Stock Market Friday Payroll Surprise

Stock-Markets / Stock Markets 2015 Apr 04, 2015 - 03:09 AM GMTBy: Tony_Caldaro

The market opened the week at SPX 2061 after last week’s sharp decline from near record levels. After a rally to SPX 2089 on Monday the market nearly retested last week’s low at 2046, then bounced to end the holiday shortened week at 2067. For the week the SPX/DOW gained 0.3%, the NDX/NAZ lost 0.25%, and the DJ World gained 0.7%. On the economic front, reports continue to come in generally positive. On the uptick: personal income/spending, the PCE, pending homes sales, Case-Shiller, the Chicago PMI, Consumer confidence, factory orders, the MMIS, the WLEI, plus weekly jobless claims and the trade deficit both improved. On the downtick: the ADP index, ISM manufacturing, construction spending, the monetary base, and monthly payrolls (which were reported Friday at +126k v 295k, the lowest monthly gain since December 2013, and a big disappointment). Next week’s reports will be highlighted by the FOMC minutes, ISM services, and Export/Import prices.

The market opened the week at SPX 2061 after last week’s sharp decline from near record levels. After a rally to SPX 2089 on Monday the market nearly retested last week’s low at 2046, then bounced to end the holiday shortened week at 2067. For the week the SPX/DOW gained 0.3%, the NDX/NAZ lost 0.25%, and the DJ World gained 0.7%. On the economic front, reports continue to come in generally positive. On the uptick: personal income/spending, the PCE, pending homes sales, Case-Shiller, the Chicago PMI, Consumer confidence, factory orders, the MMIS, the WLEI, plus weekly jobless claims and the trade deficit both improved. On the downtick: the ADP index, ISM manufacturing, construction spending, the monetary base, and monthly payrolls (which were reported Friday at +126k v 295k, the lowest monthly gain since December 2013, and a big disappointment). Next week’s reports will be highlighted by the FOMC minutes, ISM services, and Export/Import prices.

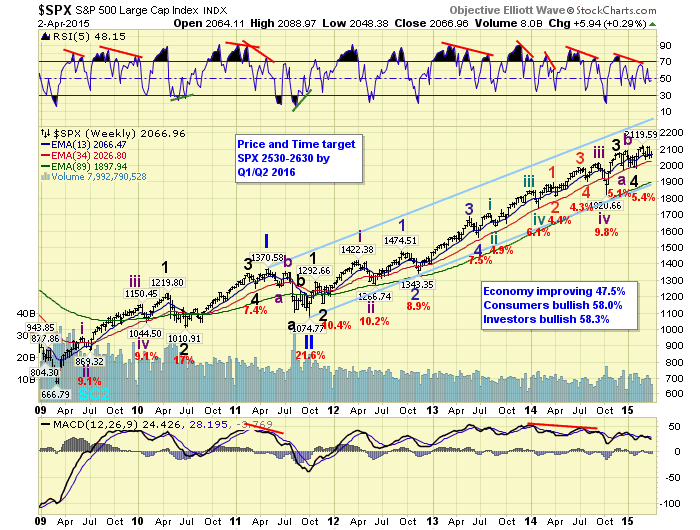

LONG TERM: bull market

This six year Cycle wave [1] bull market continues to unfold as expected. This Cycle wave consists of five Primary waves, with the first two completing in 2011 and the third still underway from the October 2011 low. Primary I unfolded in five Major waves with a subdividing Major wave 1, and simple Major waves 3 and 5. Primary III has also been unfolding in five Major waves, but with a simple Major wave 1, a subdividing Major 3, and an expected subdividing Major wave 5 as well.

When Major wave 5 and Primary III complete the market should have its largest correction since 2011. Since this correction will be Primary IV it will not end the bull market, as Primary V will then take the market to new highs. Our current estimate is for Primary III to end in 2016 with the SPX between 2530 and 2630. Then Primary IV should unfold in the later part of 2016, before Primary V ends in the year 2017.

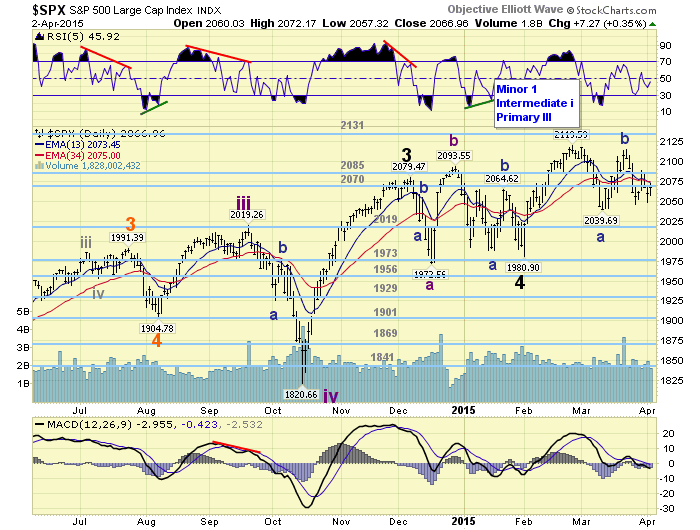

MEDIUM TERM: downtrend looking more probable again

We noted last weekend five potential medium term scenarios using the daily charts of the SPX and DOW: https://caldaro.wordpress.com/2015/03/28/weekend-update-493/. We gave a probability of 40% and 30% to the first two of the scenarios, and a 10% probability to each of the remaining three. This week we give the first two scenarios an equal probability at 35%. The other three remain at 10% each.

