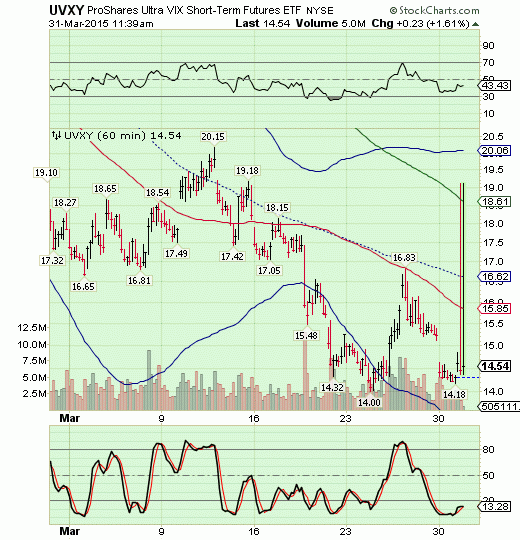

VIX shorts scream bloody murder as stops are run, ETF markets halted

Stock-Markets / Stock Markets 2015 Mar 31, 2015 - 05:37 PM GMT ZeroHedge reports that all S&P Sector ETs and VIX ETFs are halted.

ZeroHedge reports that all S&P Sector ETs and VIX ETFs are halted.

One of the most crowded trades today are the VIX shorts. One way to buy VIX shares en masse is to run all the stops on the shorts, effectively making these shares available for sale. There is no control of the price at which these shares are sold when the algos are turned loose, causing massive losses among those shorts and an opportunity for some large player to load up (long) on these shares. This may not be allowed if the regulators are on the ball, as the transactions may be cancelled. But the regulators may have a hard time trying to figure out what to do, since the computer outage occurred on such a large range of ETFs.

That is why I do not employ stops on my transactions. A limit up or down could cause those positions to be sold at a loss. We can count on seeing more of this monkey business as the equities resume their decline.

Trading has halted again , for the third time.

After attempting to close the gap and failing, SPX has resumed its decline back beneath mid-cycle support at 2076.45.

At this rate, we should see the 50-day Moving Average at 2070.47 challenged this afternoon.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.