Danger Will Robinson - Stock Market Crash Warning

Stock-Markets / Stock Market Valuations Mar 25, 2015 - 05:36 PM GMTBy: James_Quinn

It’s funny how the truth sometimes leaks out from the government. I’m guessing that Mr. Ted Berg will not be working for the Office of Financial Research much longer. This new agency was created by the Dodd Frank Law and is supposed to protect consumers from the evil Wall Street banks. But we all know the evil Wall Street banks wrote the bill, have gutted the major provisions, have captured all the regulatory agencies, own the Federal Reserve, and control all the politicians in Washington D.C. So, when an honest government analyst writes an honest truthful report that unequivocally proves the stock market is grossly overvalued and headed for a crash, the Wall Street banking cabal will surely call the top government apparatchiks to voice their displeasure. Truth is treason in an empire of lies.

It’s funny how the truth sometimes leaks out from the government. I’m guessing that Mr. Ted Berg will not be working for the Office of Financial Research much longer. This new agency was created by the Dodd Frank Law and is supposed to protect consumers from the evil Wall Street banks. But we all know the evil Wall Street banks wrote the bill, have gutted the major provisions, have captured all the regulatory agencies, own the Federal Reserve, and control all the politicians in Washington D.C. So, when an honest government analyst writes an honest truthful report that unequivocally proves the stock market is grossly overvalued and headed for a crash, the Wall Street banking cabal will surely call the top government apparatchiks to voice their displeasure. Truth is treason in an empire of lies.

The soon to be fired Mr. Berg’s verbiage is subtle, but pretty clear.

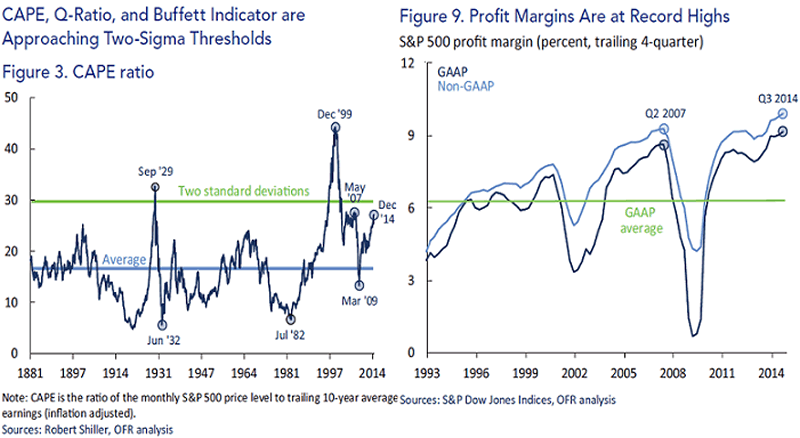

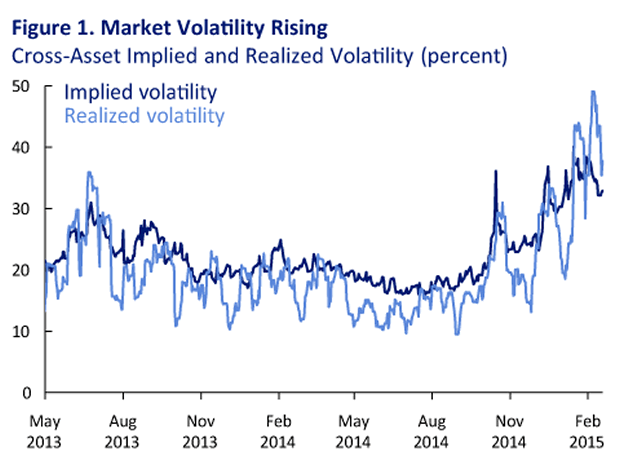

Option-implied volatility is quite low today, but markets can change rapidly and unpredictably, a phenomenon described here as “quicksilver markets.” The volatility spikes in late 2014 and early 2015 may foreshadow more turbulent times ahead. Although no one can predict the timing of market shocks, we can identify periods when asset prices appear abnormally high, and we can address the potential implications for financial stability.

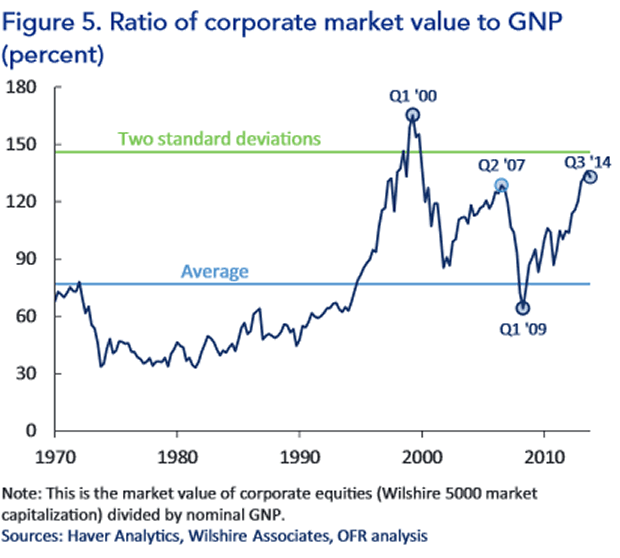

Markets can change rapidly and unpredictably. When these changes occur they are sharpest and most damaging when asset valuations are at extreme highs. High valuations have important implications for expected investment returns and, potentially, for financial stability.

