Multifaceted Credit Crises Hitting the Financial Markets- Part 2

Stock-Markets / Credit Crisis 2008 Jun 08, 2008 - 05:44 PM GMT Click here for Part 2 BCA Research: US Inflation – diverging from expectations

Click here for Part 2 BCA Research: US Inflation – diverging from expectations

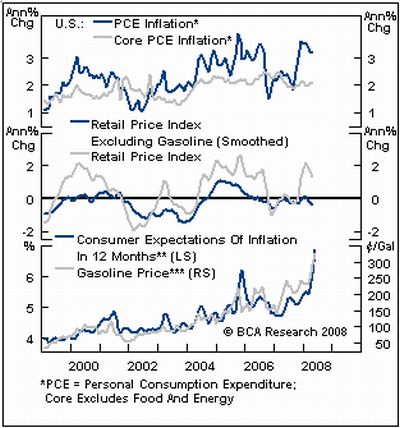

“US core consumer inflation, as measured by the PCE price index, remains near 2%. In contrast, consumer inflation expectations continue to soar, courtesy of gasoline and food prices.

“US inflation worries have intensified, as the surge in highly visible gasoline and food prices continues. Government data are not trusted because they show that core consumer price inflation has failed to rise. The build up of pipeline price pressures from rising input costs is a long-term concern, but higher core consumer inflation will only become a threat after the economy gains significant momentum, i.e. not a danger for 2008.

Sub-par economic growth ensures that there will be minimal leakage from producer prices into retail/consumer prices. Moreover, housing accounts for about one third of the PCE index, and the decline in this sector is not over.

“Bottom line: It is still premature to worry about higher inflation, and bond yields should soon calm if oil prices stop rising.”

Source: BCA Research , June 2, 2008.

Bill King (The King Report): Spiraling inflation is alive and kicking hard

“The scheme of mitigating inflationary expectations even when inflation reality is drastically different by crafting fraudulent CPI and Core is ending. Few people cared or paid attention to the various ways and means that fraudulent economic data was manufactured for most of the past two decades. But over the past few years, roaring food and energy inflation has enlightened many people.

“Barron's Alan Abelson: ‘A vivid example of spin is the response to inflation. With gasoline prices now around $4 a gallon and pointed higher, the cost of food levitating to dauntingly high levels and a passel of other items large and small spiraling upward, inflation is alive and kicking hard – as anyone who fills up his car or wanders into a supermarket knows. But, much like those Krishna kids who used to shuffle the streets decked out in robes and moaning their incantations, a surprising number of economists in the Street keep uttering their mantra, ‘there is no inflation'.

“‘By way of proof, they cite a concoction deliberately created by the Federal Reserve under Arthur Burns, seeking to mollify political pressures – and refined several times subsequently – that eliminated food and energy, supposedly because they were too volatile. Which is how some misbegotten monstrosity called ‘core inflation' was born.

“‘It's also why the core-ists sound so cheerful about current inflation, which might range as high as 11% if it were measured by the more stringent standards in effect before Burns puffed his pipe and ordained the end of food and energy as components of the inflation yardstick …'”

Source: Bill King, The King Report , June 2, 2008.

The New York Times: Think the economy is bad? Wait till the states cut back

“Struggling as we are with the housing bust, the credit crunch, shrinking consumption, rising unemployment and faltering business investment, we can be forgiven for thinking that all the big shoes have dropped. There is another one up there, however, and it is about to come down.

“State and city governments have yet to shrink the economy; indeed, they have even managed to prop it up. They have quietly maintained their spending at pre-crisis levels even as they warn of numerous cutbacks forced on them by declining tax revenues. The cutbacks, however, are written into budgets for a fiscal year that begins on July 1, a month away.

“That share is gigantic. At $1.8 trillion annually in a $14 trillion economy, the states and municipalities spend almost twice as much as the federal government, including the cost of the Iraq war.

“… when the current fiscal year ends in 30 days (or in the fall for many municipalities), state and city spending will fall, along with employment – slowly at first and then quite noticeably after the next president takes office.

“Sometime next year, the decline will reach an annual rate of $50 billion, Goldman Sachs estimates. ‘It is a big reason to expect a weak economy in 2009,' said Jan Hatzius, chief domestic economist at the firm.”

