Multifaceted Credit Crises Hitting the Financial Markets- Part 1

Stock-Markets / Credit Crisis 2008 Jun 08, 2008 - 04:17 PM GMT After stock markets have held up bravely in the face of the credit crises and mounting economic woes, a combination of renewed concerns about the financial sector, a record-breaking spurt in the oil price, and a rotten unemployment number claimed their toll on Friday, triggering a sharp sell-off in most parts of the world.

After stock markets have held up bravely in the face of the credit crises and mounting economic woes, a combination of renewed concerns about the financial sector, a record-breaking spurt in the oil price, and a rotten unemployment number claimed their toll on Friday, triggering a sharp sell-off in most parts of the world.

“Today was a bona fide panic day. They threw ‘em in,” said Richard Russell, author of the Dow Theory Letters for the past 50 years. The bears were out in force, as personified by Bill King ( The King Report ): “The technicals, seasonals, fundamentals and financial system conditions are negative. And now the Fed is suggesting that it will no longer cut rates. Rallies should be viewed as a gift from the trading gods.”

Angst about banks' credit and funding problems resurfaced strongly last week on the back of Lehman Brothers' (LEH) rumored quarterly loss and capital raising exercise, the ousting of Wachovia's (WB) CEO, a Wall Street Journal report that the SEC was investigating AIG (AIG) for its swaps accounting, and the downgrading of the credit ratings of bond insurers MBIA ((MBI) and Ambac Financial (ABK).

Angst about banks' credit and funding problems resurfaced strongly last week on the back of Lehman Brothers' (LEH) rumored quarterly loss and capital raising exercise, the ousting of Wachovia's (WB) CEO, a Wall Street Journal report that the SEC was investigating AIG (AIG) for its swaps accounting, and the downgrading of the credit ratings of bond insurers MBIA ((MBI) and Ambac Financial (ABK).

Fed Chairman Ben Bernanke broke tradition on Tuesday when he, rather than the Treasury, commented on the US dollar. He said the Fed was “… attentive to the implications of changes in the value of the dollar for inflation and inflation expectations” and that price stability and maximum sustainable employment would be key factors ensuring the dollar remains a strong and stable currency.

Bernanke's remarks, together with generally better-than-expected economic reports, reinforced expectations of the Fed keeping interest rates on hold for the months ahead. However, Friday's huge jump in the unemployment rate caused pundits to revisit this belief, leading to increased volatility in all financial markets. By way of example, the CBOE Volatility (VIX) Index surged by 26.5% to a two-month high on Friday.

Before highlighting some thought-provoking news items and quotes from market commentators, let's briefly review the financial markets' movements on the basis of economic statistics and a performance round-up.

Economy

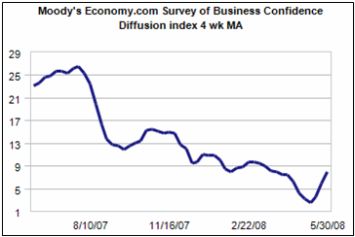

In contrast to how pundits perceived the investment picture by the close of business last week, Moody's Economy.com reported: “Global business confidence notably improved in May. While sentiment remains very weak and fragile it is well above its April low. Expectations regarding the six-month outlook are negative but are as strong as they have been since the end of 2007. Confidence remains weakest in the US where they suggest the economy is contracting, and remains best in Asia where expectations are consistent with an economy growing near its potential.”

In contrast to how pundits perceived the investment picture by the close of business last week, Moody's Economy.com reported: “Global business confidence notably improved in May. While sentiment remains very weak and fragile it is well above its April low. Expectations regarding the six-month outlook are negative but are as strong as they have been since the end of 2007. Confidence remains weakest in the US where they suggest the economy is contracting, and remains best in Asia where expectations are consistent with an economy growing near its potential.”

US economic reports throughout the week were generally more robust than expected, starting with the ISM Manufacturing Index and Construction Spending reports, and continuing with the Factory Orders, Jobless Claims, productivity growth and wholesale inventories reports.

