What an Interest Rate Hike Means for Stocks

Stock-Markets / Stock Markets 2015 Apr 07, 2015 - 06:02 PM GMTBy: Investment_U

Matthew Carr writes: It’s inevitable. The Fed will raise rates at some point... probably within the next year.

Matthew Carr writes: It’s inevitable. The Fed will raise rates at some point... probably within the next year.

At the moment, the money appears to be on a September/October move, instead of June (which many previously predicted). But the Fed’s June meeting is still 2 1/2 months away, and anything can happen.

For many investors, though, a dark cloud is looming. A single question keeps them up at night: What does a rate hike mean for the markets?

To answer this, I went back and looked at the best-performing sectors prior to the Fed lifting rates... and the best sectors following rate hikes.

The results are interesting...

What’s Best to Own (In Good Times and Bad)

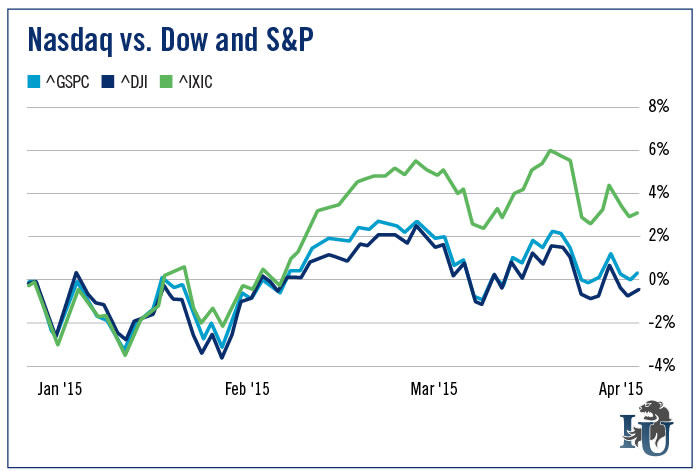

Historically, one of the best sectors to own right before the Fed raises rates is technology. This is especially evident when you look at the tech-heavy Nasdaq.

In fact, right now the Nasdaq is on a nearly unprecedented streak of ending nine consecutive quarters in positive territory.

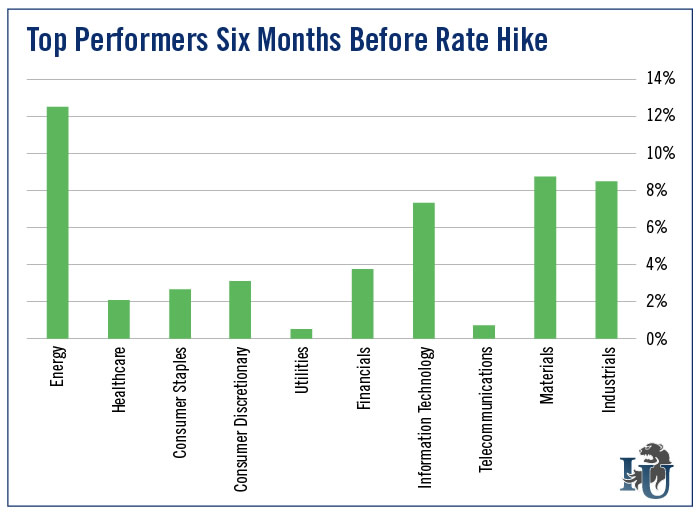

Looking at the six months before the last four rate increases, the best-performing sectors have typically been Energy, followed by Materials, Industrials and Information Technology. Utilities and Telecoms were the worst performers.

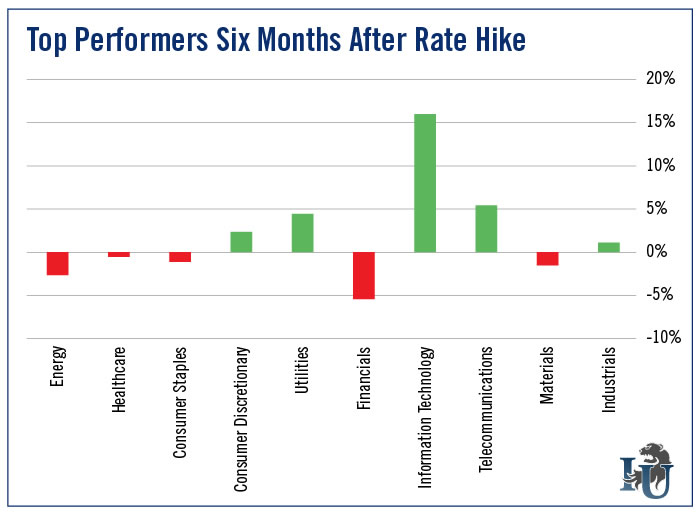

Now, in the six months following a rate increase, a completely different picture forms...