However, quicksilver markets can turn from tranquil to turbulent in short order. It is worth noting that in 2006 volatility was low and companies were generating record profit margins, until the business cycle came to an abrupt halt due to events that many people had not anticipated.

The full report can be found here:

http://financialresearch.gov/briefs/files/OFRbr-2015-02-quicksilver-markets.pdf

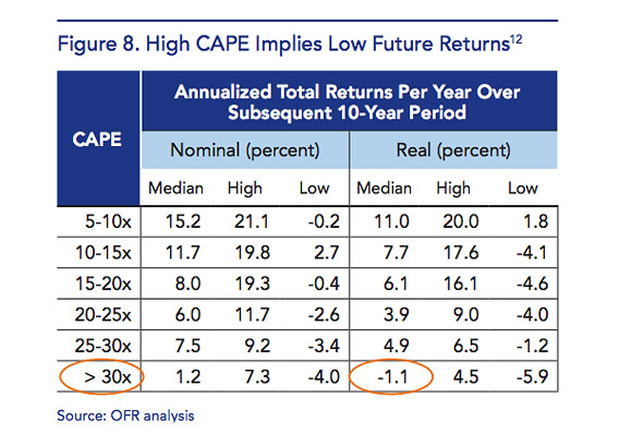

The meat of the report is in the charts. The CAPE Ratio, which has been a highly accurate predictor of market tops is now almost two standard deviations above the long term average and at the same level it was before the 2008 crash. It has only been higher in 1929 and 1999. That should give you a nice warm feeling about the coming bull market. Right?

Profit margins are at all-time record highs as corporations don’t have to pay higher wages, can borrow for virtually free, and continue to outsource to foreign countries. Profit margins are 60% above the long-term average and always revert to the mean. Do you expect them to expand or contract from here?

Warren Buffett, before he became a shill for the status quo, judged the value of the market based upon corporate market value to GNP. This ratio is also almost two standard deviations above the long term average. It is higher than it was in 2007. It is 75% above the long-term average. It has only been higher during the internet bubble in 2000. Would you bet on it reaching 3 standard deviations above the long-term average? Wall Street and CNBC are telling you to make that bet.

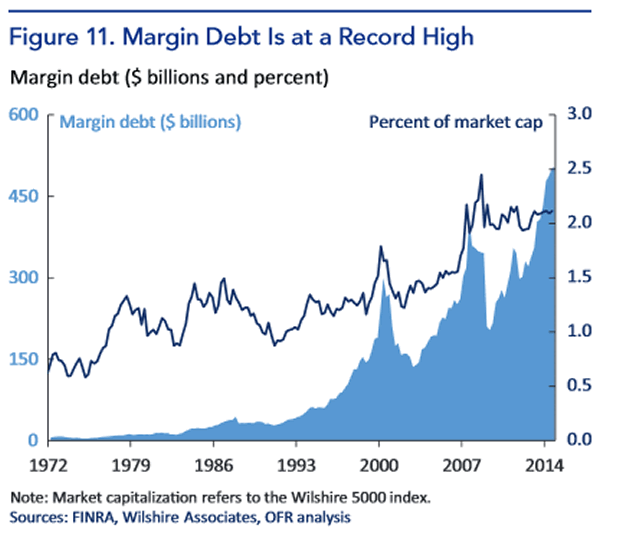

We all know about the cash on the sidelines ready to come into the market and drive it higher. The fact that margin debt is at an all-time high shouldn’t be a concern at all. Right? What you have are a bunch of monkeys who think they are brilliant investors. They are sure Janet has their back. The panic when this market begins to go south will be epic. As the margin calls come in, the market will spiral out of control, creating more margins calls. The bodies will be piled high and calls for Janet to save the monkeys will be shrill.

As you may have noticed, the market is now regularly experiencing 200 to 300 point swings on a regular basis. Low volatility and a steady rise in prices is a hallmark of bull markets. High volatility and choppy markets is a sign of bear markets. The spike in volatility since September is a warning sign. But the captains of the Wall Street Titanic banks declare “full steam ahead”. We all know what happens next.

Some people never learn. Even though we’ve experienced two horrific stock market crashes in the last fifteen years, with losses of 40% to 80%, the professional monkeys posing as investment experts ignore facts, history, and common sense. At current stock market valuations, you are virtually guaranteed to lose money in the market over the next ten years, and experience a death defying collapse in the foreseeable future. Will the Ivy League MBA’s heed these warnings? Not a chance. They think they are the smartest guys in the room.

We’re Lost in Space. Danger is everywhere, but no one seems to care.

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2015 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.