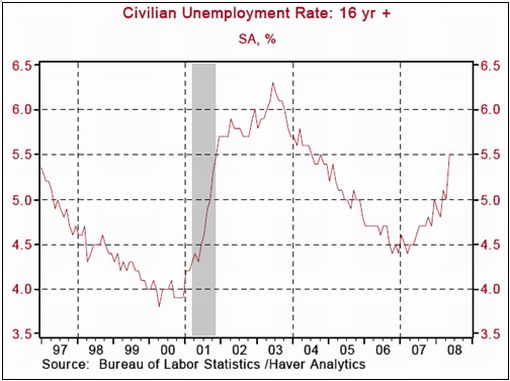

The influential employment report, however, failed to meet the market's expectations. Non-farm payrolls fell by 49,000 and the unemployment rate shot up to 5.5% – the largest monthly increase in 22 years. Although the payroll decline was smaller than expected, the surge in the unemployment rate suggests considerable weakness in the pipeline, especially regarding consumer spending.

Elsewhere in the world, the ECB left its refi rate unchanged at 4.0%, but President Jean-Claude Trichet confounded the markets when he expressed his concerns about inflation and said that a Eurozone rate hike in July was a possibility.

The Bank of England held interest rates steady at 5%, notwithstanding a darkening outlook for the UK economy as manifested by, among others, a contraction in the services sector and falling house prices.

WEEK'S ECONOMIC REPORTS

| Date | Time (ET) | Statistic | For | Actual | Briefing Forecast | Market Expects | Prior |

| Jun 2 | 10:00 AM | Construction Spending | Apr | -0.4% | -0.8% | -0.6% | -0.6% |

| Jun 2 | 10:00 AM | ISM Index | May | 49.6 | 49.0 | 48.5 | 48.6 |

| Jun 3 | 12:00 AM | Auto Sales | May | - | NA | NA | 4.9M |

| Jun 3 | 12:00 AM | Truck Sales | May | - | NA | NA | 5.6M |

| Jun 3 | 10:00 AM | Factory Orders | Apr | 1.1% | -0.5% | -0.1% | 1.5% |

| Jun 4 | 8:15 AM | ADP Employment | May | 40K | - | -30K | 10K |

| Jun 4 | 8:30 AM | Productivity -Rev. | Q1 | 2.6% | 2.5% | 2.5% | 2.2% |

| Jun 4 | 10:00 AM | ISM Services | May | 51.7 | 52.0 | 51.0 | 52.0 |

| Jun 4 | 10:30 AM | Crude Inventories | 05/31 | -4802K | NA | NA | -8883K |

| Jun 5 | 8:30 AM | Initial Claims | 05/31 | 357K | 370K | 372K | 375K |

| Jun 6 | 8:30 AM | Average Workweek | May | 33.7 | 33.8 | 33.7 | 33.7 |

| Jun 6 | 8:30 AM | Hourly Earnings | May | 0.3% | 0.3% | 0.2% | 0.1% |

| Jun 6 | 8:30 AM | Nonfarm Payrolls | May | -49K | -50K | -60K | -28K |

| Jun 6 | 8:30 AM | Unemployment Rate | May | 5.5% | 5.1% | 5.1% | 5.0% |

| Jun 6 | 10:00 AM | Wholesale Inventories | Apr | 1.3% | 0.6% | 0.4% | 0.1% |

| Jun 6 | 3:00 PM | Consumer Credit | Apr | $8.9B | NA | $7.0B | $13.1B |

Source: Yahoo Finance , June 6, 2008.M

The next week's economic highlights, courtesy of Northern Trust , include the following:

1. International Trade (June 10): The trade deficit is predicted to have widened to $59.5 billion in April from $58.2 billion in March. Consensus : $59.5 billion.

