Bitcoin Price Still in Important Territory

Currencies / Bitcoin Mar 27, 2015 - 05:39 PM GMTBy: Mike_McAra

In short: speculative short positions, stop-loss at 283, take-profit at $153.

In short: speculative short positions, stop-loss at 283, take-profit at $153.

This week the U.S. Securities and Exchange Commission (SEC) adopted new rules regulating small companies' access to capital, we read on CoinDesk:

On Wednesday, the US Securities and Exchange Commission (SEC) adopted regulations permitting crowdfunding for business startups.

The new rules give businesses in the blockchain ecosystem an avenue to get financial backing from the best-educated investors out there: their users.

(...)

Here's how it works: prior to these rules, a company could generally sell securities only to wealthy individuals or after going through expensive registration with the SEC.

Now, companies can file a mini-registration statement with the SEC and then sell securities to ordinary people, including over the Internet.

(...)

These new rules are good -- and potentially revolutionary -- for bitcoin 2.0 companies.

But they're also good for all companies in the bitcoin ecosystem, who can take advantage of them to raise capital from their tech-savvy pool of users. Selling securities this way still isn't a walk in the park -- it will place some additional burdens on companies and require careful legal advice. But it is decidedly good news that companies can now count this path as among their options.

So far, most investments in the Bitcoin space have been made by venture capital firms or angel investors. Now, we might see more crowdfunding entering the ecosystem. There might be a potential advantage in that it might be easier to sell an investment idea to people who are familiar with the matter. On the other hand, crowdfunding hasn't really even come close to replacing VC when it comes to investing in startups and we don't expect it to limit the VC presence.

Even if crowdfunding doesn't really change the importance of VC for Bitcoin, it still might have an impact as it might help startups that wouldn't necessarily be able to secure VC funding. This might include startups operating on a smaller scale or individuals having innovative ideas about the Bitcoin network.

For now, let's focus on the charts.

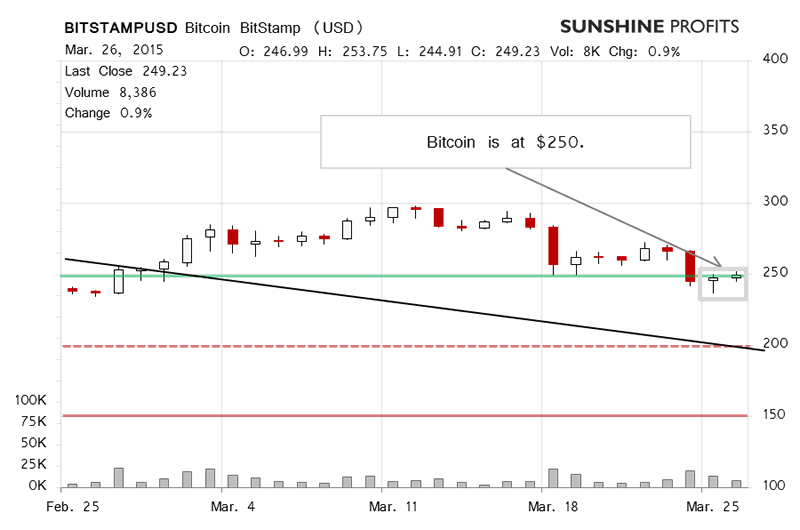

On BitStamp, we didn't see very much action yesterday, but Bitcoin went above $250 during the day, which could have been read as a slightly bullish development, but we discouraged this interpretation yesterday:

(...) we've seen some appreciation (...). Bitcoin crossed back above the $250 level which might look like bullish development at first. But is it?

We tend to think that the action we've seen so far has been weaker than what we saw yesterday in terms of volume. Bitcoin has not erased its recent losses. This might be a suggestion that the current move remains very much to the downside.

Bitcoin actually closed below $250, in line with the recent move down. This made the outlook even more bearish. Today Bitcoin hasn't moved much (this is written before 12:00 p.m. ET). The volume has also been similar to what we saw today. The currency went up to slightly above $250 at one point but retraced later on. As it is, we don't see any major changes from yesterday and the short-term outlook remains bearish.

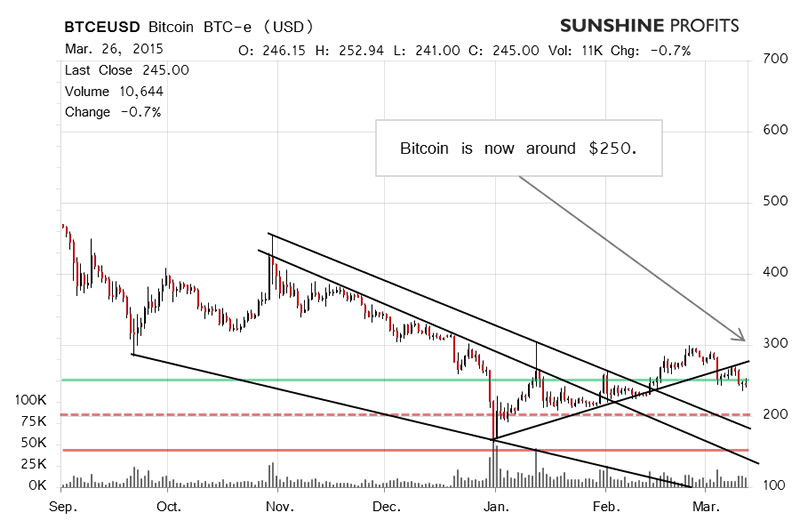

On the long-term BTC-e chart, we don't see any major changes from yesterday, so our previous comments remain up to date:

(...) today, the currency was able to go over this level. This might not look very bearish at first sight, but let's consider that the cryptocurrency is still well below a possible rising trend line (the one ending not that far away from $300). If we look closely, we might see that Bitcoin went below this line, tested it and went down again. While there's no guarantee, it might be the case that the currency will move further down.

Actually, the move above $250 seems to be the only bullish indication. The strength of the move, the volume levels, possible trend lines - all of this suggests a possible continuation of a move down. Right now, it seems that Bitcoin might actually decline more significantly, to $200 or even lower. This doesn't have to take place in a day or two but our current take is that Bitcoin might drift toward $200. A move back below $250 could accelerate the decline.

Since Bitcoin went back below $250, the points made above are reinforced. The short-term outlook remains bearish and the currency still might have room to decline. If anything, the situation just became more bearish, in our opinion. One thing to remember here is that the decline won't have to be immediate - we might see some lingering around $250 before a more significant move to the downside.

Summing up, in our opinion speculative short positions might be the way to go now.

Trading position (short-term, our opinion): short, stop-loss at 283, take-profit at $153.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.