Austrian Government to No Longer Guarantees Bank Deposits

Stock-Markets / Credit Crisis 2015 Apr 09, 2015 - 01:30 PM GMTBy: GoldCore

- Austria will remove state guarantee of bank deposits

- Austria will remove state guarantee of bank deposits

- Austrian deposit plan given go ahead by the EU

- Banks to pay into a deposit insurance fund over 10 years

- Fund will then be valued at a grossly inadequate €1.5 billion

- New bail-in legislation agreed by EU two years ago

- Depositors need to realise increasing risks and act accordingly

- “Bail-ins are now the rule” and ‘Bail-in regime’ coming

Bank deposits in Austria will no longer enjoy state protection and a state guarantee in the event of bank runs and a bank collapse when legislation is enacted in July. The plan to ensure that the state is no longer responsible for insuring deposits has been readied by the Austrian government in conjunction with the EU two years ago according to Die Presse.

Currently, Austrians have their bank deposits guaranteed to a value of €100,000 – the first half to be provided by the failing bank and the other by the state. From July, however, the state will be removed from the process and a special bank deposit insurance fund is to be set up and paid into by banks to meet potential shortfalls.

The fund will be filled gradually over the next ten years to a value of €1.5 billion. In the the event of a failure of a major bank in the intervening period the legislation will allow the fund to borrow internationally although who will provide such funding and on what terms is not clear, according to Austria’s Die Presse.

However, even when the scheme is fully funded it is clear that €1.5 billion will be woefully inadequate to deal with a bank failure.

€1.5 billion amounts to a mere 0.8% of total deposits in Austria. It is highly unlikely that deposits of any major bank would be adequately covered and in the event of multiple concurrent bank failures it is likely that most savers would be wiped out.

Die Presse gives the example of Bank Corp in Bulgaria. When that bank failed it had €1.8 billion in deposits but there was only €1 billion in the deposit insurance fund.

On a positive note “inheritances, real estate transactions, a dowry or a divorce [will be] be protected for three months, even up to an amount of 500,000 euros,” according to Die Presse (via google translate).

It is telling that, as Die Presse reports, the framework for the legislation was agreed in Europe two years ago and the legislative change has to take place by this summer. It was on June 27th, 2013 that Irish Finance Minister Michael Noonan made his infamous declaration that “bail-in is now the rule.”

The Die Presse story suggests that the Austrians may have gotten a derogation or an exemption from the new bail-in legislation which was enacted in 2013. “Bail-in is now the rule” as Irish finance Minister Michael Noonan warned in June 2013. Noonan admitted then that the move to not maintain deposits as sacrosanct was a “revolutionary move.” That it was and yet investors and depositors remain very unaware of the risks of bail-ins both to their own deposits but also to the wider financial system and economy.

At that time average depositors with deposits of less than €100,000 were given no indication that their savings may be at risk even as EU institutions were working on removing state liability for such deposits.

Romania’s Bursa newspaper points out that this is not some monetary experiment being foisted upon some peripheral Eurozone country. Austria is regarded as being part of the EU’s “hard core”.

What unfolds in Austria will likely follow across the EU. It may be that Austria was prompted to enact this legislation first among its European partners precisely because it anticipates major banks failures in the wake of the failure of its “bad bank”, Heta.

Also many Austrian banks have large exposures to Eastern European countries and property markets. Austrian banks are the most exposed to potential losses from tougher sanctions on Russia according to Fitch and the IMF. Swedish, French and Italian lenders are also vulnerable, the International Monetary Fund also warned.

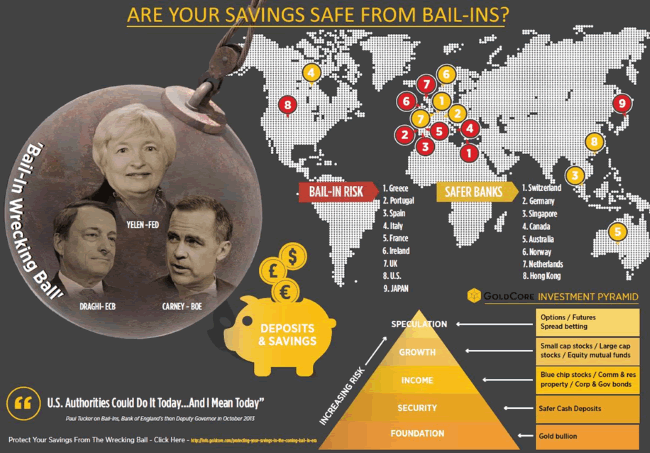

Deposits in the insolvent banking system are no longer safe. So where is one to place one’s savings?