2. Retail Sales (June 12): Auto sales fell in May. Non-auto retail sales may have received an extra boost from tax rebate checks. Weekly retail sales data present a mixed picture. There was a significant gain in gasoline prices in May. Net, the headline (+0.2%) may show a small increase to reflect the impact of these diverse trends. Consensus : 0.5% versus -0.2% in April; non-auto retail sales: 0.7% versus 0.5% in April.

3. Consumer Price Index (June 13): A 0.3% increase in the CPI is predicted for May following a 0.2% gain in April. Higher gasoline prices should be the major culprit. The core CPI is expected to have moved up 0.2% versus a 0.1% increase in April. Consensus : CPI +0.5%, core CPI +0.2%.

4. Other reports : Pending Home Sales (June 9), Beige Book (June 11), Inventories, Import Prices (June 12), Consumer Sentiment Index (June 13).

Markets

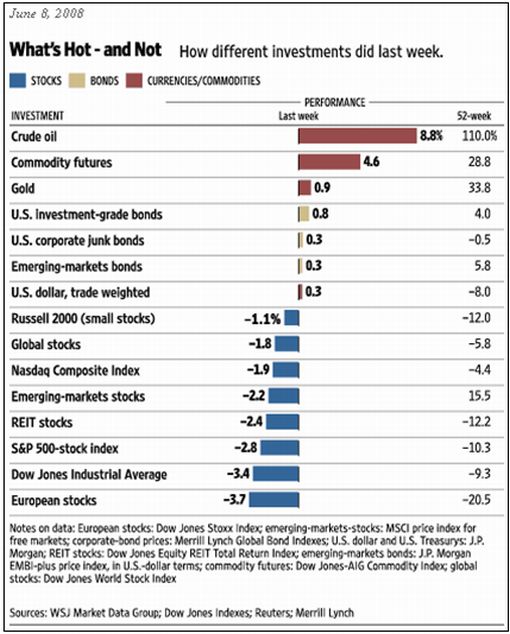

The performance chart obtained from the Wall Street Journal Online shows how different global markets performed during the past week.

Source: Wall Street Journal Online , June 8, 2008.

Equities

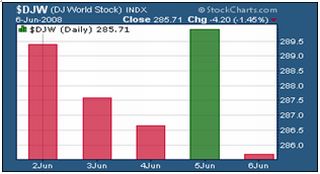

The past week witnessed four down days on most world stock markets, culminating in plummeting prices by the close of the week as a result of a sharply higher US unemployment number, soaring oil prices and renewed fears about the financial sector.

The MSCI World Index dropped by 1.8% during the week, with Continental European stock markets bearing the brunt of the declines as a result of ECB President Trichet's hawkish statement regarding Eurozone interest rates. The The FTSE Eurofirst 300 Index shed 3.8% to a seven-week low.

The Nikkei 225 Average (+1.1%) was the only mature market to record a gain. David Fuller ( Fullermoney ) said: “I maintain that Japan currently has the most interesting technical patterns among non-resources, developed country markets.”

The US stock markets were in the thick of things, as shown by the last week's index movements: Dow Jones Industrial Index -3.4% (YTD -8.0%), S&P 500 Index -2.8% (YTD -7.3%), Nasdaq Composite Index -1.9% (YTD -6.7%) and Russell 2000 Index -1.1% (YTD -3.3%).

Energy (+2.9%), materials (+2.1%), and gold/silver stocks (+1.3%) were some of the few to keep head above water during the sell-off. Worst hit were banks (-8.2%), broker dealers (-3.6%) and financials (-2.9%).

The Dow Jones Industrial Index and the S&P 500 Index hit two-month lows on Friday on heavy volume. These indices, as well as the Nasdaq and Russell 2000, are now all below their 200-day moving averages.

Stock markets have been characterized by a truly roller-coaster pattern of late, as illustrated by the up and down nature of the S&P 500 Index over the last six weeks (beginning with last week): -2.8%, +1.8%, -3.5%, +2.7%, -1.8% and +1.2%.

