Yield Curve, Futures, Suggest No U.S. Interest Rate Hike Until December

Interest-Rates / US Interest Rates Mar 21, 2015 - 10:36 AM GMTBy: Mike_Shedlock

Curve Watcher's Anonymous is investigating the yield curve following Janet Yellen's exceptionally dovish FOMC announcement on Wednesday.

Curve Watcher's Anonymous is investigating the yield curve following Janet Yellen's exceptionally dovish FOMC announcement on Wednesday.

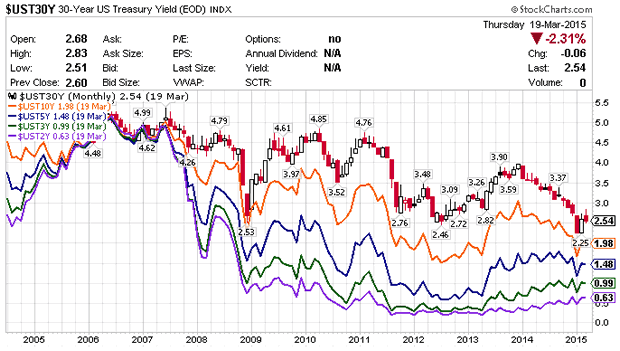

Yield Curve 2-yr, 3-yr, 5-yr, 10-yr, 30-yr

- 30-year in black and red

- 10-year in orange

- 5-year in blue

- 3-year in green

- 2-year in purple

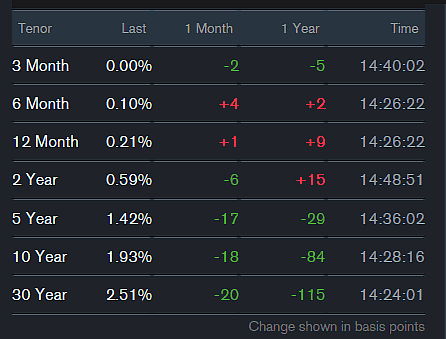

Change From Year Ago

Above rate table from Bloomberg.

Futures Suggest No Rate Hike Until December

Please consider Yellen Sends Odds of Any Rate Increase Below 50% Until December

"The likelihood that policy makers will lift their benchmark rate from near zero in September fell to 39 percent from 55 percent on Tuesday, according to calculations by Bloomberg using federal fund futures contracts. Futures traders have wiped out the chance of an increase in June, assigning it an 11 percent probability."

Door Open

On Wednesday, Bloomberg took the stance Fed Drops Patient Stance, Opening Door to June Rate Increase.

I found that rather amusing and responded Fed Drops Word "Patient"; Door Open, But For What?

Although the Fed removed the word "patient", the rest of Yellen's yap could not possibly have been any more dovish.

The panel said it will be appropriate to tighten "when it has seen further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term."

That statement can mean virtually anything, prompting me to ask "How much more improvement does the Fed want? Or does the Fed not believe all these glowing labor reports either?"

And of course no one has any clues about the true meaning of "medium term."

Weak Data

For four months nearly all data except lagging jobs data has been weak.

- March 19: Philly Fed Growth Trends Lower 4th Month: Prices, Shipments, Workweek Negative

- March 10: Wholesale Trade: Sales Down, Inventories Up; GDP Estimate Revised Lower Again; Sticking With Recession Call

- March 5: Factory Orders Unexpectedly Decline 6th Month; Five Excuses; Orders vs. Shipments

- January 31: Diving Into the GDP Report - Some Ominous Trends - Yellen Yap - Decoupling or Not?

That's just a sampling. Nearly every economic report except for jobs has been weaker than expected.

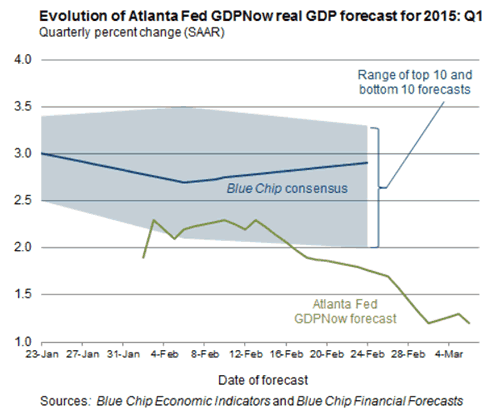

GDP Forecast Halved Again

On March 13 I noted Atlanta Fed Halves GDP Forecast to 0.6%; Blue Chip Consensus Eight Miles High

Today we see the Atlanta Fed's GDPNow Forecast has been halved again.

The forecast for GDP growth is now down to 0.3%.

I doubt the Fed will hike in a recession, and I do think a recession is on the way. If the Fed does hike, it will be to prick the asset bubble in stocks.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2015 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.