Source: Louis Uchitelle, The New York Times , June 1, 2008.

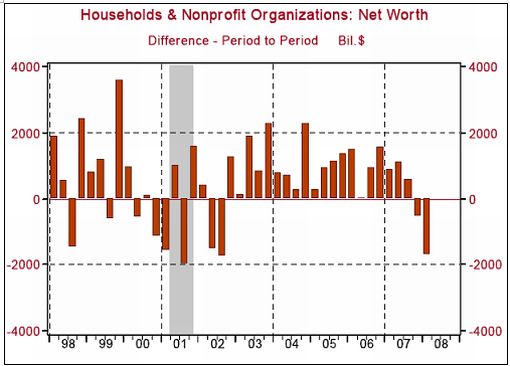

Bloomberg: Sharp decline in US household net worth

“US household wealth fell in the first quarter by the most in more than five years and borrowing slowed as home values and stock prices plunged and lenders restricted credit, Federal Reserve figures showed.

“Net worth for households decreased by $1.7 trillion from the previous three months, the second straight decline and the biggest since the third quarter of 2002, according to the Fed's quarterly Flow of Funds report today. Real estate-related assets dropped by $328.9 billion, the most since records began in 1952.”

Source: Carlos Torres, Bloomberg , June 5, 2008.

Source: Asha Bangalore, Northern Trust – Daily Global Commentary, June 5, 2008.

Bill King (The King Report): David Rosenberg – recession in discretionary spending

“Merrill's David Rosenberg: ‘Today's consumer spending and personal income report for April was a real eye-opener – not to mention a splash of cold water on the view that we have dodged the bullet on the recession scenario.

“‘First, wages and salaries in nominal terms fell 0.2% in April as the labor market contracted – too many pundits focused exclusively on the modest 20,000 payroll decline instead of the fact that the other 135 million of us in the workforce saw their hours cut during the month. Basically, a decline in nominal wages is a 1-in-15 event in the context of an expanding economy but a 3-in-4 event in the context of a recessionary economy …

“‘Recession in discretionary spending has already arrived … The only thing preventing consumer spending from contracting outright at the current time are the usual outlays on non-cyclical services such as medical care and education that don't go away necessarily in a recession, but make no mistake, the recession in discretionary spending has already arrived and is very likely going to rival the steep and prolonged consumer-led downturn of 1973 to 75 …'

“David warns that the 0.2% decline in real spending on durables and semi-durables was the sixth decline in a row, which is unprecedented (data back to 1959). In the past 50 years, there has never been a time – nada – that real consumer spending on durables and semi-durables contracted in back-to-back quarters without the economy being in a technical recession.”

Source: Bill King, The King Report , June 2, 2008.

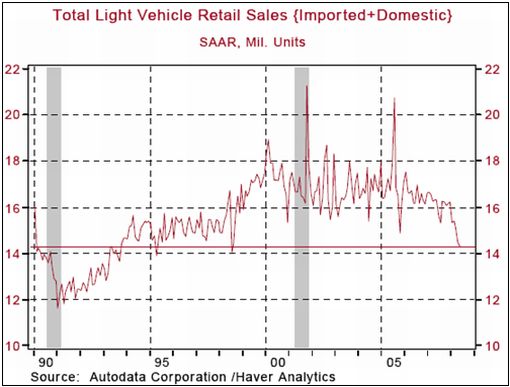

Asha Bangalore (Northern Trust): Auto sales indicate soft consumer spending

“Auto sales dropped to an annual rate of 14.29 million units in May from 14.46 million units in April. The May tally of auto sales is the lowest since April 1995, excluding a strike-related drop in 1998. The April to May average of 14.38 million units in auto sales is far below the 15.3 million average of the first quarter which reinforces expectations of soft consumer spending in the third quarter.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , June 3, 2008.

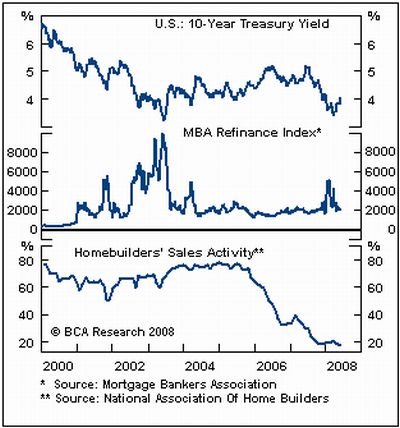

Financial Times: Toll urges action to lift US housing market

“Toll Brothers, the largest US builder of luxury homes and apartments, on Tuesday called for greater government action to help boost demand for homes as it reported its third consecutive quarterly loss.

