Safety Deposit Boxes In UK Being Closed By HSBC – Not Closing Gold Vaults

Commodities / Gold and Silver 2015 Mar 24, 2015 - 04:11 PM GMTBy: GoldCore

- Incorrect rumours abound around blogosphere that HSBC is rapidly and quietly closing gold vaults

- Incorrect rumours abound around blogosphere that HSBC is rapidly and quietly closing gold vaults

- HSBC are in fact closing down their safety deposit box facilities in vaults in branches

- Banks internationally closing boxes as not profitable and move to “cashless society”

- Incorrect speculation that HSBC move forcing gold clients to sell bullion

- Speculation understandable given poor communications from HSBC and manipulation of precious metal markets

- Salutary lesson to all – media and blogosphere – to be more rigorous

- Underlines vital importance of owning gold in allocated manner outside financial system

An incorrect rumour that HSBC is rapidly and quietly closing gold vaults where clients gold bullion was stored and gold in the GLD ETF is stored has been swirling around the internet.

After conversations with key players in the industry including a bullion dealer who used the safety deposit boxes for storage and delivery to clients, we can now confidently say that the speculation was incorrect.

What HSBC is actually doing is closing its safety deposit box facilities some of which are in vaults and strong rooms in branches. The vaults are not specialist gold vaults rather standard vaults or strong rooms which contain safety deposit boxes. These safety deposit boxes hold all sorts of valuables – from legal documents, to family heirlooms, to art works, to jewellery and of course bullion coins and bars.

Availability of safety deposit boxes is in decline in Britain and much of the world. Costs of security, insurance and opportunity to use such facilities in a more profitable manner are driving the closures. Banks in Ireland including the Bank of Ireland claim that the safety deposit boxes are “causing an unacceptable health, safety and security risk in some branches.”

While the move is understandable from a purely profit motive point of view, it must be remembered that this is a greatly needed service by many people including entrepreneurs and professionals who need to safe keep important legal documents that they are not comfortable keeping in a home or office. It is also a greatly needed service for the elderly and other people who have valuable jewelry and heirlooms that they are uncomfortable keeping in the house.

It is another case of banks blindly pursuing profit ahead of the interests of their own clients.

Banks and insolvent governments desperate for cash likely also dislike safety deposit boxes as they are means for people to protect and grow wealth and protect themselves from inflation and indeed bail-in and deposit confiscation. A percentage of box holders so store cash and bullion.

In our brave new world of the ‘cashless society’, the financial independence and freedom that a safety deposit box confers upon the citizen is frowned upon.

As a consequence citizens are being deprived of the opportunity of having their savings, valuables and wealth stored outside of the increasingly precarious financial system and digital banking system.

The implications of the rumours were significant. Analysts speculated that a precious metals market disruption might be imminent and with it delivery calls by clients who believe they own physical gold in GLD which HSBC most likely could not meet.

Such an event would likely have a dramatic upward effect on the price of gold not to mention a catastrophic effect on the finances of those who believe they actually own physical gold in ETFs. Irish Finance Minister, Michael Noonan, being one recent buyer of the gold ETF.

The misunderstanding regarding HSBC closing its deposit box facilities had led to speculation by people familiar with the underlying dynamics of precious metals markets. HSBC was implicated in a gold price manipulation scandal last year, and has been fined numerous times in the past decade for an array of corrupt practices.

As “the largest COMEX/NYMEX depository”, according to their website, they are viewed by sceptics as having both a capacity and a track record to manipulate precious metals prices.

This view was compounded back in 2012 when respected analyst, Ned Naylor-Leyland, tracked the serial number of a gold bar that was presented on CNBC as belonging to the GLD ETF, of which HSBC is custodian.

Naylor-Leyland discovered that the bar, in fact belonged to a different ETF – ETF Securities – fuelling speculation that GLD did not have the gold it claimed to be in possession of and that gold is rehypothecated.

The recent misunderstanding regarding HSBC’s gold vaults, when viewed from this perspective, is understandable. Long time observers of the precious metals markets are aware of the price suppression actions that occur.

These include the dumping of contracts for massive volumes of gold onto the market at quiet periods – often after the close of business on the COMEX or after Asian trading and before European markets commence trading. In the absence of demand, the huge supply of paper contracts for gold overwhelms the market forcing the price down and triggering stop losses which then accelerate the sell-offs.

The sellers of these contracts are clearly not looking for the best price for their asset. The aim is to force down the price in illiquid markets. The seller can then buy back contracts for the same volume of gold at a greatly reduced price for a large profit.

The incorrect information regarding the HSBC vaults thus sparked intense speculation that some major developments were afoot in the gold market and HSBC was using the closures to force clients to sell their gold.

However, it is the case that those owning gold in HSBC’s safety deposit boxes do not have to sell their gold and most won’t. They have 60 days to find new secure storage and we are already seeing flows in this regard.

The rapidity with which this information became received wisdom is a salutary lesson for the alternative media and the gold blogosphere. Bloggers need to be rigorous in establishing facts as they will be held to a much higher standard by the mainstream media – higher, even, than the latter sometimes hold for themselves.

It also again underlines the vital importance of owning allocated and segregated gold outside the global banking system, in the safest vaults in the world.

How To Store Gold Bullion – 7 Key Must Haves

MARKET UPDATE

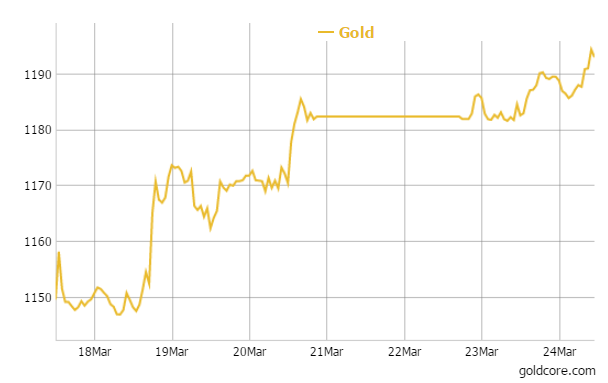

Today’s AM fix was USD 1,193.25, EUR 1,085.56 and GBP 798.96 per ounce.

Yesterday’s AM fix was USD 1,181.40, EUR 1,086.15 and GBP 791.77 per ounce.

Gold climbed 0.625 percent or $7.40 and closed at $1,190.60 an ounce yesterday, while silver surged 1.97 percent or $0.33 at $17.06 an ounce.

Gold in US Dollars – 1 Week

Gold remained firm near its two week high reached yesterday in spite of disappointing Chinese PMI figures. In Singapore, bullion for immediate delivery initially fell prior to gains and was $1,187.46 an ounce near the end of day. These gains continued in European trading.

Dollar weakness in recent days, the chance of Greece leaving the euro and the continuing crisis in the Ukraine are all supporting gold.

John Williams, San Francisco Fed chief said in Australia yesterday that policymakers should wait no more than a

few months before considering raising U.S. interest rates from their current near-zero level. A Reuters poll of analysts show that they are expecting a U.S. interest rate hike in September now rather than June.

An Airbus operated by Lufthansa’s Germanwings budget airline crashed in southern France on this morning and all 148 on board were feared dead. French President Francois Hollande said he believed none of those on board had survived.”There were 148 people on board,” Hollande said. “The conditions of the accident, which have not yet been clarified, lead us to think there are no survivors.”

In London spot gold in late morning trading is at $1,194.96 or up 0.47 percent. Silver is $17.11 or up 0.25 percent and platinum is $1,147.96 or up 0.06 percent.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.