SPX Reaches 61.8% Retracement

Stock-Markets / Stock Index Trading Mar 30, 2015 - 05:45 PM GMT SPX reached a high of 2088.25, just 9 ticks beneath the 61.8% retracement level and 65 ticks from the point at which Wave v equals Wave I (2088.80). It appears to be about to cross beneath Intermediate-term support/resistance at 2085.85. The likelihood of the retracement being complete is very high. No buy signal was given, so the only thing I might add is to add to any short positions at this time. This retracement was stronger than expected, but considering the end of the quarter is almost here, it makes sense that this rally could be engineered for large investors to take profits at the expense of retail investors.

SPX reached a high of 2088.25, just 9 ticks beneath the 61.8% retracement level and 65 ticks from the point at which Wave v equals Wave I (2088.80). It appears to be about to cross beneath Intermediate-term support/resistance at 2085.85. The likelihood of the retracement being complete is very high. No buy signal was given, so the only thing I might add is to add to any short positions at this time. This retracement was stronger than expected, but considering the end of the quarter is almost here, it makes sense that this rally could be engineered for large investors to take profits at the expense of retail investors.

VIX has made a reversal off its low today. Friday’s bottom looked awfully inviting, but today’s low was still only a fraction lower.

The NYSE Hi-Lo is above its 50-day Moving Average, so we will have to look for another day to get a sell signal confirmation from it. Its Slow Stochastic is at 100.00, so it is overbought to the extreme.

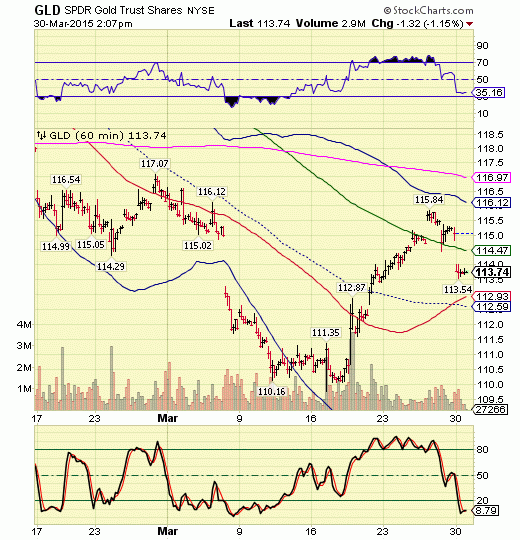

GLD has made three waves down. In order to be a reversal it needs five waves. This can be accomplished with a decline down to Short-term support at 112.93 before a retracement ensues. We’ll wait for the fifth wave and retracement before giving any sell signal at this time.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.