This Rising Interest Rates Play Could Make You a Quick 55%

Companies / Investing 2015 Mar 23, 2015 - 10:48 AM GMTBy: Money_Morning

According to Bloomberg Business, people collectively waste an hour a day on Facebook debating everything from Kim Kardashian's hair to the now infamous gold/blue dress.

According to Bloomberg Business, people collectively waste an hour a day on Facebook debating everything from Kim Kardashian's hair to the now infamous gold/blue dress.

After last Wednesday, I've got to wonder how much time they're going to blow talking about what Fed Chair Janet Yellen said… or didn't say.

At the end of the day it doesn't matter.

I say that because one of the most fundamental investing truisms of all is that "money moves to where it's treated best."

Simply put, a rise in interest rates is a sign that money is going to be treated better. It's a capital attractor, not the deterrent hyperactive day traders think it is.

The Data Proves It

Let me share some data with you and see if you don't agree.

Let's start with historical precedent.

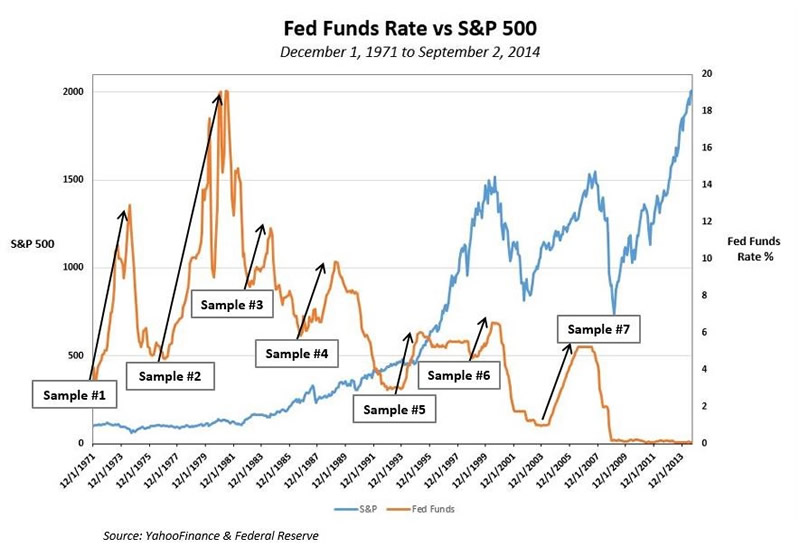

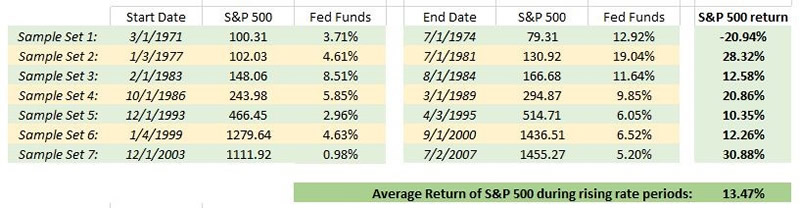

The chart below demonstrates S&P 500 performance vs. Fed Funds Rate going all the way back to December 1, 1971.

It might be hard to see what's actually happening in that chart above so I've broken it down in the table below based on seven distinct sample periods when the Fed was raising the Fed Funds rates.

Contrary to what people think will happen, history is very clear.

Six out of the last seven periods during which the Fed was raising rates, the markets actually went up – gaining an average 13.47% during the rising rate periods.

In fact, stocks have gone up in six out of the last six periods when the Fed was in a rising rate environment.

The only time the S&P 500 didn't increase in value alongside of rising rates was all the way back in the early 1970s, when the Fed Funds Rate increased a whopping 9.21 percentage points, from 3.71% to 12.92%.

You see, love it or hate it, the Fed typically only raises rates when it believes the economy can absorb the increase – and even then, it's usually slow to finally increase rates.

Further, when the time comes, the Fed tends to move in small digestible increments. Then at some point the cycle reverses, the economy goes into a recession, and the Fed lowers rates, again.

Statistically speaking, we come to the same conclusion.

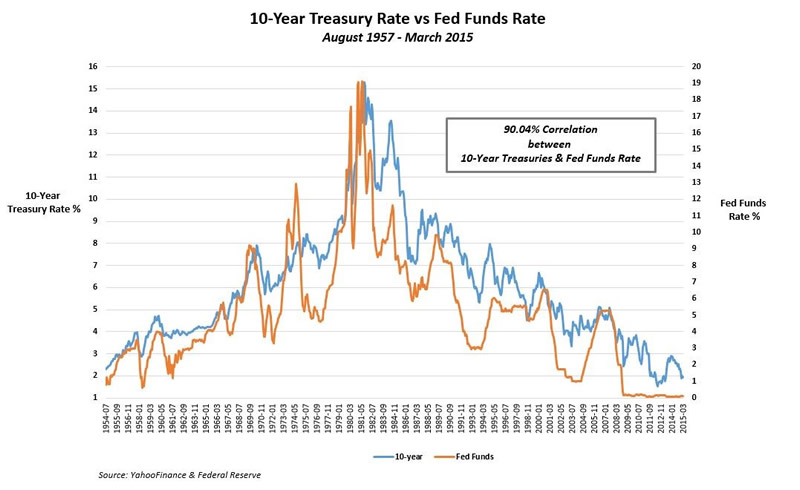

The chart below demonstrates a 90% correlation between Fed Funds Rates and U.S. 10-Year Treasury rates.

This shows you that there is, indeed, a link between Fed actions and perceived risk.

Which brings us to common sense.

If 10-year rates are "increasing" it's because traders are "selling"… bond yields and bond prices move in opposite directions.

That freed-up capital has to go somewhere. Historically, it's moved into equities.

There's no reason to believe this time will be any different – primarily because there isn't an attractive alternative with enough liquidity to absorb the flow of capital.

At some point that reverses and yields become attractive enough to sway traders out of equities and into bonds – but that's not going to happen anytime soon with the Fed raising the rates in miniscule 0.25% increments.

Critics say that the economy isn't strong enough to withstand an increase. I think they're making a mountain out of a molehill. If the economy does stall out when the Fed raises rates, you can bet they'll reverse course, lickity-split, and bring rates right back down again. At which point, we'll be right back (or at least very close) to where we are now – with historic low rates and traders pushing up equity prices in search of return.

So when the Fed does raise rates – and the inevitable short-term rate riot occurs – we'll use the volatility to go shopping.

Discount Shopping That Provides You with Returns

In fact, I've already put readers on alert for this possibility in my trading service, Small-Cap Rocket Alert.

If that sounds risky, I understand. But consider one of my favorite Warren Buffet quotes: "Be fearful when others are greedy and greedy when others are fearful."

No doubt, it takes a lot of courage to buy when the market is selling – but doing so is the best way to lower your risk and juice your returns.

Case in point, I told my subscribers to use the October 2014 sell-off (when the S&P 500 dropped 7.38% in less than a month) as a buying opportunity and recommended a $450 million network visibility company. It's up 55%, compared to a 5.31% gain in the S&P 500 over the same time.

If you want to make the same move and have similar potential, consider establishing a position in iShares Russell 2000 Index (ETF) (NYSE Arca: IWM) or iShares Micro-Cap (NYSE Arca: IWC).

And don't forget to thank Janet Yellen for giving you the opportunity.

You can smile all the way to the bank later.

Source :http://moneymorning.com/2015/03/23/this-rising-rate-play-could-make-you-a-quick-55/

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.