Bitcoin Price Gearing Up for a Fall

Currencies / Bitcoin Mar 24, 2015 - 09:40 PM GMTBy: Mike_McAra

In short: speculative short positions, stop-loss at 283, take-profit at $153.

In short: speculative short positions, stop-loss at 283, take-profit at $153.

Nasdaq is going to provide a new Bitcoin exchange with technology allowing its future users to trade Bitcoin, we read on the Wall Street Journal website:

Nasdaq OMX Group Inc. has agreed to provide New York-based startup Noble Markets with core technology to power a new marketplace aimed at allowing companies and institutional investors such as hedge funds to trade bitcoin and related digital-currency assets.

According to a joint statement provided to The Wall Street Journal, Noble's platform will use Nasdaq's X-stream trading system, a high-tech system for matching market participants' orders that is used by more than 30 exchanges and marketplaces worldwide. Nasdaq will also provide marketing support.

The agreement follows other Wall Street initiatives that could pave the way for financial institutions to own and trade digital currencies, which fans say have the potential to make the global financial system more efficient but which have also been marred by price fluctuations, investment scams and cybersecurity concerns.

This is most probably part of a broader process in which financial institutions such as banks or exchanges will step into the Bitcoin space. Here, Nasdaq isn't actually setting up its own Bitcoin shop but is instead providing a startup with the necessary technology. The startup will use this technology to enable Bitcoin to be traded just as stocks are. This might not seem very different from the exchanges we already have but the idea here might be that an exchange set up using already tried and tested tools might be attractive to the kinds of institutions which have so far mostly stayed away from Bitcoin, such as investment funds, hedge funds, but also individual investors which are accustomed to trading stocks but are not necessarily familiar with Bitcoin wallets.

It will be interesting to see how this exchange will compete with other initiatives currently underway, such as the upcoming Gemini exchange. We'll probably see more activity in the Bitcoin exchange space in the months and years to come. The rise in numbers of regulated Bitcoin exchanges seems to be the trend now. The outcome Bitcoin users might hope to is an increase in the transparence of the Bitcoin market and a possible rise the popularity of Bitcoin among individuals and institutions.

For now, let's focus on the charts.

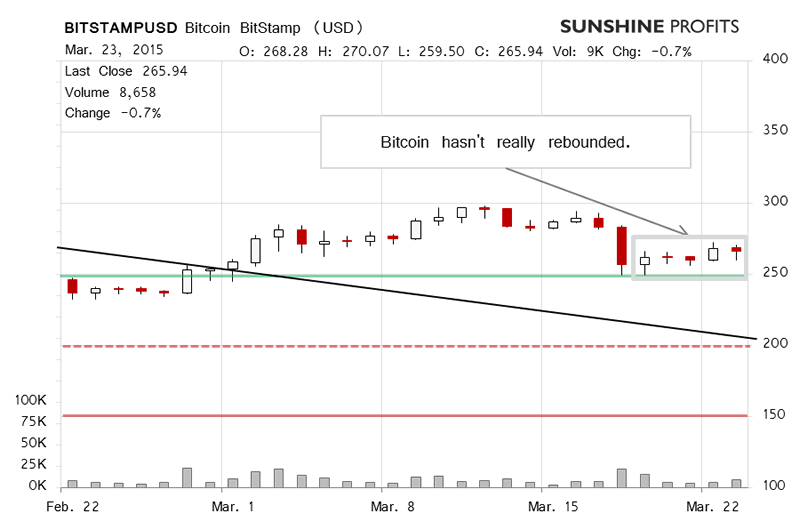

On BitStamp, we didn't see much action yesterday. The volume was up but it wasn't really strong. If you recall the comments from our yesterday's alert:

(...) we saw a relatively muted move up over the weekend. Bitcoin partially reversed course and erased some of last Wednesday's losses. Is this a bullish move? Not necessarily. The volume over the weekend was not really strong. From Friday to Sunday we didn't really see volume levels like the ones that came about on Wednesday and Thursday. As such, the very recent appreciation doesn't look like a very strong move to the upside. One reason to be cautious here is that Bitcoin didn't move below $250 (green line in the chart). But most of the other hints (volume, price action, possible breakdown below a rising trend line) point to more depreciation.