“The plea for help came as the builder of high-end homes said that buyers were still scarce in most of its markets in the second quarter.

“‘We believe Congress should jump-start demand for new homes with an initiative that will bring buyers off the sidelines and into the market, and thereby stop the downward spiral of home prices,' said Robert Toll, the company's chairman.

“‘With a little motivation, the new home market could turn around, which would have a very positive impact on banks, bond prices and many other areas of the economy.'

“The Senate banking committee overwhelmingly agreed a plan last month that would allow up to $300 billion of federal guarantees for refinanced home loans. Action to help stabilise falling home prices has been widely called for, as it would not only ease the pain felt by homeowners, but could also help slow losses related to mortgage securities – thereby relieving lenders after hundreds of billions of dollars in write-downs have hit the financial sector.”

Source: Daniel Pimlott, Financial Times , June 3, 2008.

Bloomberg: New overdue home loans swamp effort to fix defaults

“Newly delinquent mortgage borrowers outnumbered people who caught up on their overdue payments by two to one last month, a sign that nationwide efforts to help homeowners avoid default may be failing.

“In April, 73,880 homeowners with privately insured mortgages fell more than 60 days late on payments, compared with 39,584 who got back on track, a report today from the Washington-based Mortgage Insurance Companies of America said. Mortgage insurers pay lenders when homeowners default and foreclosures fail to cover costs.

“Foreclosure filings surged 65% and bank seizures more than doubled in April compared with a year earlier as rates on adjustable mortgages increased, according to RealtyTrac. Lawmakers and Federal Reserve officials are trying to ease the worst US housing slump since the Great Depression through tax rebates, expanded federal mortgage insurance and other programs.

“‘It's going to take a while before you see the impact of the government's plans, if you can even see a discernable one,' Steve Stelmach, an insurance analyst at Friedman, Billings, Ramsey Group said in an interview.

“In April, a record 183,000 homeowners were able to work out new borrowing terms with lenders and avoid foreclosure filings, according to the Hope Now Alliance, a mortgage industry coalition formed last year at the urging of US Treasury Secretary Henry Paulson.”

Source: Josh P. Hamilton and Bob Ivry, Bloomberg , May 30, 2008.

LA Times: Southern Californian homes – buy one, get one free

“In a sign of how difficult it is to sell new homes in Southern California right now, a San Diego developer is offering a ‘buy one, get one free' deal, pairing million-dollar homes with less expensive homes.”

Source: Michael Crews , May 2008.

Times Online: Rating agencies to agree new method of risk assessment

“The world's three biggest credit-rating agencies were close to securing a deal with US regulators yesterday to reform the way in which they assess risk in the wake of America's credit crisis.

“Andrew Cuomo, the New York attorney-general, is in the final stages of agreeing a new regime for the rating agencies to try to make them more transparent and less vulnerable to conflicts of interest.

“The rating agencies have been criticised for their role in the credit crisis that erupted on Wall Street last summer. The groups, which include Standard & Poor's, Moody's and Fitch, were said to have failed to recognise the increased risk of default of a number of mortgage-backed bonds and of being too slow to alert the market.

“The rating agencies are already being investigated by the US Securities and Exchange Commission and by senators in Washington for their role in the credit turmoil on Wall Street.

“In the past, bond issuers have shopped around between rating agencies to get the best rating for their securities. This meant that the agencies had an incentive to go easy on their rating in order to win the business. Mr Cuomo is proposing that the agencies be paid for their review, even if they were not hired to rate the deal. This would mean that the firms would be paid even if they handed out a tough rating.

“As part of the agreement, the rating agencies are thought to have negotiated immunity from prosecution over their alleged role in the credit crisis in return for assisting the SEC with its inquiry – a move that will anger many on Wall Street, who believe that the agencies failed them.”

Source: Suzy Jagger, Times Online , June 5, 2008.

