Stock Market Pivotal Events - History is Fact

Stock-Markets / Stock Markets 2015 Apr 10, 2015 - 06:51 PM GMTBy: Gary_Tanashian

In writing this post I came to realize that its subject matter is too expansive for any single post. So consider this an introduction to a series of posts that I'll probably do in the coming months, as facts come to the fore and lend themselves to historical analysis. Two examples are presented below.

In writing this post I came to realize that its subject matter is too expansive for any single post. So consider this an introduction to a series of posts that I'll probably do in the coming months, as facts come to the fore and lend themselves to historical analysis. Two examples are presented below.

You might not be the type who needs or cares to subscribe to commercial market commentary/advice/trading/management services, but one thing we all can do is work through the freely available stuff calling itself 'analysis' flying around out there at warp speed and cull what is based on facts or honestly produced analytical work from the other garbage that is all too often based on ego, bias or agenda.

Most weeks you are able to download a time-delayed version of Bob Hoye's Pivotal Events newsletter right here at Biiwii.com. While Bob has certainly got his opinions and biases (as we all do, let's be honest), he is the most historically learned commentator I have read. I enjoy the old and not so old news article quotes from bubbles that culminated in 1873, 1929, 2000 and 2007. Reading Bob's history lessons is like hitting a 'Refresh' button on personal perspective each time.

This is not a promo of Hoye's service and Institutional Advisors are not even aware of this post. Hoye is simply one of several influences on my own market management methods, and probably a reason the words "patience" and "perspective" show up so often in my own writing. It is vital to keep frames of reference and perspective at all times, no matter how long things that we view each day with our own two eyes take to play out as noisy short-term components of a longer-term process.

It used to be easy to skim Bloomberg or MarketWatch (or in the old days when people actually knew it existed, Thestreet.com) and pick out 'bubble head' headlines during bull markets, but the current phase is complicated by the fact that these services, especially MarketWatch, seem to 'day trade' the news based on what is happening on any given day or over night action.

Taking the likes of MarketWatch seriously can induce a whipsaw like you read about (literally) to an investor's frontal lobe. I know for a fact that there are some sharp commentators there (as I have interacted with some of them elsewhere and found them to be very forthright and intelligent) but there are dullards as well and more than the actual writers, I think it is the editorial staff that is responsible for selecting and presenting content each day and creating a noise level that can literally scream 'Market Crash Imminent!' one day and 'Here's Why You Need to be Fully Invested in US Stocks' the next. It's like a sick joke.

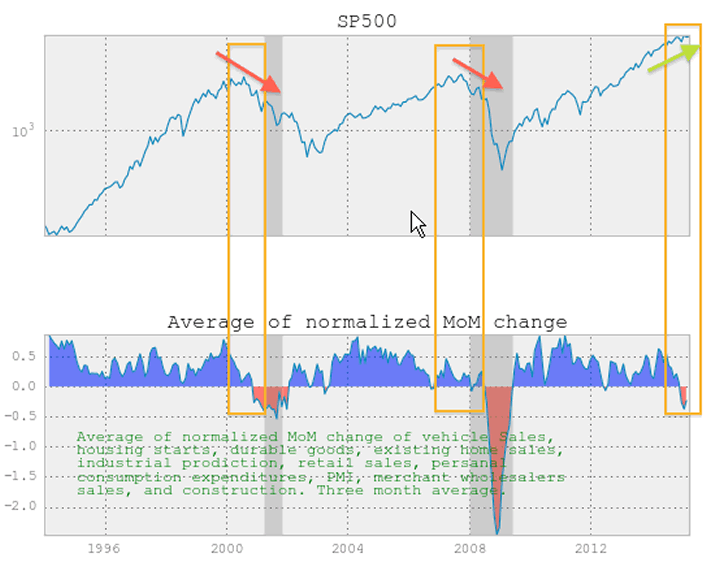

Moving on, let's use a few pictures to illustrate some historical facts. From a post yesterday (Looking for Your MoM?), the S&P 500 is happily climbing despite a gathering of economic data that has gone negative by MoM change as it did in the last two recessions. The facts are that this condition actualized the implied risk to equity investors in both previous examples but on this occasion has not yet done so.