Fixed-interest instruments

Trichet's concerns about inflation and unexpected indication that the ECB might raise Eurozone interest rates in July put strong upward pressure on European government bond yields. The two-year German Schatz yield rose by 33 basis points over the week to 4.65% – 23 basis points higher than the 10-year yield.

US bond yields, on the other hand, declined as a result of the jump in the unemployment rate, triggering safe-haven buying. The two-year Treasury yield dropped by 23 basis points and the 10-year yield by 11 basis points.

Credit market stress increased as shown by the widening spread of the Markit iTraxx Europe Crossover Index, jumping by 30 basis points to 477.

Currencies

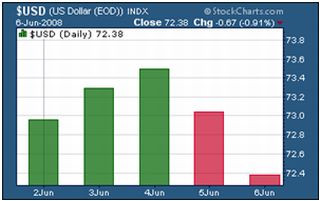

The US dollar started the week off by gaining ground as a result of Bernanke's remarks that the Fed was working with the Treasury to “carefully monitor developments in foreign exchange markets” and that the Fed was aware of the effect of the dollar's decline on inflation and price expectations. However, the dollar reversed course after Trichet's surprising suggestion of an ECB rate hike in July. The dollar received a further setback from the disappointing unemployment number and the spike in the oil price.

The euro gained 1.4% against the US dollar during the week, but the British pound had to contend with a dire UK economic outlook and lost 0.6% against the dollar and 1.8% against the euro.

Both the Swiss franc (+2.2%) and Japanese yen (+0.6%) closed the week higher as the carry trade fell out of favor due to increased risk aversion.

Commodities

The commodity complex mirrored the movements of the US dollar, with the CRB Index closing the week 4.6% higher.

Although all commodities were higher by Friday, crude oil was again in the limelight, with West Texas Intermediate jumping $16 on Thursday and Friday, resulting in an improvement of 8.8% over the week. Friday's increase of $11.3 represented a record one-day gain, spurred on by the lower dollar, suggestions that an Israeli attack on Iran's atomic facilities looked “unavoidable”, short-covering, and a view from Morgan Stanley that prices could hit $150 by Independence Day on July 4.

The weaker dollar, together with renewed concerns about inflation and expectations that US interest rates might remain negative in real terms for quite a while, positively impacted on gold (+0.9%), platinum (+3.4%) and silver (+3.4%%).

As far as agricultural commodities were concerned, US corn prices jumped to record levels as a result of bad weather across parts of the Midwest.

Now for a few news items and some words and charts from the investment wise that will hopefully assist in steering our investment portfolios on a profitable course during what could be a rather tricky patch.

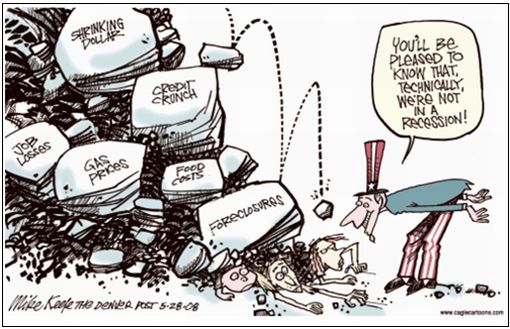

Hat tip: Barry Ritholtz, The Big Picture , May 30, 2008.

Bloomberg: Bernanke says rates are “well positioned” to spur growth

“Federal Reserve Chairman Ben Bernanke signaled he's done cutting interest rates for now and raised his biggest concerns yet about the inflationary effects of the dollar's 16% drop in the past year against the euro.

“The Fed is working with the Treasury to ‘carefully monitor developments in foreign exchange markets' and is aware of the effect of the dollar's decline on inflation and price expectations, Bernanke said today in his first speech on the economic outlook in two months. In addition, interest rates are ‘well positioned' to promote growth and stable prices, he said.”

Source: Bloomberg , June 3, 2008.