Financial Times: Banks fear new $5,000 billion balance sheet burden

“Accounting changes could force US banks to take thousands of billions of dollars back on to their balance sheets in the coming months in a move that is likely to curb further their lending and could push them into new capital raisings, analysts have warned.

“Analysts at Citigroup said a planned tightening of the rules regarding off-balance sheet vehicles would force banks to reconsider arrangements and could result in up to $5,000 billion of assets coming back on to the books.

“The off-balance sheet vehicles have been used by financial institutions to keep some assets off their balance sheets, thereby avoiding the need to hold regulatory capital against them.

“Birgit Specht, head of securitisation analysis at Citigroup, said: ‘We think it is very likely that these vehicles will come back on balance sheet. This will not affect liquidity because [they] are funded, but it will affect debt-to-equity ratios [at banks] and so significantly impact banks' ability to lend.'”

Source: Paul J Davies, Gillian Tett and Jennifer Hughes, Financial Times , June 3, 2008.

BCA Research: Global bonds – test the long side

“We recommend taking a tactical long position in the global bond market.

“Most of our indicators remain bond bullish. The US economy is likely to be sluggish for some time and the housing market, in particular, cannot handle the recent backup in mortgage rates. The UK real estate market is now also deflating – the huge selloff in the short end of the gilt market will be devastating for housing if it does not at least partly unwind. Business surveys in the euro area continue to herald a further slowdown in GDP growth. The Japanese economy is also slowing.

“In addition, while conditions in credit markets have improved as of late, we do not expect the banks to begin lending aggressively and relaxing lending standards anytime soon, as balance sheet rebuilding continues. Thus, credit availability will be a headwind to growth. Moreover, the latest inflation scare should soon subside. Admittedly, valuations do not favor long duration positions. Ten year government bonds in the major countries are fair-to-expensive according to our models (except in Australia where bonds are cheap). However, yields should be well below fair value given the downside economic risks.”

Source: BCA Research , June 3, 2008.

David Fuller (Fullermoney): US Treasuries in a secular bear market

“I maintain that US Treasuries and most other long-dated government bonds are in a secular bear market, due to too much supply, low yields and rising inflation. However, action remains choppy, not least due to concern over slower GDP growth, so my personal strategy is to sell long-dated Treasury futures short following technical rallies such as we are seeing at the moment.”

Source: David Fuller, Fullermoney , June 3, 2008.

Bill King (The King Report): No reason to buy stocks now

“The technicals, seasonals, fundamentals and financial system conditions are negative. And now the Fed is suggesting that it will no longer cut rates. Rallies should be viewed as a gift from the trading gods.”

Source: Bill King, The King Report , June 4, 2008.

John Hussman (Hussman Funds): Market climate for equities unfavourable

“… the market climate for stocks remains characterized by unfavorable valuations and unfavorable market action. The stock market remains relatively overbought, so there remains a continued risk of abrupt weakness given the unfavorable climate.

“Here and now, we remain defensive and very skeptical of the notion that the US has skirted a downturn.”

Source: John Hussman, Hussman Funds , June 2, 2008.

Jeffrey Saut (Raymond James): Be on alert for “W-shaped” economic pattern

“‘Sell in May and go away' is an old stock market ‘saw' whose long-term track record is compelling. To wit, starting in 1950 investing $10,000 in the SPX every May 1st and liquidating on October 31st compounds to a shockingly small $10,026 today. Conversely, buying the SPX every November 1st and selling every May 1st compounds to $372,890 (according to Ned Davis Research). Yet we have learned the hard way that markets can do ANYTHING. For example, if you sold in May 2003 you missed a 30% rally into year end.

“With near-term stronger than expected economic statistics, increasing risk appetites, and commodities normalizing (read: declining, which should be bullish for equities), we think we could be in the middle of the envisioned ‘W-shaped' economic pattern. If so, the perception will be that the worst is behind us and stocks could continue to levitate until we enter the backside of the ‘W' where a rise in interest rates should ameliorate any robust economic recovery. Consequently, we are currently ‘out' of trading positions and focusing on investment positions, preferably ones with a yield.”

Source: Jeffrey Saut, Raymond James , June 2, 2008.

David Fuller (Fullermoney): Banks are a leading indicator

“Fullermoney has long maintained that banks are a leading indicator, more often than not. Therefore at a time when confidence in western banks and bankers is at a once-in-a-generation low, the accountancy nonsense … will not help. However a key market-related question for investors is likely to be: To what extent has the bad news, current and anticipated, already been discounted?

