Stock Market Large Gap Down, Despite the Algos' Push Back

Stock-Markets / Stock Markets 2015 Mar 26, 2015 - 01:00 PM GMT At 5:00 am the SPX futures were down 19 points, but a push-back ensued to cut that decline nearly in half. The Premarket still shows the better part of that rout in stocks.

At 5:00 am the SPX futures were down 19 points, but a push-back ensued to cut that decline nearly in half. The Premarket still shows the better part of that rout in stocks.

ZeroHedge reports, “In a somewhat surprising turn of events, this morning's futures reaction to last night's shocking start of a completely unexpected Yemen proxy war, which has seen an alliance of Gulf State launch an air, and soon land, war against Yemen's Houthi rebels, is what one would expect: down, and down big.”

Here’s a surprise. The NDX was dow 45 points earlier in the session, crossing both the 50-day Moving Average and its cycle Bottom Support. The algos managed to push it back above Cycle Bottom. It is still unclear whether it will find support for a bounce at the Cycle Bottom or not.

Dow futures collapsed nearly 167 points before the bounce brought it back to a loss of approximately 90 points. It’s unclear whether the Dow opens above or below the Cycle Bottom,,,a critical juncture.

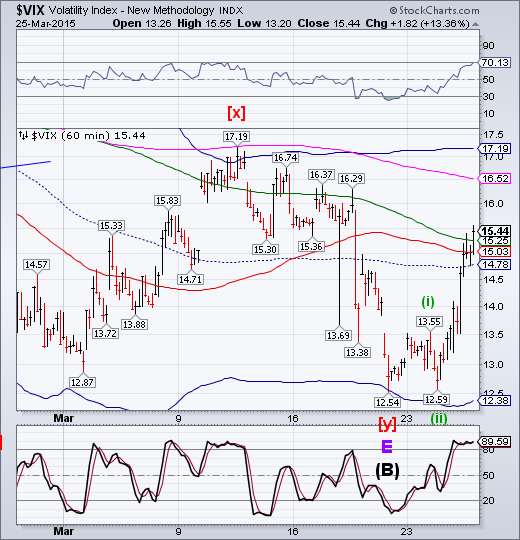

VIX challenged its 50-day Moving Average in the morning futures, but fell back closer to the open. This may be the top of a sub-Minute Wave (iii) with a pullback for Wave (iv) to come.

Crude futures jumped to 52.47 overnight but scaled back to 50.41 based on a rumor of the death of a Houthi leader.

ZeroHedge reports, “After overnight strength in oil (post-Yemen) and bonds and gold (and weakness in stocks), the last few minutes have seen some of this reverse as chatter crosses the wire of the death of top Houthi leadership in Yemen. Oil prices are tumbling, the dollar is surging, and bond yields are spiking. Stocks are starting to creep off the lows...”

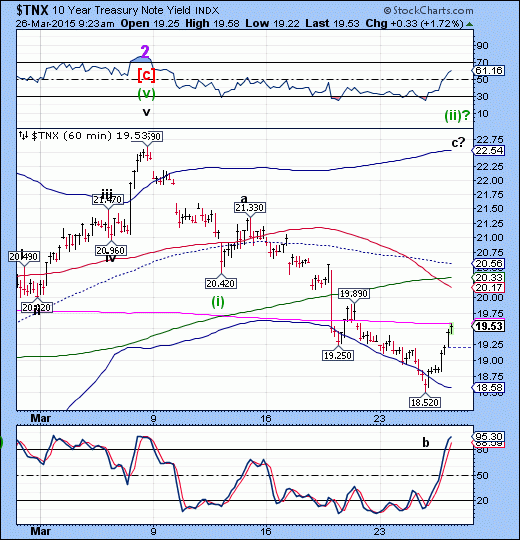

TNX spiked higher and is challenging its 50-day Moving Average at 19.58. This is the beginning of a rally that may strike fear into investors of the imminent rate hike since it has the ability to rally all the way to its Cycle Top at 22.54.

More commentary after the open.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.