Today's Stock Market Rally Only Makes Things Worse

Stock-Markets / Stock Markets 2015 Apr 06, 2015 - 05:18 PM GMT The Primary Dealers are using this morning’s action as another selling opportunity. A lot of retail traders had layered in buy orders all the way down to 2050.00 which may have been filled on Friday. This is a ready market for the institutional players to sell into. That means once the 50-day

The Primary Dealers are using this morning’s action as another selling opportunity. A lot of retail traders had layered in buy orders all the way down to 2050.00 which may have been filled on Friday. This is a ready market for the institutional players to sell into. That means once the 50-day

ZeroHedge reports, “We can't make this up. Following Friday's dismal payrolls, today's Fed Labor Market Conditions Index (the aggregate index of all Yellen's indicators) collapsed to its lowest in almost 3 years. That was just the news that stocks needed to complete the biggest opening rally of the year so far...

Worst labor market conditions in almost 3 years...”

The SPX denominated in Euros is challenging its 50-day Moving Average. US stocks are no longer moving higher in euros and are subject to the same selling pressure in Europe as they are domestically.

VIX has already completed its retracement and is starting to move higher. It is still on an aggressive seel and will not be confirmed until it crosses above the 50-day Moving Average at 15.79.

NDX was repelled by its 50-day Moving Average an its Orthodox Broadening Top trendline at 4342.54.

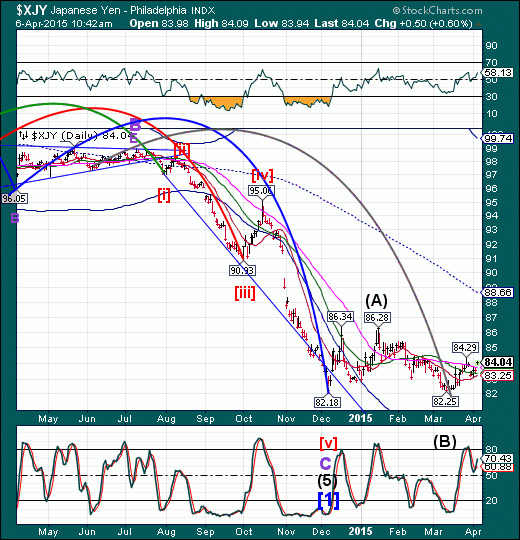

$USD is down, but what is even more telling is that XJY id back above its 50-day Moving Average. XJY has the ability to rally to 88.66 at a minimum. This would take out a lots of dollar longs playing the USD/JPY carry trade. USD/JPY is flat today at 119.02 after being above 120.00 last week. A further decline below 119.00 would seriously weaken the dollar in all of the currency markets.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.