“For several months we have maintained that while the credit crisis had passed its nadir, the convalescence for banks would be lengthy, not least because their most lucrative business model of the last decade also led to their downfall last year.

“While the prospect of banks returning to more prudent forms of banking should be reassuring for the long term, it does not answer investors' present concerns as to how the attractive dividends will be funded. Moreover, minority shareholders have often seen their equity diluted. Consequently they have been voting with their feet recently, as we can see with this weak performance by bank indices in the USA, UK and to a lesser extent, Continental Europe.

“The spectacle of US and UK bank indices testing their January and March lows is certainly not reassuring for equity investors, neither is the recent move beneath the April reaction low by the DJ Euro Bank Index. However, on a more positive note, these indices appear somewhat overstretched once again as a consequence of recent and persistent weakness.

“The catalyst for such a rebound is not immediately apparent to me, although contrarian thinkers may be encouraged by today's front-page headline for the UK's Evening Standard: ‘Major Banks in New Crisis'. Personally, I regard the current spate of rights issues (secondary offerings) as a good sign in terms of the long term outlook for commercial banks.”

Source: David Fuller, Fullermoney , June 2, 2008.

Richard Russell (Dow Theory Letters): US dollar not going out of business yet

“With a number of Mideast nations threatening to remove their currencies from the dollar peg, Treasury Secretary Paulson is getting worried, and again he's announcing that the US is in favor ‘a strong dollar'.

“Is anyone listening? By this time, no one believes in a strong dollar, but now time may be on the dollar's side. Here's why I say that. Check out the chart of the dollar. Are you looking at the latest plunge to 71. That uncorrected decline is almost ridiculous. The dollar is not going out of business yet. In fact, the dollar is long overdue for a correction to the upside.

“The dollar's direct competition is the euro, and the euro is too expensive. Europe is as afraid of inflation as the US is afraid of deflation. And Europe's interest rates are too high. The high Euro interest rates are killing business. The pressure in Europe is for lower rates, and the pressure in the US is for higher rates to offset inflation. This, plus the oversold condition of the dollar, should send the dollar higher. Of course, if oil tops out, that too would help the dollar. At any rate, that's the way Richard Russell sees it – for now.”

Source: Richard Russell, Dow Theory Letters , June 3, 2008.

David Fuller (Fullermoney): US dollar to remain in ranging pattern

“… I think the USA and its trade partners would like to see at least a quietly steady greenback over the medium term.

“The US government has achieved much of its unstated devaluation objectives and further near-term weakness for the USD would most likely be counterproductive, not least in terms of inflationary pressures. America's trade partners can live with the dollar at this level; creditors have no interest in a further devaluation of their USD holdings, and currency appreciation has mitigated inflationary pressures somewhat.

“Some commentators look at the USD's long slide and conclude that it should bottom out near current levels, not least because it is ‘cheap' in terms of purchasing power parity. I have never been impressed by PPP as a currency forecasting tool but even if the USD has commenced a base building phase prior to a significant recovery, I think the process would be lengthy as we have seen before.

“After all, US short-term rates are hardly an incentive to buy the USD and likely to stay low for some time; everyone knows that the Fed will continue printing and the presidential candidates are promising even more big spending, and creditor nations probably feel that they already have too many US dollars.

“I maintain that the US Dollar Index will remain in a broadly ranging pattern for a while longer. Beyond that I think the prospect for a significant rally is at least matched by the possibility for another downward slide.

“The latter would probably have a whiff of crisis about it and therefore be a headwind for most stock markets. Conversely, a steady dollar should be a benign influence. … it could pay to acquire precious metals during easing in this seasonally dull period for bullion and while the USD is temporarily firm.”

Source: David Fuller, Fullermoney , June 4, 2008.

John Authers (Financial Times): Pound reflects increasing pessimism in UK

Source: John Authers, Financial Times , June 4, 2008.

MarketWatch: Soros says commodity bubble echoes ‘87 climate

“The investment flood into commodity indexes bears eerie similarities to the craze for portfolio insurance that led to the stock-market crash of 1987, according to hedge-fund investor George Soros, who warned that the rush into oil has created a ‘bubble'.

