FED Guidance Like Flying in Bermuda Triangle

Stock-Markets / US Federal Reserve Bank Mar 22, 2015 - 12:04 PM GMTBy: Brad_Gudgeon

Last week, I thought from what I was reading on my volume indicators, (showing that money was leaving the S&P 500) that the market would fall on the FOMC news Wednesday. WRONG! Here I am flying in the Bermuda Triangle!

Last week, I thought from what I was reading on my volume indicators, (showing that money was leaving the S&P 500) that the market would fall on the FOMC news Wednesday. WRONG! Here I am flying in the Bermuda Triangle!

A few weeks ago, I related how last year was so difficult trading the market for me. The normal 10,20,30, 40 week cycle lows are not acting like they used to. I had surmised that the normal 20 week (100 trading day 15-16%) low would not be the dominant low, but that it would likely come in April instead. March 11 proved to be the 100 trading day low and we fell less than 4% top to bottom! But, because of volume indicators like OBV, Money Flow and Chaiken Money Flow that are showing net money outflows (I'll elaborate on these more next week), I thought this time might be different. WRONG!

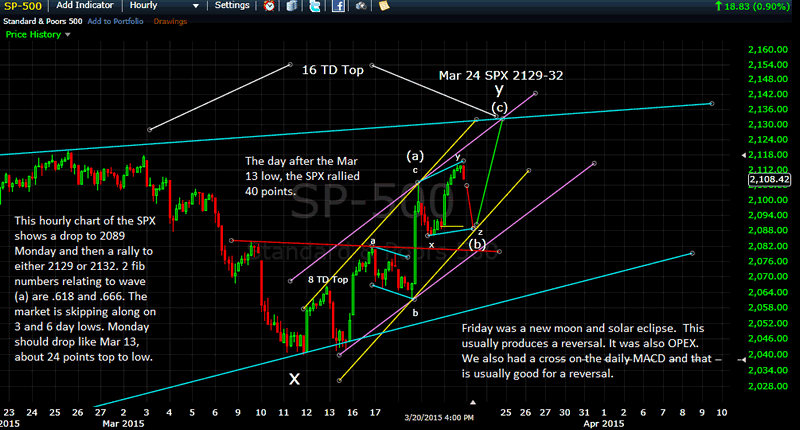

Welcome to the Bermuda Triangle! A place where "flying instruments" won't work. Heck, even the FED rally showed net outflows of money. That means the smart money is selling into the rallies and it was likely also a short covering rally. I wasn't the only one who got caught short though. Many of my respected peers also got caught. So, I waited until Thursday to cover my shorts at a net loss of 36 SPX points and went long. Yesterday, I captured 20 or so points back on the long side, and went short again... just until Monday where I think one more rally is due into Tuesday (read chart below).

I'm thinking to myself "wow, that Bradley Siderograph showed a market turn due around Mar 12-13, and dang...we turned!" I'm thinking maybe I should look out of my cockpit and let the stars guide me, because obviously they know something I don't know. So I did some study on future Bradley turns. I also checked out a good financial astrologer named Ray Merriman and read his stuff. He had Saturn doing something or other with (I forget) around the end of last week where he believed the market should reverse (on April 3rd it will be the moon with Uranus..just kidding... maybe it was Pluto... I forget). Now I'm matching his stuff to the Bradley and my work (more later on this). Hey, I need some guidance! I'm not getting it from the FED!

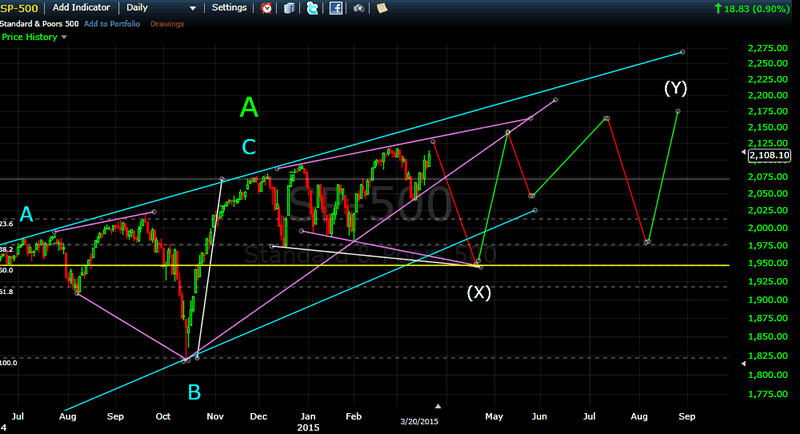

Below, are some charts of what I believe is happening now (and will possibly in the future). Eventually, this market is going to break to the down side in a big way (like 20+%), but that may not happen until late August to late October (remember the Irregular Megaphone Pattern and current channel? Now you're confused..).

S&P500 Hourly Chart

S&P500 Daily Chart

Meanwhile, we could easily be on Toad's Wild Ride for a few more months. Will they hike rates? Maybe not. Maybe they could. No, I don't think so. Yes, they might. Welcome to the new normal! I should be telling myself, Brad, you're no longer in Kansas anymore. Somehow or other, I got blown off course, just off the coast of Florida by Hurricane Yellen (or was it Bernake? I'm confused???). Maybe I should click the heels of my ruby red loafers and wish myself back to the heartland. (Oh, how I wish I were "back home" in the 80's and 90's again when things were a lot simpler!). WRONG!

Brad Gudgeon

Editor of The BluStar Market Timer

The BluStar Market Timer was rated #1 in the world by Timer Trac in 2014, competing with over 1600 market timers. This occurred despite what the author considered a very difficult year for him. Brad Gudgeon, editor and author of the BluStar Market Timer, is a market veteran of over 30 years. The website is www.blustarmarkettimer.info To view the details more clearly, you may visit our free chart look at www.blustarcharts.weebly.com Copyright 2015. All Rights Reserved

Copyright 2015, BluStar Market Timer. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.