U.S. Hegemony and Dollar Threatened By New Chinese Bank

Stock-Markets / Global Financial System Apr 09, 2015 - 09:38 AM GMTBy: GoldCore

- Chinese Success in Attracting Major Western Countries to New Bank Marks Beginning of New Era

- Chinese Success in Attracting Major Western Countries to New Bank Marks Beginning of New Era

- Diverse members include UK, Israel, Germany, Australia and Russia and Iran

- Demonstrates the degree to which U.S. global influence is declining

- U.S. needs to reform its approach to IMF and World Bank system if it to successfully reassert its influence

- U.S. “Failure of Strategy and Tactics was a Long Time Coming”

- Beijing’s challenge to post-World War II financial and monetary order

- New bank shows continuing decline of U.S. hegemony and dollar as reserve currency

The success of China in attracting countries traditionally within Washington’s sphere of influence to join its Asian Infrastructure Investment Bank (AIIB), such as the UK, Israel, Australia and Germany, marks another milestone toward a new multi polar world and a new era in international politics and economics.

The AIIB is seen as a potential rival to established lenders the World Bank, IMF and Asian Investment Bank, which are dominated by the United States.

The era of infrastructure investment and multilateral banks and financial institutions controlled, in large part, by Washington – often as an aggressive strategic policy tool – has come to an end. The AIIB which will be controlled by China will compete with the World Bank and the IMF for infrastructure projects and potentially could become a global lender of last resort to sovereign nations such as Greece.

It is almost certain that the AIIB will begin lending in yuan – another phase in the inevitable demise of the dollar as sole reserve currency and the fulfilment of Chinese ambition to make the yuan an internationally traded currency.

Even the Chinese themselves were reportedly “surprised”at their success in attracting key U.S. allies – particularly Britain – to join the AIIB. The U.S. had exerted pressure on its allies to eschew the new Asian bank. However, when Washington’s closest ally – Britain – broke ranks and announced its application in March it led to a slew of western countries following suit.

It is interesting to note that the World Bank’s US-appointed President has vowed to find “innovative” ways to work with a new Chinese-led global bank, welcoming it as a “major new player” in the world. The positive overtures by Jim Yong Kim comes ahead of next week’s World Bank and International Monetary Fund spring meetings in Washington. It also marks a split with the administration of U.S. President Barack Obama which put him forward to head the World Bank in 2012.

According to the Financial Times, China’s success stems from softening of its diplomacy early last year following tensions with Vietnam with the sinking of a Vietnamese fishing vessel. By the time the APEC conference came around China was negotiating agreements and deals with its neighbours, including Japan.

That Britain, Israel, Australia and Germany have turned a deaf ear to Washington on an issue that is of such vital strategic importance to the U.S. demonstrates the shocking degree to which the influence of the U.S. has declined in the past fifteen years.

While Canada and Japan remain on the sidelines for now – many believe that it is just a matter of time before they too join the new bank.

Former U.S. Treasury Secretary Lawrence Summers wrote this week that the “failure of strategy and tactics was a long time coming, and it should lead to a comprehensive review of the US approach to global economics.”

Summers is a U.S. and international political insider and was Chief Economist of the World Bank from 1991 to 1993. Summers worked as the Director of the White House United States National Economic Council for President Obama from January 2009 until November 2010, where he emerged as a key economic decision-maker in the Obama administration’s response to the financial crisis.

He was widely tipped as the potential successor to Ben Bernanke as the Chairman of the Federal Reserve, though after criticism from the left, Obama nominated Janet Yellen for the position.

If the U.S. is to arrest the decline in its influence through the World Bank, Summers identifies three areas that Washington needs to address . Firstly, in its approach to the wider world it must rebuild a bipartisan foundation and “be free from gross hypocrisy and be restrained in the pursuit of self interest.”

The U.S. needs to apply the same standards to its “state regulators, independent agencies and far-reaching judicial actions” that it demands of other countries. He advises against using the dollar as an “aggressive” geopolitical tool such as the attempts to suffocate the Iranian economy by cutting Iran out of the banking system.

“We cannot expect to maintain the dollar’s primary role in the international system if we are too aggressive about limiting its use in pursuit of particular security objectives.”

Ultimately the new global institution will help China knock the U.S. off its pedestal as the world’s pre-eminent economic and military superpower and will likely lead to a further erosion in trust of the debased dollar as the global reserve currency.