“‘In both cases, the institutions are piling in on one side of the market and they have sufficient weight to unbalance it,' said Soros in testimony prepared for a Senate panel on energy manipulation. ‘If the trend were reversed and the institutions as a group headed for the exit as they did in 1987, there would be a crash.'

“Tuesday's hearing by the Senate Committee on Commerce, Science and Transportation aimed to determine what factors the Federal Trade Commission should consider when it makes rules on preventing manipulation in the wholesale oil and petroleum-distillates markets.

“It's the latest public forum focused on whether drivers besides supply and demand are responsible for the recent spike in oil, grains and other commodity prices.

“Soros, who made his fortune speculating on currencies, advised lawmakers to use caution when considering regulations designed to reduce speculation.

“Such rules could push investors further into unregulated markets, he said. Still, varying margin requirements can be used to more actively prevent asset bubbles from inflating, he added. ‘That is one of the main lessons to be learned from the recent financial crisis.'

“He said there are fundamental factors behind the rise in oil prices. Namely, there are increasing costs of developing new reserves and waning oil production in countries like Russia and Venezuela, as well as domestic subsidies in countries such as China that keep prices artificially low.”

Source: Laura Mandaro, MarketWatch , June 3, 2008.

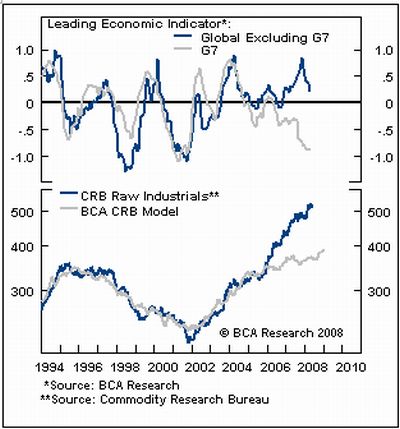

BCA Research: Is a commodity correction approaching?

“Our global Leading Economic Indicator (LEI) is signaling that some contagion from the US slowdown is spreading beyond the G7 countries, which could finally trigger a shakeout in commodity prices.

“Since the end of 2006 there has been an unprecedented divergence between the G7 and non-G7 LEI. However, the steady decline of the non-G7 indicator warns that some contagion may soon develop. Though the worst of the US economic slide may be past, a long period of sluggishness seems probable, and there remain downside risks given the ongoing housing slump and relentless rise in energy prices.

“Bottom line: A slowing in non-G7 economic growth at a time when the US is still weak could be the catalyst for the long overdue correction in commodity prices. We would hold back from putting fresh funds to work until overbought conditions and sentiment ease.”

Source: BCA Research , May 28, 2008.

Bloomberg: Jim Rogers says bull market in oil has “years to go”

Source: Bloomberg , June 5, 2008.

CNBC: Ed Schafer – Food inflation to hit 43%

“‘Internationally we're looking at a 43% inflation rate in food this year,' Ed Schafer, US secretary of Agriculture, told CNBC on Tuesday. Schafer said the big driving factor was energy.”

Source: CNBC , June 3, 2008.

Eoin Treacy (Fullermoney): Food production to lag demand significantly

“Food over-production was such a problem in Europe, that the infamous butter mountains and wine lakes were synonymous with bureaucratic incompetence and a Common Agricultural Policy which had outgrown its usefulness. However, now that production has decreased and the price of food has become an international cause celebre, set-aside policies are likely to be revisited. As one would expect, higher demand should result in an eventual corresponding move from the supply side.

“While there are a number of contributing factors surrounding the run up in commodity prices, there is a temptation to blame everything on biofuel. The bigger picture is just not that simple. Rising food demand from growing populations who can afford to have a more balanced diet is the key driver behind increased demand for food of all types. This is not something which is about to change anytime soon. In fact as global GDP growth continues to be led by the largest population centres, and millions more enter the middle classes, demand is only going to increase.

“Many crops have an annual cycle, which means that when prices rise, a bumper crop the following year is possible as farmers plant more of that commodity. However, this also leads to less of another crop being planted and sows the seeds of the next bull market. When one factors in weather, agricultural commodity prices are volatile. It will take a significant amount of time before global food production taken on aggregate can meet rising demand.”

