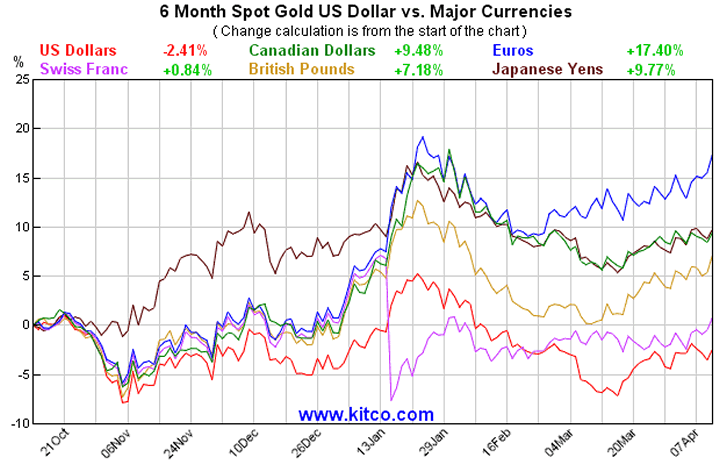

Another big distortion is in local-currency gold prices. Here in the US, gold has been in a brutal bear market since 2013. But for people in most other countries,living as they are with relatively weak currencies, gold's bull market has resumed without missing a beat. In the past week, gold rose by 3.5% and 2.2% in euros and pounds, respectively. And that's par for the recent course. Here's a chart from Kitco showing the past six months' gold price action. Note that it's down a bit in US dollars but up by varying amounts against the other major currencies. These are six-month numbers, so annualizing them produces very nice gains, especially in euros where it's about 35%.

Two conclusions can be drawn from this:

1) People everywhere are getting seriously distorted pictures of their world. Europeans and Japanese especially are seeing zero consumer price inflation but rapid currency depreciation against assets such as equities, penthouses and, lately, gold. So is that inflation or deflation? This question is just as confusing for economists as it is for regular people.

2) The US, now feeling the impact of a too-strong dollar on corporate revenues and (potentially) earnings and therefore share prices, can't keep this up much longer and will have to not just delay the promised rate increases but change course entirely and join the global devaluation party. Deflation is not an option when your debts exceed 300% of GDP.

But in the meantime, the world's non-US gold miners (which comprise the vast majority of the sector) are seeing the world through a less-confusing, more rose-colored lens. The price of the gold they're mining is up nicely, usually at a double-digit annual rate, while their labor costs are stable due to flat local wage growth and their fuel costs are down big thanks to the (partially strong-dollar-induced) plunge in oil prices.

So almost alone among major industries, the miners are entering a margin sweet spot, with higher selling prices and flat-to-falling costs.

They won't blow the doors off of analyst expectations this quarter, especially with all the write-downs that are baked into the cake, though they might surprise to the upside a bit more than in the recent past. But let the current environment persist for a while and the gap between cost and sales trends might reach a point where it gets noticed. That combination -- beaten-down stocks and widening margins -- is what puts a period at the end of bear markets.

By John Rubino

Copyright 2015 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.