Today (...), we've seen more of the same, meaning not much action and Bitcoin above $250. The fact that we haven't really seen a surge suggests that what we're seeing now might just be a short counter-trend move up. It seems that we might see a move below $250 and an acceleration of the decline in the days and weeks to come.

Today, we've seen a stronger move down, very much in line with the outlook outlined in our last alert (this is written around 11:00 a.m. ET). The volume is already up and this might very well be the move down we've been waiting for some time now (today's move is not yet visible on the above chart). What might be important, Bitcoin is now below $250. The outlook has definitely deteriorated compared with yesterday. Mind that it was already bearish then, and it has now become even more bearish. If Bitcoin stays below $250 today, we will have an even more bearish outcome and we might see a move down to $200, perhaps not an immediate one but the possibility would be there. $250 is very much the level to observe now.

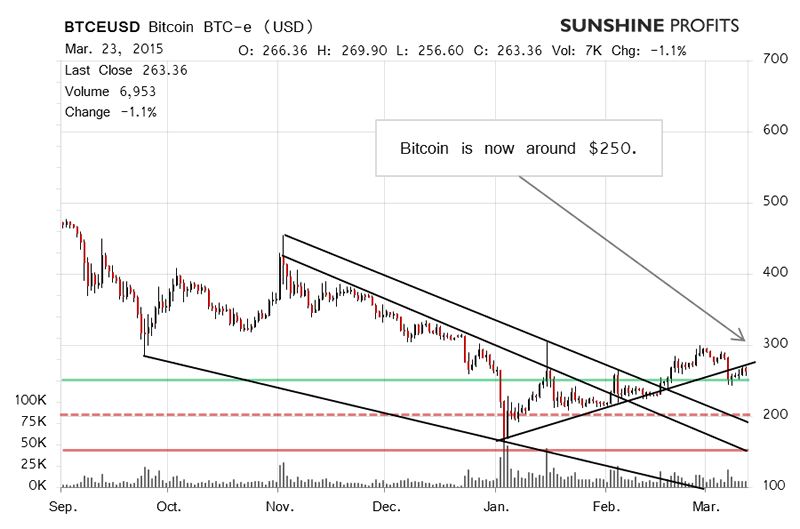

On the long-term BTC-e chart, we see that Bitcoin is still below the possible rising trend line. Yesterday, we commented on this situation in the following way:

(...) we see a more bearish picture in that Bitcoin has stayed below a possible rising trend line. The currency is now below this line but above $250. It seems that any strong move now might trigger a more sizeable decline or rally. The fact that we've seen more of a slowdown in the last couple of days, that the most violent action recently was to the downside and that we've already seen a possible lower local top just before the decline suggest that the momentum might actually be building up in favor of a move lower.

At the moment, it seems that $250 might be a level at which market players would decide to open short orders or close their positions. Our take is that in the current environment a move below this level could herald yet another decline. The short-term outlook seems bearish.

Today, we have seen a further deterioration of the short-term outlook. The move down below $250 (not yet seen on the above chart), if confirmed, could open up Bitcoin to a more pronounced decline, even in the medium term. Our tentative target for the move would be around $200 (dashed red line in the chart), but a move even lower could be in the card. This is why we have the take-profit level at $153.

The RSI Index is still not in the oversold territory, which might be a hint that there's still room for declines. If Bitcoin stays below $250, the outlook would deteriorate further. This might be a critical time for Bitcoin traders since a lot might happen in the next couple of days.

Even if the move below $250 is prolonged, Bitcoin won't have to decline right away. Instead, we might see a smoother decline, much like we saw after the May 2014 rally. Alternatively, the decline might speed up in the next couple of days. One way or another, it is our opinion that the short-term outlook is now bearish.

Summing up, in our opinion speculative short positions might be the way to go now.

Trading position (short-term, our opinion): short, stop-loss at 283, take-profit at $153.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.