Source: Eoin Treacy, Fullermoney , June 3, 2008.

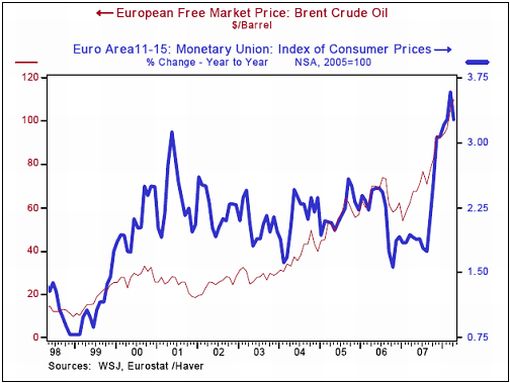

Victoria Marklew (Northern Trust): European Central Bank sounds hawkish tone

“As expected, the European Central Bank (ECB) left its refi rate at 4.0% again this morning. What was not expected was the hawkish tone of the subsequent statement and the press briefing from President Trichet. He noted that the Governing Council had a ‘deep discussion' and remains ‘in a state of heightened alertness'. Some members apparently wanted a rate hike this month but the consensus was to hold. The President then noted that the Council may decide to make ‘a small hike' at the July 3 meeting in order to anchor inflation expectations. The euro promptly firmed anew.

“So, what are the odds of a July rate hike? The ECB's mandate is to keep inflation ‘below but close to 2%' in the medium term. That qualifier allows some wriggle-room – the Council can say that current conditions are temporary and prices will come back toward target in the ‘medium-term' and can define that however it sees fit. For now, our hunch is that the Council will continue to talk tough but the consensus to stand pat will prevail. As always, though, watch the data.”

Source: Victoria Marklew, Northern Trust – Daily Global Commentary , June 5, 2008.

Reuters: UK house prices fall 2.4%

“House prices fell a larger-than-expected 2.4% in May, the country's biggest mortgage lender, Halifax, said on Thursday, providing further evidence the property market downturn is gathering pace.

“‘The latest data on the housing market are undeniably alarming,' said Howard Archer, an economist at Global Insight. ‘Clearly, the downward pressure on house prices coming from stretched buyer affordability and tight lending conditions is now biting hard.'

“Analysts polled by Reuters had expected only a 1.3% monthly decline.

“Figures from rival lender Nationwide last week were equally weak, showing house prices fell 2.5% in May, the sharpest monthly fall since its survey began in 1991.

“Halifax said the average cost of a house in May was 184,111 pounds, 6.4% lower than in the same month last year. The Halifax index shows house prices have fallen 7.8% from their peak in August 2007.”

Source: Reuters , June 5, 2008.

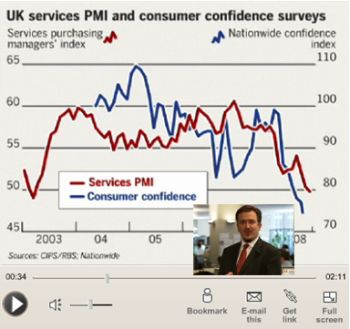

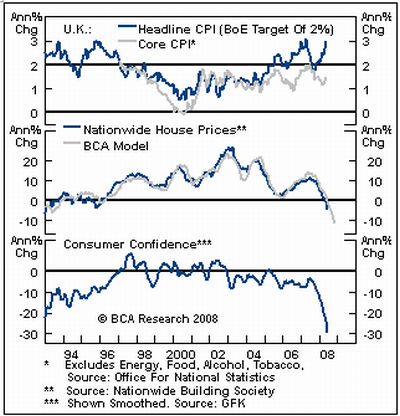

BCA Research: BoE stubborn as economy melts

“The Bank of England (BoE) remains fixated on inflation risks and opted to leave the official Bank Rate unchanged at 5%, as expected.

“According to the BoE's May Inflation Report, the central bank sees the risks in the current macro environment as very asymmetric, with inflation posing a significant threat and weak but manageable downside for growth. We disagree with the central bank's assessment and hold a much more bearish outlook for growth. Indeed, the latest macro data suggests that the economy is deteriorating rapidly. Real estate prices are already plunging faster than our models had warned, with Nationwide house prices down 4.4% YoY and commercial real estate price inflation contracting at a double digit pace.