As Germany’s Deutsche Wirtschafts Nachrichten opines “depositors will have to thoroughly research the situation of the bank they place their savings in”. It adds, “this task is extremely difficult, because of the muddy financial statements and of the complexity of the interdependencies in the banking system”.

While Austria may be the first in enacting this legislation there is no guarantee that savers, particularly in the peripheral nations, will receive any indication that their deposits may be at risk.

Emergency legislation can be drawn up over-night – as was the case when Ireland was “bailed-out” or rather Ireland’s banks were bailed out and Ireland’s tax payers were bailed in. The developing bail-in regimes, means that soon individual and corporate depositors could see their savings and capital ‘bailed in’.

These are important developments. Average savers can no longer rely on the state to protect their deposits. They provide a good reason for depositors to allocate some of their funds to physical gold stored outside of the banking system, in the safest jurisdictions in the world.

Must Read Guides: Protecting Your Savings In The Coming Bail-In Era (11 pages)

Must Read Guides: From Bail-Outs To Bail-Ins: Risks and Ramifications – Includes 60 Safest Banks In World

(51 pages)

MARKET UPDATE

Today’s AM LBMA Gold Price was USD 1,196.00, EUR 1,113.33 and GBP 808.49 per ounce.

Yesterday’s AM LBMA Gold Price was USD 1,211.10, EUR 1,113.66 and GBP 811.40 per ounce.

Gold fell 0.59 percent or $7.10 and closed at $1,203.20 an ounce yesterday, while silver slid 2.13 percent or $0.36 closing at $16.52 an ounce. Gold has remained robust in most currencies except the dollar and remains above EUR 1,100 and GBP 800 per ounce.

Gold fell in dollar terms for its third session after some traders interpreted comments from the U.S. Fed minutes released yesterday as hawkish. Market participants still think a June interest rate hike remains a possibility despite the appalling jobs number last Friday.

The yellow metal dipped below its psychological $1,200 per ounce level yesterday as the U.S. dollar surged higher. The greenback hit a one week high against the euro at 1.0730. Silver sunk to a three week low.

Gold prices in Singapore was off 0.5 percent at $1,196.30 an ounce near the end of day trading prior to ticking slightly higher in London.

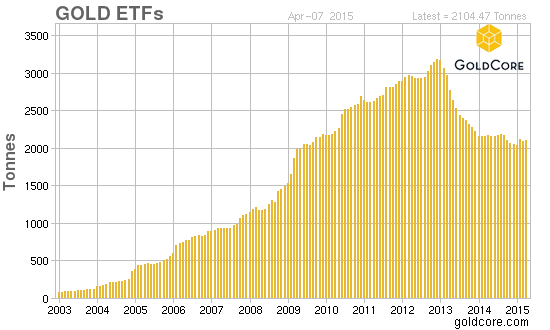

Holdings of SPDR Gold Trust, the world’s largest gold ETF, edged down to 733.06 tons on Wednesday, from its previous close of 735.45 tons on Tuesday.

Technical analysis suggest gold could drop to $1,181 as it has cleared a support at $1,205, based on a Fibonacci retracement analysis. The next support may be at $1,181, the 23.6 percent level.

Physical gold buying in China has briefly waned but powerhouse India is still seeing robust physical demand.

Fed governors, Dudley and Powell yesterday alluded to scenarios in which the central bank could make an initial move earlier than many now expect and then proceed in a slow and gradual manner on further rate increases.

As ever, many members of the Fed talk a good hawkish talk but never walk the hawkish walk. Meaning that despite continual talk of interest rate rises for years now – none never come. They will some day but it may not be this year.

In Europe, gold for immediate delivery in the late morning was trading at $1,196.30 or down 0.41 percent. Silver was $16.29 or off 1.16 percent and platinum was $1,159.55 or down 0.32 percent.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.