The first scenario suggests the February SPX 2120 high was Minor wave 1 and the current pullback is Minor wave 2. This suggests Intermediate wave i of Major wave 5 will extend upward for several more months. However, if the SPX confirms a downtrend during this lengthy pullback the second scenario is underway.

The second scenario suggests the February SPX 2120 high was the end of Intermediate wave i, and the current pullback/correction is Intermediate wave ii. When the correction concludes, probably within days of the confirmation, the market should then enter a rising Intermediate wave iii uptrend. Medium term support is at the 2019 and 1973 pivots, with resistance at the 2070 and 2085 pivots.

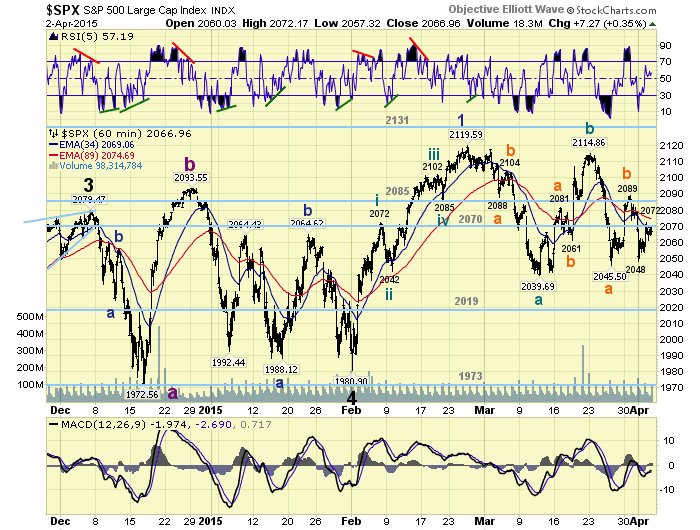

SHORT TERM

After an impulsive five wave advance from the early February Major 4 SPX 1981 low, as noted on the hourly chart. The market hit SPX 2120 and then went into a lengthy pullback/correction. We counted three complex waves down to SPX 2040 by mid-March and thought that could have been it for the pullback. But the rally that followed was corrective, even though it reached SPX 2115 – just five points from the all time high. In fact, every rally that has occurred since that SPX 2040 low, the SPX 2046 rally and the SPX 2048 rally, have all been corrective three waves patterns.

Counting the SPX 2120 high as Minor wave 1 we have labeled an a-b-c down Minute a at SPX 2040, an a-b-c up Minute b at SPX 2115, and an a-b-c underway for Minute wave c. The support levels, for this pullback/correction, we have been using since early March remain in play. At SPX 2034 Minor 2 will have made a 61.8% retracement of Minor 1. Also, now that Minute waves a and b have unfolded, at SPX 2035 Minute c equals Minute a. So there should be real good support at SPX 2034/2035. The next support under that is the 2019 pivot range (2012-2026), where Micro wave c equals Micro a of Minute wave c. Should the market decline go below those two levels, then we will need to start considering some less favorable outcomes as noted in the three 10% probability scenarios. With market breadth making new highs this week, we believe one of the two above levels should provide support in the coming week and a new rally/uptrend should begin. Short term support is at SPX 2034/35 and the 2019 pivot, with resistance at the 2070 and 2085 pivots. Short term momentum ended the week just above neutral. Best to your trading Monday as the ES futures closed down 20 points after the Payrolls report.

FOREIGN MARKETS

Asian markets were nearly all higher on the week gaining 1.8%.

European markets were also nearly all higher gaining 0.8%.

The Commodity equity group were all higher on the week gaining 5.2%.

The DJ World index continues to uptrend and gained 0.7%.

COMMODITIES

Bond prices confirmed the expected uptrend and gained 0.4% on the week.

Crude gained 2.3% and we are still expecting a confirmed uptrend here too.

Gold confirmed an uptrend and gained 0.4% on the week.

The USD has been expected to confirm a downtrend and but gained 0.2% on the week.

NEXT WEEK

Monday: ISM services at 10am. Tuesday: Consumer credit at 3pm. Wednesday: a speech from FED governor Powell at 8am, then the FOMC minutes at 2pm. Thursday: weekly Jobless claims at 8:30, and Wholesale inventories at 10am. Friday: Export/Import prices at 8:30, then the Treasury deficit at 2pm. Best to your holiday weekend and week!

CHARTS: http://stockcharts.com/public/1269446/tenpp

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2015 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Tony Caldaro Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.