Deflation Watch: Key U.S. Economic Measures Turn South

Economics / Deflation Mar 27, 2015 - 07:53 PM GMTBy: EWI

A developing deflationary trend hinders the economic "recovery"

A developing deflationary trend hinders the economic "recovery"

Lots of media stories say the Federal Reserve is weighing signs of economic strength to see if the economy is ripe for higher interest rates.

In truth, economic weakness has appeared on various fronts.

Such as, for example, the financial health of U.S. companies.

Profits for US companies are expected to decline over two consecutive quarters for the first time in six years... .

Not since the aftermath of the financial crisis have S&P 500 companies recorded two straight quarters of falling profits on a year-over-year basis.

Financial Times, March 6

Elliott Wave International released the March issue of the Elliott Wave Financial Forecast. It discussed signs of economic weakness, via these charts and commentary:

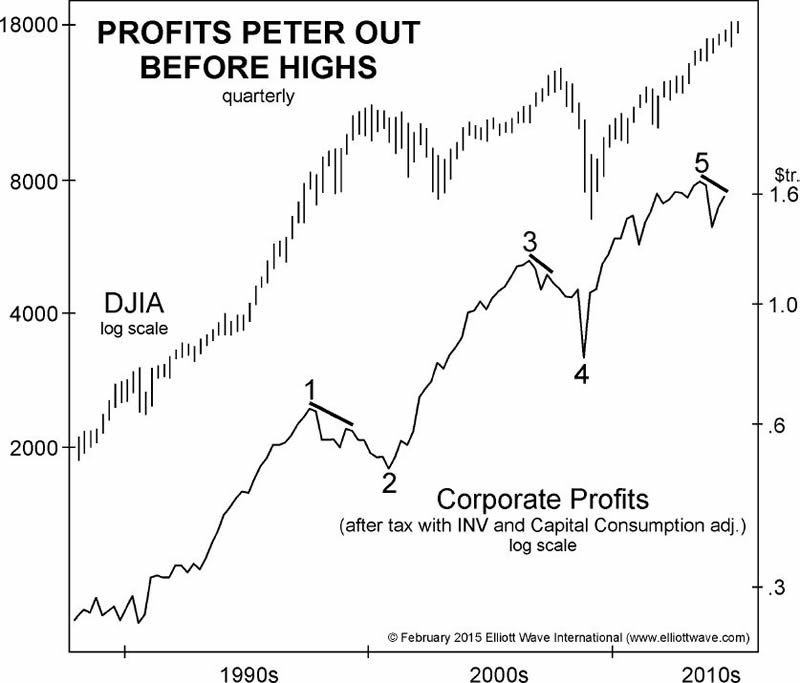

Corporate Profits are [a] key measure that turned down months ago... . In addition to trailing off ahead of market downturns in 2000 and 2007, the chart shows that in mid-2013 corporate profits completed a five-wave advance from 1990. The reversal from that all-time high of $1.67 trillion should continue and eventually move below the wave 4 low of $793 billion in late 2008.

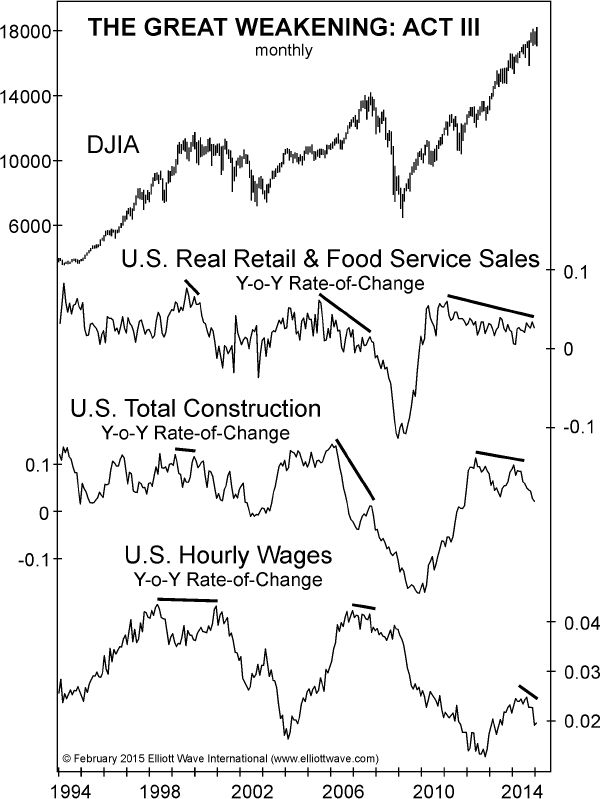

In January, Real Retail and Food Service Sales fell 0.8%. A breakdown shows the declines ranged well beyond energy expenses, as furniture sales fell 8.7%, clothing was down 9.5% and sporting goods, hobby, book and music sales fell 31.7%. The year-over-year change in Real Retail and Food Service Sales has actually been angling lower since February 2011. Note how this measure reversed in much the same manner ahead of the stock price peaks in 2000 and 2007 and the recessions that followed. ... U.S. Total Construction peaked in June 2006, a year and three months ahead of the October 2007 high in the Dow Industrials. U.S. Hourly Wages are weaker still. At 2.5%, the most recent peak rate-of-wage-growth is well below the prior highs of 4.3% in May 1998 and 4.2% in December 2006.

Also, the "recovery" in employment has gained back only about 40% of the jobs lost during the recession (despite new highs in the stock market). The data also suggests that over half of those new jobs are due to government borrowing.

Mind you, all these economic indicators have turned south despite unprecendented stimulus from the Fed.

Why?

The January Elliott Wave Theorist says "deflation is starting to win."

Oil is down 61% in seven months. Bitcoin is down 86% in thirteen months. Commodities have made new lows for the past five years. Gold and silver made their highs over three years ago. The inflation rate is negative in Europe. And interest rates just went negative in Switzerland. But remember what ... inflation forecasters have insisted all along: central banking guarantees that deflation is impossible.

Since that issue of the Theorist published, it's been revealed that January brought a year-over-year decline of 0.1% in U.S. consumer prices. It was the first fall into negative territory since October 2009. On a monthly basis the decline was 0.7%, the largest since December 2008.

Want to read more? Take a look below for details on how to get a free report from Elliott Wave International.

|

U.S. Economy Still on Life Support For years, the government has manipulated its unemployment statistics to line up with its claim that the economy has recovered strongly. But that's not ALL the government is hiding from you. From foodstuffs, to crude oil prices, to GDP, the numbers and analysis reported by the government and mainstream financial press are misleading at best, downright falsehoods at worst. Get the hidden truth in this free two-part report from now >> |

About the Publisher, Elliott Wave International Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.