The new emerging order should lead to greater geopolitical stability in the long term. The rising economic power of China seeks to work together financially and economically with both NATO members and indeed nations currently at odds with American foreign policy such as Russia and Iran.

Iran has been accepted as a founding member of the AIIB. Interestingly, China said that the decision was made by existing members, including China, Britain, France, India and Italy. The United Arab Emirates (UAE) has also been accepted. China and Iran have close diplomatic, economic, trade and energy ties.

One would hope that this should limit the potential for large-scale conflict involving Israel, the U.S. and certain NATO members and the current black sheep of the international family – Iran and Russia.

In the shorter term however it may lead to greater geopolitical tension as the neoconservative influence in Washington continues to labour under the delusion that the U.S. is still the indispensable nation chosen by history to rule the world unilaterally. Perversely, the decline in U.S. hegemony especially in the financial and economic realms may embolden the neo-conservative militarists who appear desperate to maintain U.S. hegemony … at all costs.

The clear shift in economic power from West to East will put further pressure on the dollar. The recent strong bounce in the dollar will likely be seen as a short term cyclical bull market within a secular long term bear market.

The coming dollar crisis will impact the currency international monetary system and likely lead to an international monetary crisis. Global property bubbles, leveraged finance and high risk securitization were the elephants in the room in the years prior to the start of global financial and economic crisis in 2007. Many warned but were ignored.

There are similar elephants in the room today which are also being ignored. There is the growing risk of an international monetary crisis due to the real risks posed to the global reserve currency the dollar and to the not so ‘single currency’, the euro.

Gold will continue to act as a safe haven asset and protect people in the event of an international monetary crisis.

Click here in order to read GoldCore Insight –

Currency Wars: Bye Bye Petrodollar – Buy, Buy Gold

MARKET UPDATE

Today’s AM LBMA Gold Price was USD 1,211.10, EUR 1,113.66 and GBP 811.40 per ounce.

Yesterday’s AM LBMA Gold Price was USD 1,208.50 , EUR 1,113.82 and GBP 813.63 per ounce.

Gold fell 0.44 percent or $5.40 and closed at $1,210.30 an ounce yesterday, while silver slipped 0.71 percent or $0.12 closing at $16.88 an ounce.

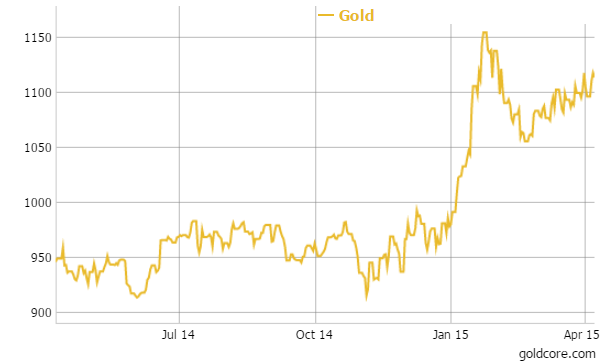

Gold in Euros – 1 Year

Gold in Singapore was firm at $1,208.95 an ounce near the end of day trading. Comex U.S. gold for June delivery was also steady at $1,209.70 per ounce.

Gold is being supported by dollar weakness today as market participants reassess the likelihood of rate rises.

Today, at 1800 GMT Fed watchers await the release of the U.S. Federal Open Market Committee’s minutes from the March 17-18th meeting. You may recall the Fed’s dovish tone used the word ‘patient’ when referring to monetary policy. At the time officials suggested an interest rate hike as early as June.

But as we expected, poor economic data, especially the very poor payrolls number last Friday which was well below expectations is revising expectations.

Yesterday, Minneapolis Fed President, Narayana Kocherlakota, spoke about waiting until the second half of 2016 to start raising rates, only a day after New York Fed President, William Dudley, said the timing of an increase was unclear.

Kocherlakota also warned of the possibility of more QE which would be very bullish for gold.

The Russian ruble has extended recent gains in its 2 month rally, setting new 2015 highs against the dollar and the euro. The ruble has become very oversold and the rally in oil prices is also helping. Oil is Russia’s main export.

In India, Platinum Guild International said that sales of platinum jewellery grew by 28% in 2014 in India. Platinum jewellery is the second largest consumer of platinum in the world (35%) after the auto-catalyst market (36%).

Gold is trading near a seven week high. In London, in the late morning gold for immediate delivery was trading at $1,210.76 or up 0.15 percent. Silver is at $16.88 or up 0.30 percent and platinum is trading at $1,173.89 or up 0.59 percent.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.