Stock Market Three Peaks/ Domed House Part III

Stock-Markets / Stock Markets 2015 Mar 24, 2015 - 04:17 PM GMTBy: Money_Morning

As the Dow appears to be sketching out the Cupola of a Three Peaks/Domed House formation I thought this would be a good time to focus on that chapter of the book I am currently working on (The Complete Technical Analysis of George Lindsay: A Unified Theory of the American Equity Market – due in 2016). While that chapter is far from complete I have stumbled across an observation which will be new to the Lindsay corpus.

As the Dow appears to be sketching out the Cupola of a Three Peaks/Domed House formation I thought this would be a good time to focus on that chapter of the book I am currently working on (The Complete Technical Analysis of George Lindsay: A Unified Theory of the American Equity Market – due in 2016). While that chapter is far from complete I have stumbled across an observation which will be new to the Lindsay corpus.

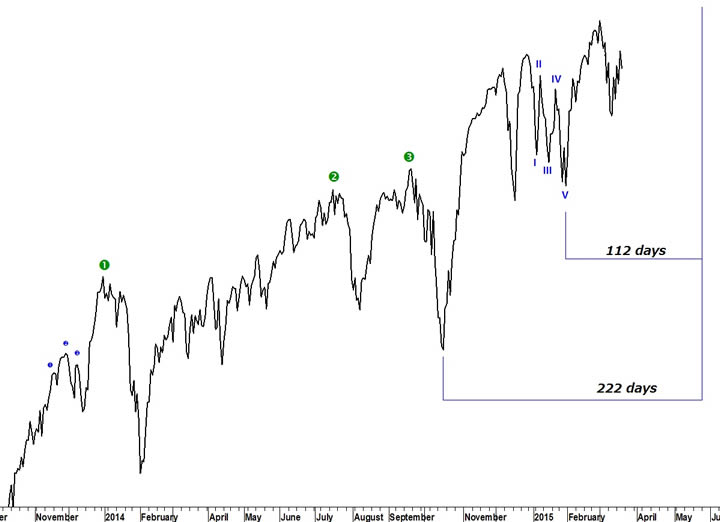

Lindsay wrote that a five-wave reversal is always seen prior to the cupola of the Domed House. This forms the First Floor Roof of the pattern. We can see a five-wave reversal during the December-January time period.

To time the high of the Cupola Lindsay spilled much ink in discussing various methods of counting from the low of the Separating Decline. In my work I have found an additional approach for forecasting the final high.

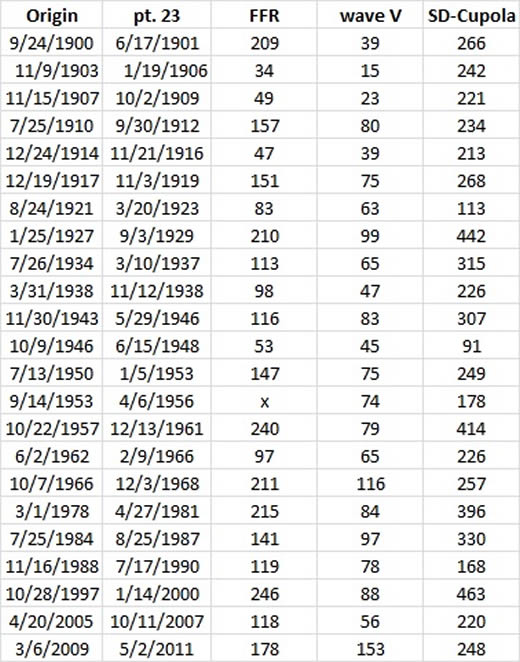

Since 1901 there have been 23 occurrences of the pattern (not including the current set-up). In 10 of the 23 patterns, the count from the low of wave 5 was roughly 50% of the count from the beginning of the first reversal (the high of the First Floor Roof) (Figure 1).

Figure 1

Of the remaining 13 occurrences all but three had some idiosyncrasy which warned that the counts would not match the typical scenario (Model 3, three peaks occurring before the bear market low, etc.).

In the remaining three instances it was found that the count from the low of wave 5 is roughly 50% of the count from the low of the Separating Decline. This is of great interest to the current pattern (as explained previously) because the current forecast for a final high near May 25 makes the count from the low of wave 5 to be 112 days which is roughly half of the 222 day count from the low of the Separating Decline on Oct 16.

On a separate note, the Hybrid Lindsay forecast for a low near Friday March 6 or Monday March 9 was two days late coming on March 11. The next hybrid forecast for a top was last Friday or Monday.

Figure 2

Try a "sneak-peek" at Lindsay research (and more) at Seattle Technical Advisors.

Ed Carlson, author of George Lindsay and the Art of Technical Analysis, and his new book, George Lindsay's An Aid to Timing is an independent trader, consultant, and Chartered Market Technician (CMT) based in Seattle. Carlson manages the website Seattle Technical Advisors.com, where he publishes daily and weekly commentary. He spent twenty years as a stockbroker and holds an M.B.A. from Wichita State University.

© 2015 Copyright Ed Carlson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.