Stock Market Showing Signs of Fatigue

Stock-Markets / Stock Markets 2015 Apr 10, 2015 - 06:08 PM GMTBy: Brad_Gudgeon

Last time I wrote, I was dealing with the futures sell-off when the market was closed on Good Friday. I had been expecting strength into Monday, but the futures down move of almost 20 points made me rethink an alternative scenario. As it was, we didn't have to sell the longs and held them into Tuesday where we sold at 2087 SPX and went short. The rest of the week was spent in a grinding, sideways, up and down market where it finally resolved itself to near 2093 today (closing at 2091). We remain short.

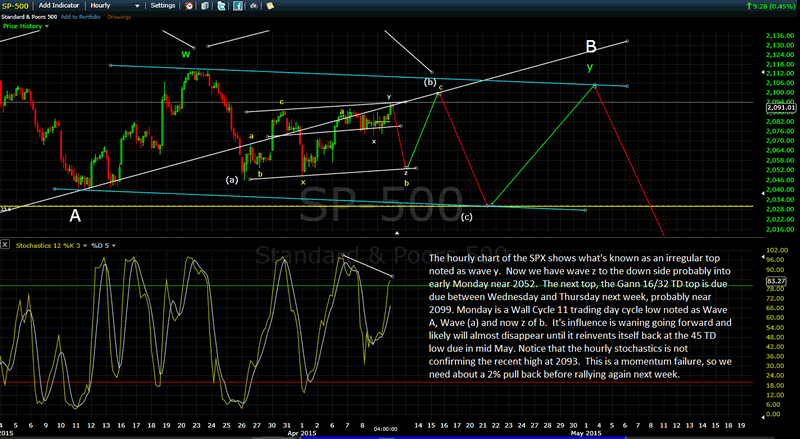

The chart below shows that the market is due for a little 2% pull back, probably into Monday with a target of about 2052 before resuming the slight up trend into about Wednesday or Thursday this next week, where a bigger drop into the following week is due. Overall, this market is trading with a downward bias, but ever so slight. At some point (sometime probably near May 1) this trend should tilt aggressively to the down side into around May 12, but for now the smart money is content on selling into the seasonal strength while the public keeps buying.

S&P500 1-Hour Chart

I keep telling people that the easy money has been made in the market. It is no longer a buy a hold market, but a traders' market (both up and down). On December 26, we were at 2093 on the SPX. We just tagged that today some 4 months later, so no net gain in all that time for the buy and hold crowd, but the traders like me have made money.

Eventually, the market will shift to the real bearish mode soon and then rally again before falling even more in the fall. There is more risk to the down side than reward on the upside and that should continue for the next few years with even more violent swings before we crash like nobody's business from 2018 to 2020/21. We are in the calm before the storm. Will you be ready?

Brad Gudgeon

Editor of The BluStar Market Timer

The BluStar Market Timer was rated #1 in the world by Timer Trac in 2014, competing with over 1600 market timers. This occurred despite what the author considered a very difficult year for him. Brad Gudgeon, editor and author of the BluStar Market Timer, is a market veteran of over 30 years. The website is www.blustarmarkettimer.info To view the details more clearly, you may visit our free chart look at www.blustarcharts.weebly.com Copyright 2015. All Rights Reserved

Copyright 2015, BluStar Market Timer. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.