I have marked up @dv_dend's graphic to better illustrate how in 2000 the market topped out and began to turn down as a group of economic indicators turned down and how in 2007 the market began to turn down before the indicators went negative. Then... the whole ball of wax nearly collapsed. The current cycle sees the economic indicators in a danger zone and the stock market - which should have topped - has not. That (the stock market intact, technically) is a fact and it needs to be respected every bit as much as the implied risk to today's confident bulls. Hence, NFTRH, while working this market happily and gainfully, continues to advise the only rational orientation for this circumstance; when in doubt the default is CASH, not heavy long and not heavy short... CASH.

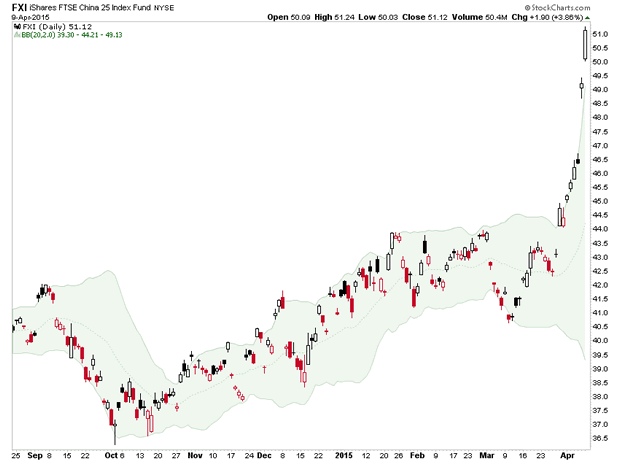

Another picture comes from China. We have charted FXI and its parent FXT for years in NFTRH, and over the last several months followed its progress in attacking and surmounting long-term resistance. We have assigned targets and I have had the pleasure of having a subscriber tell me he is getting nervous about his profits in FXI (after buying in the 41's based on NFTRH's charting) and would like to know a good selling point. It was advised that rational measured targets are being registered now and that profit is good... consider taking some of it...

...because history is littered with examples like this.

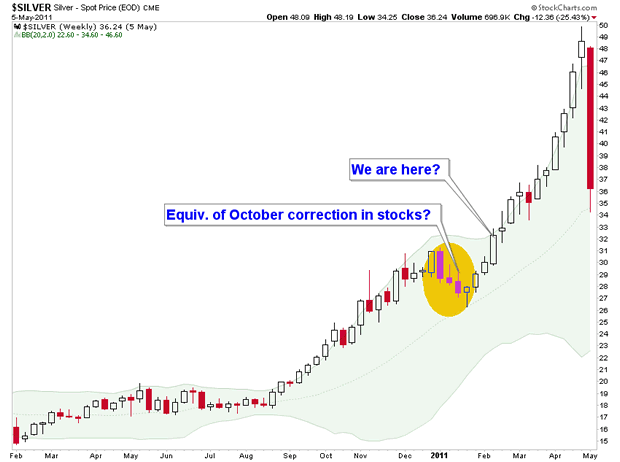

The 'We Are Here' reference was from NFTRH 318, which introduced the above chart to talk about a historical precedent in Silver for the current stock market mania and the potential that the October 2014 market correction was just a pause to refresh prior to a manic blow off. Here the post loops right back to the first graphic above.

For perspective and reference, here is the excerpt from NFTRH 318, dated November 23, 2014 that accompanied the above historical Silver chart:

"Just a month ago market players were barely recovering from their knee jerk puke fest kicked off by a negative projection by one semiconductor company and a pig pile of media hype that was something to behold. We called it hype then and conveniently enough, there is the SOX at a new recovery high.

So two momos (BTK & SOX) are bullish and threatening accelerating upside.

And yet nothing about the market is healthy. Nothing about silver and commodities in general was healthy in early 2011 either. I find myself using the silver example repeatedly in discussing the US stock market, so let's dial in its bull market blow off.

Understand that human behavior does not change, however it does tend to herd and gravitate to whatever is giving the good feelings.

Let me ask you, in early 2011 what was the average silver bug's sentiment profile? Sure, there had been a 5 buck setback in the silver price in late 2010 and early 2011. What did that serve to do? It fueled the final phase of the bull by taking out some of the already embedded over bullish sentiment and clearing the pipes for a massive blow off amidst hysteria about $100, $200 an ounce silver and touting about how the Silver-Gold ratio still had a long way to climb.

In short, it killed silver; but not before silver killed a hell of a lot of shorts."

History is a 'probabilities and perspective' guide... always. It is also fact. It is a time in history now to play what the market gives, sure. But it is also a time to manage risk and default to cash.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2015 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.