Signs of the End for Fed US Interest Rate Cuts Are Everywhere

Interest-Rates / US Interest Rates Jun 08, 2008 - 02:04 AM GMTBy: Donald_W_Dony

With inflationary pressures coming out of Pandora's box again, and largely fueled by soaring crude oil prices, is it any wonder that the Fed has stated in its last FOMC meeting in late April that this rate cut was "a close call" and that "any future rate deductions will be closely reviewed". The talk now, coming from Mr. Bernanke, is concern surrounding the low level of the U.S. dollar and inflation. So as the shift in direction has moved 180 degrees from providing stimulus to the financial markets and preventing a recession from taking root to inflation and currency protection. But were there signs of this new direction earlier in the market? From an intermarket perspective, there were plenty of clues by April.

With inflationary pressures coming out of Pandora's box again, and largely fueled by soaring crude oil prices, is it any wonder that the Fed has stated in its last FOMC meeting in late April that this rate cut was "a close call" and that "any future rate deductions will be closely reviewed". The talk now, coming from Mr. Bernanke, is concern surrounding the low level of the U.S. dollar and inflation. So as the shift in direction has moved 180 degrees from providing stimulus to the financial markets and preventing a recession from taking root to inflation and currency protection. But were there signs of this new direction earlier in the market? From an intermarket perspective, there were plenty of clues by April.

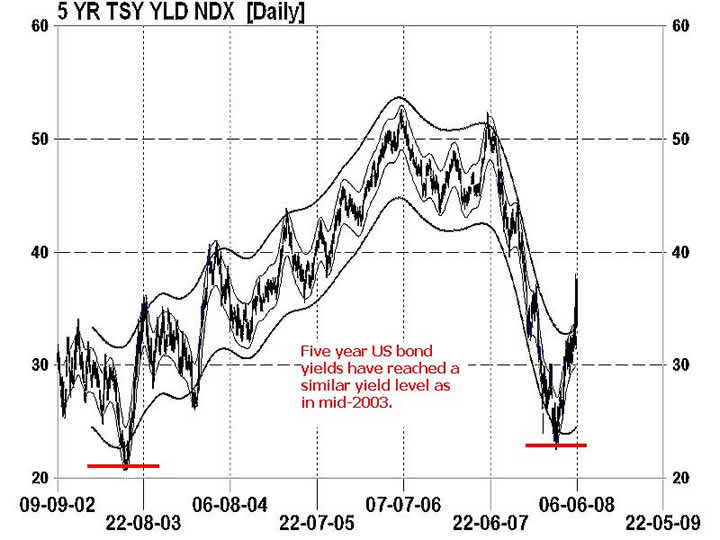

Five year U.S. Treasury bonds are one of the most sensitive durations to Fed interest rate changes. Chart 1 shows that yields have been falling since mid-2007 and had declined down to 2.18% in March, a yield level very similar to the Fed's last round of bear market rate easing in 2003. And like bond yields, after that rate reductions in 2003 where five year Treasury rates vaulted upward, yields are now moving up steadily as bond traders sensed the completion of rate reductions and began bidding up bonds by mid-April.

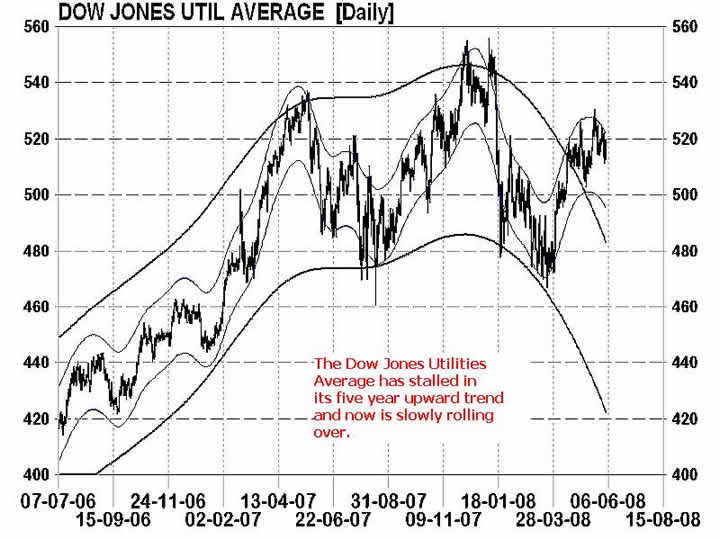

In Chart 2 of the Dow Jones Utilities Average, this highly interest rate sensitive equity group began displaying early signs of weakness by late April. After over five years of steady advancing, technical models are indicating a deterioration in price levels is expected in June and July. Utilities typically rise in an environment where interest rates are stable or declining. Conversely, share prices in utilities usually weaken on interest rate increases.

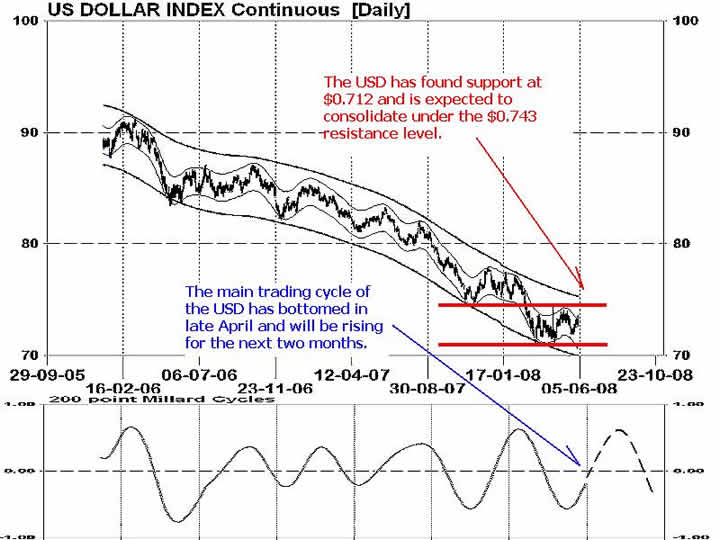

The U.S. dollar (Chart 3), has also displayed technical evidence of no additional rate reductions in late April. Interest rate cuts are normally negative for the greenback because they offer a lower return for the dollar verses other major currencies. With the prospect of U.S. dollar protection and renewed fears of inflation, this translates into a retention of the 2% Fed rate and the very real potentially to rate increases later in 2008. In response, currency traders began supporting the dollar at $0.712 and held it up against further declines.

Bottom line: Market reaction in interest rate sensitive markets such as bonds, utilities and currencies was clearly evident by late April that the Fed was no longer considering any additional interest rate cuts for the foreseeable future. A careful review of other intermarket securities can often help forecast the direction of the Fed rate policy.

Additional research about the economy, and the markets is available in the June newsletter. Go to www.technicalspeculator.com and click on member login.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2008 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.