CNBC: Bill Gross on the US dollar and interest rates

Source: CNBC , June 3, 2008.

The Wall Street Journal: Grep Ip on Bernanke's remarks about the US dollar

“Grep Ip discusses Fed Chairman Bernanke's recent remarks about the dollar and how its decline has created inflationary pressures.”

Source: Grep Ip, The Wall Street Journal , June 4, 2008.

Asha Bangalore (Northern Trust): Bernanke's balancing act

“Chairman Bernanke's remarks offer a backdrop to the June 24 to 25 FOMC meeting. He mentioned that the Fed acts in the context of the dual mandate of price stability and maximum sustainable employment – no surprises here. The housing market's influence on the functioning of the economy in the near term featured in his speech. Bernanke noted that ‘until the housing market, and particularly house prices, shows clearer signs of stabilization, growth risks will remain to the downside. Recent increases in oil prices pose additional downside risks to growth.'

“At the same time, the concern about inflation was noted with the expectation of moderation in the near term due to softening of demand conditions. He added that ‘the pass-through of high raw materials costs to domestic labor costs and the prices of most other products has been limited, in part because of softening domestic demand. However, the continuation of this pattern is not guaranteed and will bear close attention.'

“The evenhanded focus on both inflation and growth reinforces expectations of the Fed on hold in the months ahead. This statement of Bernanke – ‘We will, of course, be watching the evolving situation closely and are prepared to act as needed to meet our dual mandate' – suggests that the Fed is prepared to act in either direction at this juncture.

“The dollar was discussed more extensively than on prior occasions. Here is the excerpt on the dollar:

‘In collaboration with our colleagues at the Treasury, we continue to carefully monitor developments in foreign exchange markets. The challenges that our economy has faced over the past year or so have generated some downward pressures on the foreign exchange value of the dollar, which have contributed to the unwelcome rise in import prices and consumer price inflation. We are attentive to the implications of changes in the value of the dollar for inflation and inflation expectations and will continue to formulate policy to guard against risks to both parts of our dual mandate, including the risk of an erosion in longer-term inflation expectations. Over time, the Federal Reserve's commitment to both price stability and maximum sustainable employment and the underlying strengths of the US economy – including flexible markets and robust innovation and productivity – will be key factors ensuring that the dollar remains a strong and stable currency.'

“Chairman Bernanke touched on the dollar, inflation, and growth so deftly that both the dollar and the bond market rallied.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , June 3, 2008.

Financial Times: Stephen Schwarzman on the credit crunch

“Stephen Schwarzman, Chairman and CEO of the Blackstone Group, talks to Chrystia Freeland of the Financial Times about whether we are approaching the end of the financial crisis, how deleveraging will reshape the competitive landscape among financial institutions and whether lower profitability and availability of credit will prompt consolidation in the banking sector.”

Source: Financial Times , June 4, 2008.

Liam Halligan (Telegraph): US staring at double-dip recession

“By slashing interest rates in the face of rising price pressures, has the world's most important central bank sowed the seeds of a new inflationary era? It's an alarming idea, but one gaining currency all the time … In real terms, American borrowing costs are firmly in negative territory. No wonder the markets are wondering if Ben Bernanke, Fed chairman, has made a grave error …

“The US is now suffering from the aftershock of the irresponsible policies of Alan Greenspan. By keeping rates too low for too long following the terrorist attacks of 2001 and the dotcom crash, Bernanke's iconic predecessor may have pleased his political masters, but he also pumped up America's gigantic real estate bubble …

“A growing band of analysts has been arguing the Fed should have handled the credit crisis in the same way as the European Central Bank – injecting liquidity into gummed up money markets, rather than lowering rates. Last week, such criticism got much louder.

“For just as Greenspan caused a housing bubble, so Bernanke's rate cuts – combined with rising fuel and food costs – have unleashed an inflationary bubble.”

Source: Liam Halligan, Telegraph , June 2, 2008.

