GDXJ / Gold Ratio

Commodities / Gold and Silver Stocks 2015 Mar 20, 2015 - 08:54 AM GMTBy: Dan_Norcini

This key predictive ratio continues to struggle when it comes to gaining upside traction. It remains below the starting level of the year.

This key predictive ratio continues to struggle when it comes to gaining upside traction. It remains below the starting level of the year.

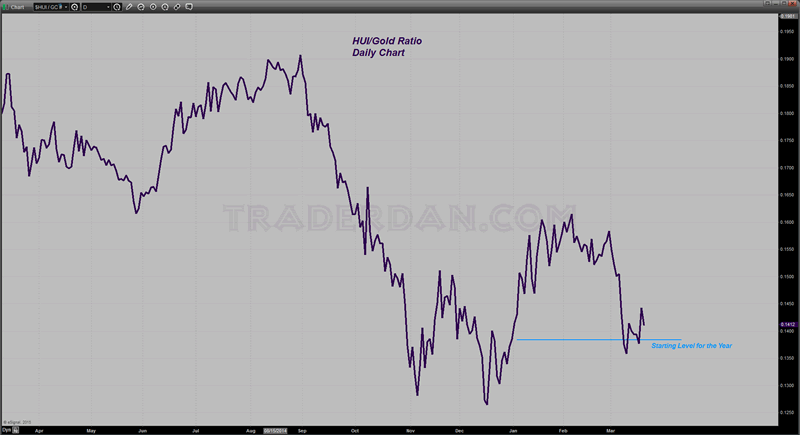

The HUI/Gold ratio looks a bit better but certainly nothing to write home about.

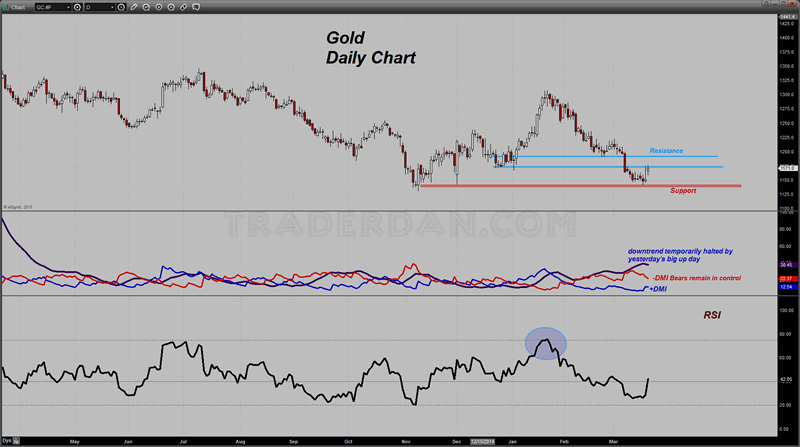

Consistent with the weak-showing in this ratio, gold is struggling to breach overhead resistance on its chart emerging near $1175 and extending up to the old familiar $1180 level.

The ADX has turned down indicating a pause in the downtrending move lower. That big up day from yesterday and the subsequent upside follow through from today’s session were enough to cause an interruption in the downtrend. Bears still remain in control of the market at this point as the -DMI(Negative Directional Indicator) remains above the +DMI ( Positive Directional Indicator).

The RSI is moving higher from out of oversold territory.

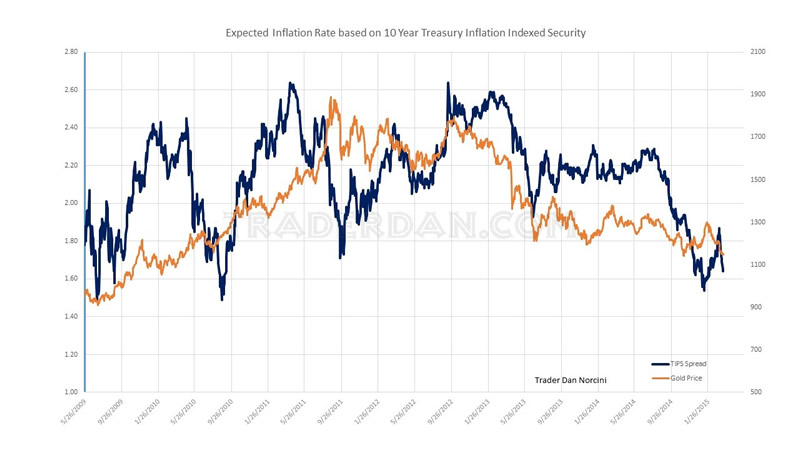

I am also seeing that inflation expectations continue to remain quite weak as they are barely above a 5 year low.

One can say the same thing about gold as they can say about crude oil. If the inflationary pressures from rising crude oil/energy are missing, and if the TIPS spread is continuing to meander in 5 year low territory, why buy gold? There is no inflation and no signs of an overheating economy, at least as far as the market is concerned at this point. It then becomes a matter of holding gold for insurance reasons against falling interest rates as the opportunity cost to hold an asset that throws off no yield is minimized.

I am simply unsure how high such a sentiment can carry the metal at this point. Obviously the gold shares are having doubts as well. The onus will therefore be firmly on the shoulders of the bulls to PROVE that they can take the metal higher. So far, they have not been able to do that. The FOMC statement saved them yesterday as the metal was threatening to breach downside chart support but the FOMC, terrified of deflation, decided to try to talk the Dollar down and commodities up as if that could somehow engender the much-longed for 2% annual inflation rate that they are desperately seeking to achieve.

With that mindset, the last thing the Fed wants to see is an imploding gold price. GATA and the other “Gold is always manipulated all the time” crowd has no idea that they are barking up the wrong tree. The Fed is terrified of deflation, not a collapsing Dollar, which is what is necessary to see a substantially higher gold price.

Based on what I am currently seeing at this time, it looks as if the best the Fed could do is to put a temporary floor under the gold price and a temporary cap on the Dollar. As to how long either or both will hold, that is anyone’s guess. Perhaps until we get the next payrolls report?

Editor’s Note : This from a member

“Bravo Trader Dan

Any intelligent fool can make things bigger, more complex and more violent but it takes a touch of genius and a lot of courage to move in the opposite direction]

Albert Einstein”

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2015 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.