“Consumer confidence continues to drop to new cyclical lows and the PMI services index has slipped below its boom/bust line. While retail sales volume growth has held up reasonably well, this is largely due to aggressive price discounting and our models warn that dramatic headwinds are building. In turn, it is likely that consumer price pressures will ease in the coming months.

“Bottom line: Stay overweight gilts within a global hedged fixed income portfolio. The BoE is making a policy mistake by remaining hawkish and will be forced to play catch up later this year.”

Source: BCA Research , June 6, 2008.

Business Day: China's growing inflation threat

“Six months after the People's Bank of China signaled a stepped-up battle against inflation, it has only fallen further behind in the fight.

“With inflation the highest in almost 12 years, central bank Governor Zhou Xiaochuan has lifted interest rates once, by just 0.18 percentage points, since the PBOC declared in December it was shifting to a ‘'tight' monetary stance. That means price increases are outpacing the return on loans and deposits, encouraging people to borrow and spend more.

“Inflation quickened to 8.5% in April, up two percentage points from December. The benchmark one-year lending rate is 7.47%, and the equivalent for deposits is 4.14%.”

Source: Business Day , June 2, 2008.

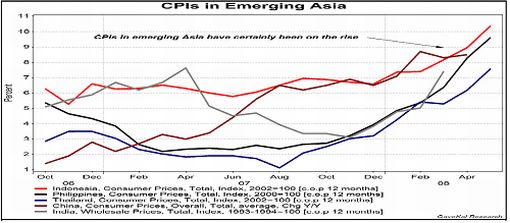

GaveKal: CPIs spiraling up

Source: GaveKal – Checking the Boxes , June 2 & 5, 2008.

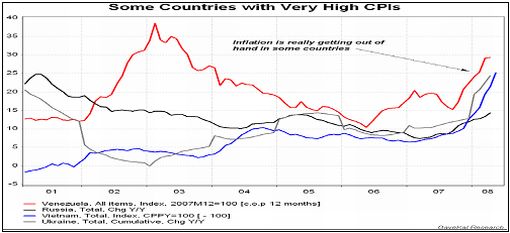

Ambrose Evans-Pritchard (Telegraph): Argentine alert as inflation spectre stalks the world

“Argentina is defaulting on its sovereign debt yet again, this time by stealth.

“European and US pension funds that snapped up Argentina's peso bonds at the height of the credit bubble are discovering that it pays to probe the politics of Latin America - and indeed, Eastern Europe, and emerging Asia - before taking the plunge.

“It seems like only yesterday that Argentina halted payments on $95 billion of external debt. The ‘Great Haircut' of 2001 was the biggest default in history. Investors are so forgiving.

“Argentina's trick this time, under the presidential double act of Nestor and Cristina Kirchner, has been to purge the National Statistics Office and appoint a friend to manage inflation data.

“The official Consumer Price Index (CPI) is 8.9%. This is the benchmark used to set payments on inflation-linked bonds, now 40% of the country's debt. The true inflation rate is more than 25%, according to union staff of the statistics office. They allege manipulation.

“‘Argentina is engineering a partial default on its domestic debt,' said Professor Carmen Reinhart, from Maryland University.

“Vladimir Werning, from JP Morgan Chase, said the yield spread on inflation-linked peso debt has ballooned to 1,230 basis points. They are priced for the dustbin.

“On paper, Argentina looks safe. The world's biggest exporter of soybeans - and number two in corn - is riding the food boom, even if at war with its own farmers. The trade surplus is $12 billion. Foreign reserves are more than $50 billion. Yet the default premium is soaring anyway.

“Argentina is a warning of what can go wrong once inflation gets out of hand, as it has in roughly half the world.

“Among the CPI rates – if you believe them – are: Ukraine (30%), Venezuela (29%), Vietnam (25%), Kazakhstan (19%), Latvia (18%), Qatar (17%), Pakistan (17%), Egypt (16%), Bulgaria (15%), Russia (14%), the Emirates (11%), Estonia (11%), Turkey (9.7%), Indonesia (9%), Saudi Arabia (9.6%), Romania (8.6%), China (8.5%) and India (7.6%).”

Source: Ambrose Evans-Pritchard, Telegraph , June 3, 2008.

Click here to go back to Part 1

Did you enjoy this posting? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.