Energy, Healthcare, Consumer Staples, Financials and Materials all struggle. But Information Technology picks up pace, gaining an average of 16.12%.

The second-best performer is Telecom, followed by Utilities and Consumer Discretionary...

The fact that utilities performed well was surprising. I thought it might have to do with the time of year the rate increases took place. But when we look a year out from the rate increase, we get a picture everyone should be happy with...

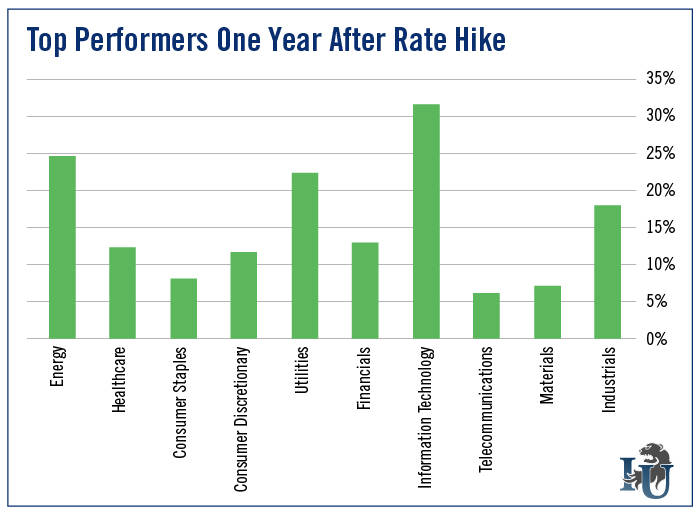

Telecoms are the worst-performing sector, not really gaining much from the six-month mark. But everything is in the green. In fact, a year after a rate hike, the gain from Information Technology is nearly twice what it was at the six-month mark, while Utilities, Industrials and Energy absolutely surge.

So, in terms of stocks, no sector should get destroyed after the Fed raises rates. At least, not based on the past four times it’s happened.

A Difficult Start

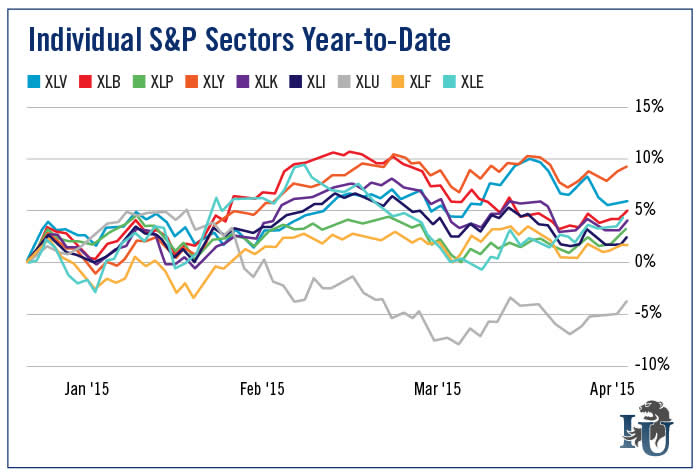

Obviously it’s been a rocky year...

The S&P 500 barely broke positive for the first quarter, while the Dow Jones Industrial Average ended the first three months of 2015 in the red.

But don’t get discouraged. Besides the fact that the S&P - like the Nasdaq - has a streak of nine consecutive quarters of positive gains, there are sectors providing returns.

Maybe even more so if the Fed acts this year.

And even though there’s a lot of concern about the Fed raising rates this year and what impact that might have, it’s technically a good thing...

It means the economy is improving and can manage on its own.

Good investing,

Matt

Copyright © 1999 - 2015 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.