Asha Bangalore (Northern Trust): Payrolls – Fed on hold as far as the eye can see

“ Household Survey – The unemployment rate rose to 5.5% in May from 5.0% in April, a 1.1% jump in the unemployment rate from a cycle low of 4.4% in March 2007.

“ Establishment Survey – Nonfarm payrolls dropped 49,000 in May, following a loss of 28,000 jobs in April. Year-to-date, payroll employment has fallen 324,000 and in the private sector payrolls have declined 397,000 in the last six months.

“ Conclusion – The futures market projects a higher federal funds rate at the end of the year, with slightly less conviction in the past week. Fed Presidents Lacker and Plosser were both focused on the importance of not losing sight of the goal of containing inflation. By contrast, the information from today's employment report supports expectations of a weaker economy and a reduced priority for inflation. A steady federal funds rate in the months ahead is the most likely case.

“Important conclusions to draw after today's report are as follows. First, the labor market is under severe stress, firms have stopped expanding payrolls, no ambiguity here. Second, the National Bureau of Economic Research (NBER) could take several more months to declare an official onset of a recession, but there is no doubt the US economy is experiencing one. Nonfarm payrolls, one of the measures the NBER uses to date business cycles, peaked in December 2007.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , June 6, 2008.

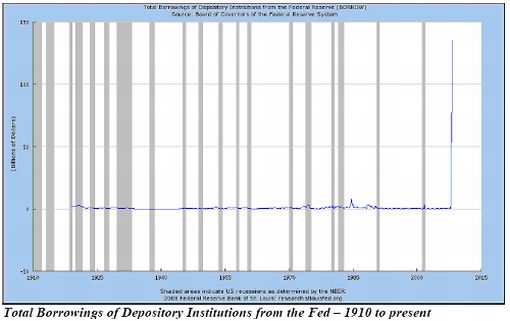

Ambrose Evans-Pritchard (Telegraph): Borrowing of depository institutions skyrocketing

“This is helicopter policy already. It is what happens when the Fed maneuvers itself into such a dire position that it has to invoke the ‘unusual and exigent circumstances' clause of the Federal Reserve Act.”

Source: Ambrose Evans-Pritchard, Telegraph , May 29, 2008.

“Talk about a hockey-stick graph. Bank borrowing has literally gone off the charts in the last year! And just what kind of collateral is the Fed getting in return for all this easy-money lending? Don't ask…” Source: The Sovereign Society , June 7, 2008.

Bill King (The King Report): Fed is hitting accelerator again

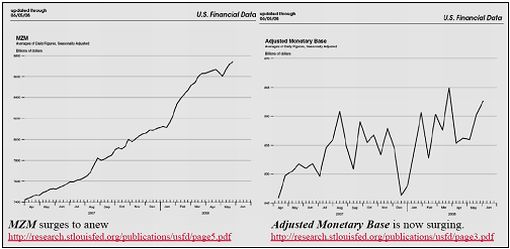

“… recent far Fed behavior is diametric to its hawkish rhetoric. The new MZM and Adjusted Monetary Base readings show the Fed has hit the accelerator again.

“Some analysts note that MZM growth has slowed substantially. It has, depending on your parameters. Per the St. Louis Fed's calculation of the 4-week moving average annualized MZM has slowed to 6.5% growth from 35% in mid-April. But the recent slowdown is only due to the absurd growth in MZM to save the US from financial implosion in mid-March. But it is clear the MZM is zooming anew.

“Some analysts have unfathomably tried to make the case that Fed has not created too much credit because the Adjusted Monetary Base has been stagnant. We addressed this issue quarters ago and concluded that leverage in the financial system was exploding because ‘reserves' were flat while credit and repos soared.

“But now the Adjusted Monetary Base has surged the past month. And if you compare May 2008 to May 2007 you will see that the tendency is for a decline in May.” Source: Bill King, The King Report , June 6, 2008.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.